As the U.S. begins to exit the pandemic stage of COVID-19, some level of “new normal” appears to be taking hold in our everyday lives. Across the country, employers are beginning to welcome their teams back to the office; children are heading back to school, on site and in person; and restrictions are finally being lifted.

At the onset of the pandemic, many of our clients were tasked with coordinating and managing work-from-home employees and their environments. As such, almost every client and employee meeting was virtual. To understate the obvious, this was not business as usual for anyone. Today, many of our clients are beginning to implement plans to reverse course yet again – managing the return to the office. With 2022 well underway and the pandemic hopefully nearing its end, clients must now deal with the “Great Resignation,” a phenomenon borne out of COVID-19 that has millions of U.S. workers leaving employment due mostly to burnout and the prioritization of personal time in favor of optimal work-life balance.

Are Your Participants Financially Ready for Retirement?

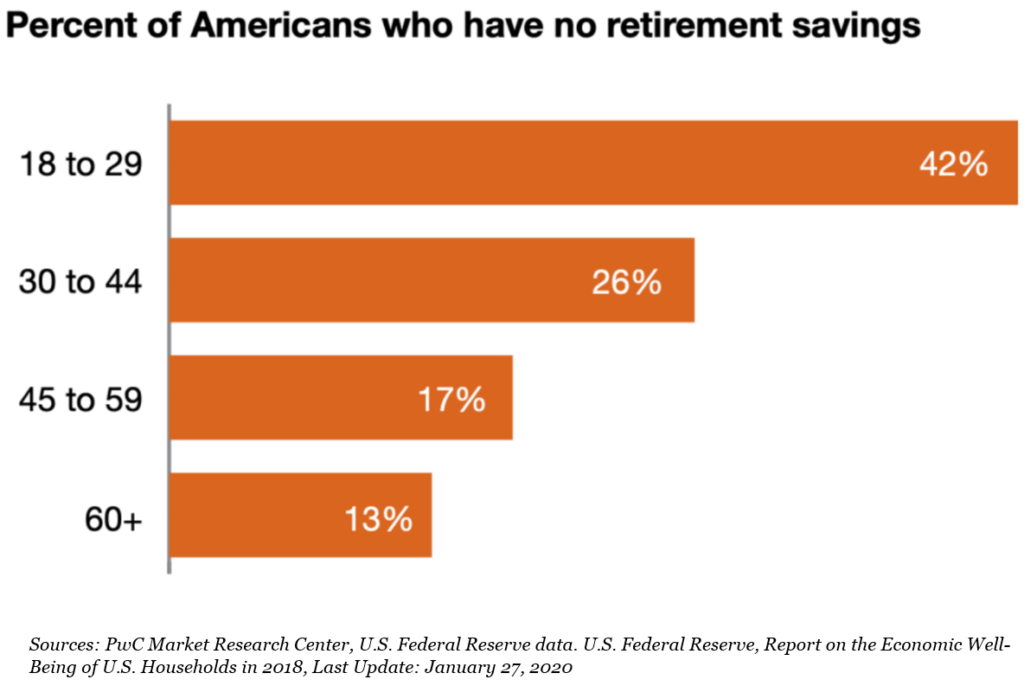

Despite these constantly changing and often turbulent workplace situations for employers and employees alike, one out of three people have no retirement savings.1

This statistic is especially eye-opening as tens of millions of U.S. employees will likely not be able to retire, “Great Resignation” or not. Engaging your pre-retirees early and frequently will help them answer two important and common questions often asked when contemplating retirement:

- Do I have enough saved for my retirement?

- At what age can I reasonably retire?

Although these answers are critical pieces of information for retirement planning, they alone cannot be accurately answered without other factors being considered. Through plan design and working with recordkeepers to develop more dynamic financial planning tools and education, Plan Sponsors today have an abundance of resources to help their employees strive to become successful retirees. Such resources include the following benefits:

- Automatic plan features drive higher enrollment and escalate deferrals.

- The catch-up feature allows additional contributions for participants older than 50.

- Managed accounts provide customized investment solutions for individual participants.2

- Partial withdrawal options can offer flexibility for plan participants, especially retirees.

- Social Security Administration and many recordkeepers have online tools that help a plan participant considering retirement maximize Social Security payments.3

- Lifetime income replacement tools are provided by the DOL and many recordkeepers, helping a plan participant design a strategy for periodic payments in retirement.4

Are Your Participants Emotionally Ready for Retirement?

Once a participant determines they are financially prepared to retire, they need to determine if they are emotionally ready as well. This sounds easy, as the first reaction by many is a resounding, “Yes!” However, being emotionally ready to retire may be a more complex issue for some.

Since the beginning of the pandemic, more than three million U.S. employees retired earlier than they initially anticipated. 5 This trend will likely continue for a few years and will be a challenge for many employers. It will benefit Plan Sponsors, and ultimately participants, to provide additional communication and education opportunities for its pre-retiree population. When developing your annual educational strategy specifically for your pre-retiree population, you can provide the following questions to help them consider emotional readiness:

- Will you continue to work part-time or volunteer?

- Do you have any hobbies or interests to occupy your newfound free time?

- If applicable, when is your significant other contemplating retirement?

- Are you and your family healthy?

- Will you be moving to a new location, staying in your existing home or downsizing?

Leveraging Resources for Educating Your Participants

Communicating and educating employees about the benefits of participating in your plan are important responsibilities. Plan participants, especially over the last two years, have sought more guidance, not less. To assist with keeping your participants on-track for retirement, and every life event in-between, ensure that the plan:

- Maximizes all contracted and available services delivered by the entity that is providing plan education services

- Leverages plan data to not only measure the success of individual campaigns but also plan for future communication and education needs

- Targets communications and education, especially for pre-retirees

- Provides personalized planning assistance (if available)

Armed with a strategic educational program, employers can improve the plan’s odds of effectively preparing a retiree who thrives during retirement. According to the 2021 Retirement Confidence Survey, 70 percent of retirees stated that the COVID-19 pandemic did not change their sentiments regarding secure retirement; in fact, 5 percent had more confidence in their retirement plans. However, a quarter of plan participants still feel that the education effort could be improved.6 This is a meaningful opportunity for the plan to drive positive results, especially for your pre-retirees.

If you to want to review your plan design, including the benefits of potentially adding a lifetime income solution, a managed account option or optimizing the educational tools and resources available through your existing recordkeeper, please contact Fiducient Advisors today. We can assist you with helping your plan participants strive to become successful retirees.

1Federal Reserve. Report on the Economic Well-being of US Households 2019, May 2020.

2Managed accounts generally charge a management fee and may differ by provider.

3Social Security Calculator (ssa.tools)

4Lifetime Income Calculator | U.S. Department of Labor (dol.gov)

5Faria-e-Castro, Miguel. “The COVID Retirement Boom” Economic Synopses, Oct. 15, 2021, No. 25.

6Employee Benefit Research Institute and Greenwald Research, 2021 Retirement Confidence Survey (31st Annual)

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.