Compounding has long been celebrated as a cornerstone of successful investing, offering the potential to grow wealth exponentially over time. Today, harnessing the power of compounding is more than just an investment principle; it is a strategic approach to help achieve financial independence and long-term security. The concept goes beyond simple returns, demonstrating how reinvested earnings can create a snowball effect that builds momentum with each passing year. Below, we will explore what compounding is, why time is its greatest ally and how individual investors can effectively leverage it to help meet their financial goals.

What is Compounding?

At its core, compounding occurs when the returns on an investment generate additional returns over time. This process allows your money to grow at an accelerating rate, as interest or investment earnings begin to earn returns themselves. Unlike simple interest, where returns are calculated only on the initial investment, compounding factors in reinvested earnings, creating a snowball effect.

For example, let’s assume you invest $10,000 in an account that earns a 6% annual return. In the first year, your investment grows to $10,600. In the second year, you earn 6% not just on the original $10,000 but also on the $600 earned in year one. Over time, this exponential growth becomes increasingly significant.

Understanding the Rule of 72

When it comes to forecasting just how long it might take for your money to double, investors often turn to a tried-and-true mental shortcut called the Rule of 72. This classic rule offers a quick way to estimate the impact of compound growth without reaching for a financial calculator.

Here’s how it works: simply take the number 72 and divide it by your anticipated annual rate of return. The result gives you an approximate number of years your investment needs to double in value.

For instance, if your portfolio is expected to yield a 10% yearly return, divide 72 by 10 to get 7.2. This means that, barring withdrawals or further deposits, your money should roughly double in just over seven years. If you begin with a $500,000 investment at this rate, you could see it grow to $1 million in 7.2 years, thanks to the power of compounding.

While the Rule of 72 is a handy estimate, it’s good to remember it works best with moderate, predictable rates of return – and like any financial tool, it shouldn’t replace thorough planning or professional advice.

Illustrating Exponential Growth: The 8-4-3 Rule

To truly appreciate the full impact of compounding, it’s helpful to visualize how your wealth can accelerate over time. Enter the 8-4-3 Rule—a simple framework that highlights just how dramatically your investments can grow when compounding is given ample time to work its magic.

The 8-4-3 Rule breaks a 15-year investment journey into three phases, each showcasing a different stage of compounding’s power:

• The First 8 Years: Laying the Foundation

During the initial years, your investment experiences steady, incremental growth. Progress may feel slow, but this stage is crucial – each gain sets the stage for future compounding. Think of it as building the snowball before you roll it down the hill.

• The Next 4 Years: Picking Up Pace

As you move into the middle years, the snowball effect becomes much more noticeable. Your investment’s growth rate accelerates, often outpacing the total returns of the earlier phase. This is compounding in action, as your earlier gains start generating new returns.

• The Final 3 Years: Rapid Expansion

By the time you reach the last segment, growth can border on explosive. The accumulated returns from years past now generate significant new earnings – sometimes rivaling or exceeding the total gains of the earlier years combined. It’s here that the exponential curve truly takes shape.

For example, imagine making an initial investment and contributing regularly each month. In the first eight years, your balance grows at a relatively modest rate. However, by years twelve to fifteen, the compounding effect takes center stage, and your total wealth may appear to surge almost overnight. What felt like slow progress in the beginning ultimately lays the groundwork for this rapid expansion.

The takeaway? The 8-4-3 Rule drives home that patience and consistency are essential. Early growth may feel unspectacular, but with time, compounding rewards you disproportionately – the longer you stay invested, the greater your potential benefit.

Why Time is Essential

Time is the single most critical factor in compounding. The earlier you start investing, the more opportunities you give your money to grow.1 This is because compounding requires patience to unlock its full potential. Consider the following comparison:

- Investor A starts investing $5,000 annually at age 25 and stops contributing at age 35, having invested $50,000 total. Their investments compound at a 7% annual rate.

- Investor B starts investing the same $5,000 annually at age 35 and continues until age 65, contributing a total of $150,000.2

Despite contributing significantly less, Investor A often ends up with more money by age 65. Why? Because Investor A’s money had more time to compound.

How to Harness the Power of Compounding

1. Start Early

The earlier you start investing, the better. Even modest contributions made consistently over a long period can grow to significant sums. For example, investing $100 per month starting at age 25 can result in over $190,000 by age 65 at a 7% annual return – far exceeding the total contributions of $48,000.3,4

2. Reinvest Returns

To take full advantage of compounding, reinvest your earnings rather than withdrawing them. This applies to interest, dividends, and capital gains. Many investment vehicles, such as dividend reinvestment plans (DRIPs), make this process automatic.5,6

3. Stay Consistent

Market volatility can tempt investors to stop contributing or withdraw during downturns. However, consistency is key to long-term success. Dollar-cost averaging – investing a fixed amount regularly – helps you buy more shares when prices are low and fewer when prices are high, reducing the impact of market fluctuations.

It’s important to remember that compounding requires consistent growth over time, yet its impact can be diminished during periods of low returns or market downturns. These challenging periods may test your resolve, but maintaining your investment discipline allows your returns to continue compounding once markets recover. Sticking to your plan – especially through volatility – not only helps smooth out the bumps but also positions your portfolio to benefit from future growth.

