Properly educating the next generation to be responsible and prudent stewards of wealth can be a big undertaking. It is important to remember successful investors started with the basics of next gen education, and that is exactly what we suggest. To start the conversation, below are two introductory topics that can serve as a helpful starting points when engaging this crucial conversation.

Compound Interest

Albert Einstein proclaimed compound interest to be the eighth wonder of the world. In his words, “He who understands it, earns it. He who doesn’t, pays it.”

Numerous books from the Automatic Millionaire to One Up on Wall Street highlight the payoff of compound interest. Time is on your side, is the pervasive message, highlighting over long periods of time compound interest is key to success.

Compound interest is calculated on the original principal dollar, which also includes the accumulated interest of previous periods. This is true regardless of the investment and can be conservative or aggressive in nature. Remember, this is different than simple interest which is a one-time calculation on the principal amount. Compound interest builds on itself and allows the earnings to be invested and grow as well. Simply put, it’s interest that’s earning interest.

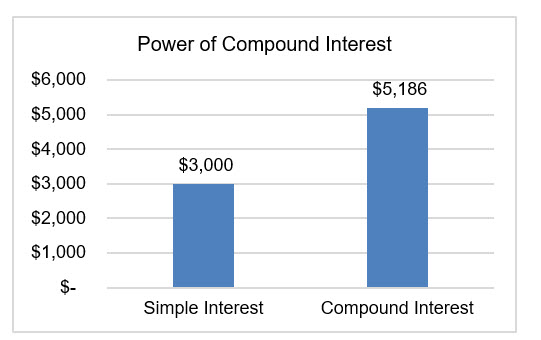

For example, take a one-time investment of $1,200 with a five percent interest rate. After 30 years, you would earn $3,000 with simple interest. However, utilizing annual compound interest would yield over 70 percent more – $5,186. If $5,000 can grow to $2.4 million in 40 years, just think over 60 years it can grow to $16.6 million. That’s the power of compound interest.

Compound interest is integral to accumulating wealth. Although investors should revisit their investment goals and objectives over short-term, it’s imperative to invest for the long-term. Fiducient Advisors’ investment philosophy, investment vehicles and retirement planning tools are based on compounding to help investors achieve their goals.

Market Timing

Another fundamental for future generations to understand, along with compounded interest, is market timing.

To get the highest returns, investors oftentimes attempt to time the market. And, it seems every television market analyst sound a bell, whistle or air horn to alert viewers of an opportunity. While some investors claim timing the market is possible, overwhelming evidence suggests otherwise.

Historically, the best days in the market are frequently followed by the worst; therefore, trying to time the market can cause investors to miss the ‘best days’.

And, while an investor may have avoided the worst days, missing the best days results in significantly lower returns.

Illustrating the point is Dalbar, Inc.’s annual Investor Behavior Study. In their most recent study, they concluded the average investor in 2018 ended the year with a loss of -9.42 percent while the S&P 500 Index only retreated -4.38 percent.1

Other firms analyze scenarios where investors miss the best days of the market over a given time period.

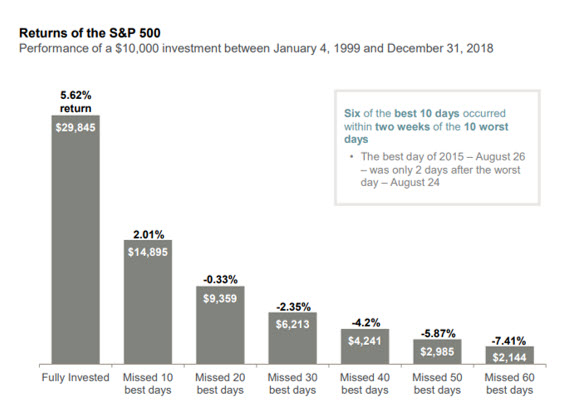

The graphic shows the S&P 500 returns of a $10,000 investment between 1999 and 2018. Over these two decades, the investment would have earned a 5.62 percent return if it remained fully invested.

However, excluding the 10 best days the investment would have only earned a 2.01 percent return.

Between 1999 and 2018, six of the market’s 10 best days occurred within two weeks of the 10 worst days. An investor trying to time the market who avoided the 10 worst days would have also missed the 10 best days, and likely have received a lower return on their investment.2

It’s important to remember timing the market requires two correct predictions – when to get out and when to re-enter. For investors who wanted to avoid the market downturn in 2008, but missed the subsequent 10-plus year bull market, this is a painful reminder.

Market timing is almost impossible and attempting to do so frequently can wreak havoc on asset allocation. As fiduciaries, Consultants at Fiducient Advisors work with clients continuously to address portfolio changes, to ensure long-term goals are in view.

1 Dalbar, Inc. (2019, March 25). “Average Investor blown away by market turmoil in 2018.” [Press Release] Retrieved from https://www.dalbar.com/Portals/dalbar/Cache/News/PressReleases/QAIBPressRelease_2019.pdf

2 J.P. Morgan Asset Management. 2019 Guide to Retirement.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.