Many endowment and foundation committee members understand the importance of good governance practices; however, investment policy statements across the endowment/foundation—and broader nonprofit world—often look wildly different from one another. These are among the most important governance documents; as such, they should reflect the specifics of each organization, including their mission, their needs and their goals. Style differences aside, below are the 10 key elements that each investment policy statement should address.

1. Introduction and Purpose of Investment Policy Statement (IPS)

Use specific details to illustrate the purpose of the fund. While the purpose could be as simple as “to support and promote the mission, growth and general welfare” of the organization, there are some instances when other items might be worth including in the IPS’s purpose. These objectives comprise a wide variety of missions or obligations, such as:

• Assisting the committee/board in fulfilling its fiduciary duties

• Conveying the fund’s purpose, investment objective, strategy and constraints

• Assigning roles and responsibilities

• Establishing a decision-making framework

2. Statement of Objective

After clearly delineating the IPS’s purpose, you should elaborate on the investment objective(s) to further support the policy statement’s reason for existing. Questions to ask when providing this statement of objective include:

• Is it achieving a minimum return equal to inflation plus spending over time, or something different?

• Is the time horizon perpetual, long-term or something else?

• Also consider any secondary objectives like prudently diversifying to mitigate risk or maintaining sufficient liquidity to meet obligations.

3. Spending Policy

Define the fund’s spending policy. This will probably involve a determination of how spending is calculated; whether it is a percentage of assets at a specific point in time or an average over another period of time; and the circumstances in which the board/committee may deviate from the policy.

More importantly, if there is a not a current spending policy, the committee/board should prioritize developing one. Doing so requires thorough deliberation on the following considerations:

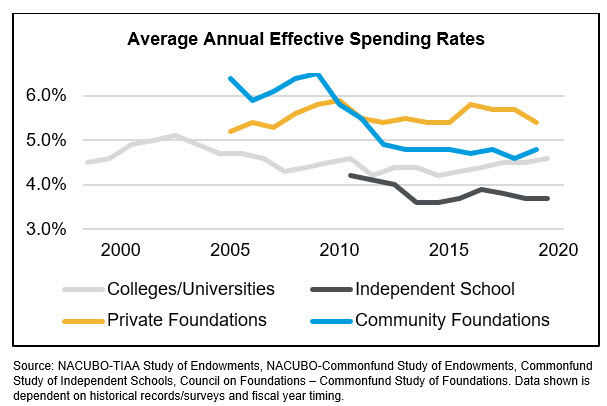

• What are the historical and potential future spending patterns?

• What is a reasonable assumption or range of spending?

• How does that impact the ability to fulfill the mission, both short- and long-term?

• Is the spending rate sustainable?

• Is the investment strategy aligned with the anticipated cash flows to maintain corpus for an extended period of time??

4. Roles and Responsibilities

You should customize all roles and responsibilities based on the structure in place; however, you also must ensure that responsibilities for the key roles are correctly and cogently defined. This mapping of vital roles and responsibilities should include all the following—but not be limited to these five roles:

1- Reviewing and approving the investment policy statement

2- Determining investment objectives and constraints

3- Selecting asset allocation targets

4- Selecting investment managers

5- Executing trades

5. Liquidity Constraints

Adequate liquidity is critical to meeting organizational spending and operational requirements; therefore, it is a best practice to define the minimum required liquidity in the IPS. This exercise is particularly important for portfolios that use illiquid alternative investments, such as private equity. Conversely, it is likely less critical to address this in portfolios invested solely with daily liquid mutual funds (and not contemplating future changes to that structure).Ideally, this section should define the minimum percentage of the portfolio that should be invested into specific liquidity categories, such as:

• Daily to monthly liquidity

• Greater than monthly and up to one year

• Greater than one year

6. Investment Guidelines and Constraints – Including ESG/Mission-Aligned Considerations

If any asset classes, investment strategies or investment manager structures are intended to be entirely prohibited from investment, include them here. If not, consider stating there are no prohibitions against any asset class, strategy or structure if it meets certain criteria. For instance, no prohibitions might be enacted provided the following criteria is qualified:

• The investment is intended for the sole purpose of advancing the fund’s objective.

• If doing so would be appropriate given the fund’s investment strategy.

• If such an investment is consistent with the fund’s liquidity constraints.

This is also an appropriate section of the IPS to state any other unique considerations, including ESG or Mission-Aligned Investing criteria, if utilized.

7. Asset Allocation Framework and Rebalancing

Asset allocation is commonly the primary determinant of performance. Reference the role of diversification among asset classes, strategies and investment managers to pursue the fund’s objectives. This establishment of an asset allocation framework and any necessary rebalancing must take into consideration the following:

• If asset allocation ranges or targets have been established for investment categories/asset classes, those should be detailed in an appendix to the policy – with the appendix location referenced in this section. Using an appendix makes future updates simpler, often avoiding the need to formally approve a full change to the policy itself.

• Include a reference to the rebalancing strategy here as well – that the allocation will be monitored to determine whether rebalancing is warranted.

• Also, state how contributions and withdrawals will be treated, whether they will be generally used as a means of rebalancing or not.

8. Investment Manager Selection

In this section, list the criteria the committee/advisor will consider during the selection process. Beyond simply historical performance alone, which can be misleading if used as the only proof point, you should consider these factors:

• Historical risk/volatility versus appropriate benchmarks

• Historical adherence to stated objectives and processes

• Depth of resources and quality of personnel

• Appropriateness of diversification

• Reasonableness of fees

- 9. Ongoing Evaluation and Manager Termination Guidelines

Before stipulating the best practices in evaluation and termination of managers, reflect on these main questions:

1- How will the committee/advisor review investments once they are implemented?

2- Are the investment managers still satisfying the original selection criteria and are they still appropriate?

Include examples of events that may trigger termination, such as:

• Illegal or unethical behavior on the part of the manager

• Failure to follow investment guidelines

• Turnover among key personnel

• Change in investment style or strategy

• Insufficient infrastructure to keep pace with asset growth

• Significant increase in expenses or fees

• Performance-related concerns

- 10. Proxy Voting

If no unique proxy voting criteria is used, convey a message in this section as shown below:

• Each investment manager is responsible for—and empowered to—exercise voting rights on behalf of the client.

• Each investment manager shall vote proxies in the best interest of the client.

If unique ESG or Mission-Aligned proxy voting criteria are utilized, describe that here as well.

Additional Thoughts

When drafting the IPS, it is helpful to clearly state at the beginning of the document who last approved it (e.g., the committee or the board) and when (month, day, year). The date will often coincide with a committee or board meeting, and the minutes of that meeting should reflect that it was approved or adopted.

Also, for good governance, be sure that actual practices are consistent with the language used in the IPS. If not, either follow the process or change the IPS language to remain consistent.

While some details are necessary, it is best to avoid unnecessary specificity overall when drafting your investment policy statement. Consider using terms like “periodically” instead of a specific frequency like quarterly whenever possible, especially if that action will not occur every quarter. Similarly, consider using words like “may” instead of “will” when describing potential actions that could be contemplated. The document should provide meaningful guidance while also allowing sufficient flexibility for the committee/board to fulfill its responsibilities.

We believe strong governance practices often lead to successful investment outcomes when applied consistently over time. Thus, crafting an investment policy statement that includes these crucial elements helps develop an enduring foundation upon which any nonprofit can successfully build and foster throughout that journey.

If you would like more information, please reach out to any of the professionals at Fiducient Advisors.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.