4. Choose the Right Investment Vehicle

Tax-advantaged accounts such as IRAs and 401(k)s can supercharge compounding by minimizing tax drag. Without taxes eating into annual returns, your investments grow faster. Ensure your portfolio is diversified and aligned with your risk tolerance to balance growth and protection.

Optimize with Tax-Efficient Strategies

Beyond choosing the right account, how you invest within those accounts matters. Here are two additional strategies to potentially maximize your returns:

- Automate Recurring Investments: Setting up automatic contributions – like monthly 401(k) or IRA deposits – not only removes emotion from your decisions but also ensures you’re consistently investing, rain or shine. This approach, known as dollar-cost averaging, helps reduce the impact of market volatility and builds a disciplined investment routine.

- Consider Direct Indexing: For those seeking further tax efficiency and customization, direct indexing allows you to own the individual stocks that make up an index rather than the index fund itself. This opens the door to strategies like tax-loss harvesting (selling losing positions to offset gains elsewhere), as well as the ability to personalize your holdings to better align with your values and financial goals. While this approach was once reserved for high-net-worth or institutional investors, it’s increasingly accessible to everyday investors through many brokerage platforms.

By combining tax-wise account selection with automated contributions and advanced portfolio strategies, you can work to harness the full power of compounding and keep more of your investment gains working for you over time.

Investment Fees: The Silent Erosion of Growth

While compounding can be a powerful force for building wealth, investment fees can quietly eat away at your portfolio’s growth over time. Even seemingly modest annual fees can result in a substantial loss of potential returns when compounded across decades.

Let’s illustrate this with a simple scenario: Imagine two investors, each starting with a $1 million portfolio and earning an average annual return of 8%. The only difference? One pays a low annual fee of 0.1%, the other, a higher 0.5% fee. Fast-forward 30 years:

- The investor paying 0.1% in fees ends up with nearly $9.79 million.

- The investor paying 0.5% accumulates about $8.75 million.

That’s a gap of over $1 million – all lost to higher costs, not market performance. Over time, these fees don’t just reduce your ending balance; they also rob you of the compounding gains you could have earned on that lost money.

Why Fees Matter More Than You Think

Compounding works best when your returns remain undisturbed, growing year after year. Every dollar spent on fees is a dollar no longer at work for you, which can add up to hundreds of thousands – sometimes even millions – over a lifetime of investing. Actively managing costs by choosing low-fee mutual funds, ETFs, and investment platforms can help safeguard your portfolio’s long-term potential.

It’s also important to stay the course during market downturns, letting your returns rebound and continue compounding. While all investments come with some cost, the key is to keep fees as low as possible so you can maximize compounding’s full potential.

Make Compounding Work Even Harder

While starting early, reinvesting returns, and staying consistent are foundational, optimizing your strategy can further enhance your results:

Leverage Automatic Tools: Set up automatic contributions and reinvestments, making disciplined investing more intentional and helping you avoid emotional decisions.

Minimize Fees: Investment costs – such as fund management fees and trading commissions – can erode returns over time. Opt for low-cost index funds or ETFs when possible.

Maximize Tax Efficiency: Utilize tax-advantaged accounts and consider strategies like tax-loss harvesting to keep more of your gains working for you.

The Cost of Waiting

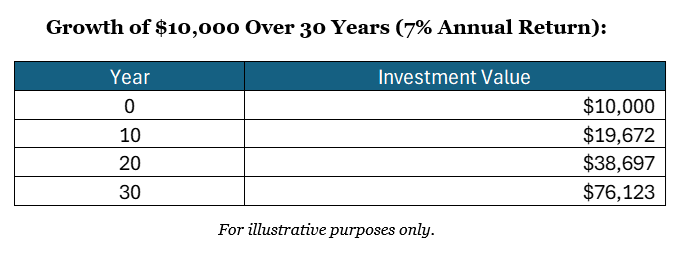

Procrastination can be costly when it comes to compounding. For every year you delay investing, you reduce the potential growth of your portfolio. For instance, a $10,000 investment earning 7% annually grows to approximately $76,123 in 30 years. Waiting just five years to invest reduces the ending balance to $53,865 – a difference of over $22,000.7

Visualizing Compounding

This chart highlights how the pace of growth accelerates as time progresses, underscoring the importance of starting early.8

Unlock Your Financial Future

The power of compounding is an investor’s greatest ally, but it requires discipline and a long-term mindset. Whether you are just starting your investment journey or looking to optimize your existing strategy, Fiducient Advisors can help.

Explore our resources to learn more:

Take the first step toward unlocking the full potential of compounding today. Remember, the best time to start investing was yesterday; the second-best time is now.

1Beginners’ Guide to Asset Allocation, Diversification, and Rebalancing | Investor.gov

2Compound Interest Calculator | Investor.gov

3Beginners’ Guide to Asset Allocation, Diversification, and Rebalancing | Investor.gov

4Compound Interest Calculator | Investor.gov

5Dollar cost averaging | Fidelity. May 6, 2024

6When to Reinvest Dividends (or Not) | Morningstar. May 17, 2024

7,8Compound Interest Calculator – Investor.gov

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.