As the holidays approach and the year winds down, the flurry of festivities and to-do lists can easily take center stage. But amid the seasonal rush, it is important to focus on key year-end financial planning opportunities. This 2025 year-end financial checklist highlights 12 meaningful opportunities which can potentially yield significant tax savings, strengthen one’s financial preparedness and help ensure alignment with long-term goals.

For personalized advice on how these strategies might benefit you, please reach out to a member of our private client team.

Tax and Charitable Planning

Manage Tax Bracket Variability

Individuals should consider how their current tax picture compares to prior years, as there may be “levers” which can be used to produce considerable tax savings.

In higher-income years, individuals may wish to accelerate itemized deductions (most notably, charitable contributions) while deferring certain income items (such as the timing of a bonus payout, the sale of a business, the sale of certain investments or stock option exercises). Charitably inclined taxpayers may wish to use a donor-advised fund to recognize a larger current-year tax deduction while making charitable grants from the donor-advised fund at a future date and at the pace of their choosing.

The One Big Beautiful Bill Act (OBBBA) includes changes for charitable giving beginning in 2026. Charitably inclined taxpayers subject to the highest federal tax bracket should consider these new changes in coordination with their charitable giving plans.

- New AGI Floor: A new 0.5% of Adjusted Gross Income (AGI) floor will apply to most charitable donations, with the proportion of charitable giving above the floor being deductible.

- New 35% Cap: The legislation caps the maximum tax benefit for charitable deductions at 35%, which will thus result in a reduced tax deduction going forward for taxpayers in the 37% federal tax bracket.

In lower-income years, individuals may wish to defer itemized deductions (such as charitable contributions) while potentially accelerating certain income items (such as a bonus payout, investment sales, stock option exercises, Roth conversions, etc.).

Charitably inclined individuals who are nearing retirement and who expect a significant drop in taxable income post-retirement might consider accelerating charitable donations (directly to charity and/or to a donor-advised fund) prior to retirement to maximize itemized deductions while in a higher income tax bracket.

Donate Appreciated Securities, Not Cash

It is estimated that December donations account for nearly a quarter (26%) of annual nonprofit revenue.1 As numerous nonprofit organizations request year-end donations, many individuals prefer the convenience of contributing by check or credit card. However, alternative giving methods may offer greater financial advantages.

Individuals with long-term appreciated securities held in a taxable account should consider gifting such securities to charity. Why? The charitable organization receives the same economic benefit as a cash donation, while the taxpayer receives a tax deduction for the full market value of the gift and, importantly, avoids paying capital gains taxes on the gifted security.

Gifting appreciated securities can also provide a tax-efficient means to rebalance a portfolio by reducing exposure to a given asset class or a concentrated stock position, without incurring capital gains.

Keep in mind the tax deduction for gifts of long-term appreciated securities to qualified public charities (including donor-advised funds) is limited to 30% of adjusted gross income (AGI) while similar gifts to a private foundation are limited to 20% of AGI.1 Charitable gifts in excess of the AGI limits result in a charitable carryforward which can be used over the next five years.

Satisfy Required Minimum Distributions (RMDs) via a Qualified Charitable Distribution (QCD)

SECURE Act 2.0 raised the beginning age for required minimum distributions (RMDs) to 73, yet eligibility to make a Qualified Charitable Distribution (QCD) remains at age 70½.

With a QCD, taxpayers aged 70½ or older can donate up to $108,000 (as of 2025) from an IRA directly to eligible 501(c)(3) charities (note: donor-advised funds, private foundations and supporting organizations are excluded).2

This strategy may be particularly beneficial for charitably inclined individuals who receive a greater tax benefit from the increased standard deduction rather than itemized deductions.

Harvest Losses in Taxable Investment Accounts

Loss harvesting presents a potential “silver lining” for taxable investors to take advantage of market declines. Realized losses can offset realized gains (and potentially up to $3,000 of current-year ordinary income), with any unused/excess realized losses resulting in a loss carryforward to be applied against future gains.3

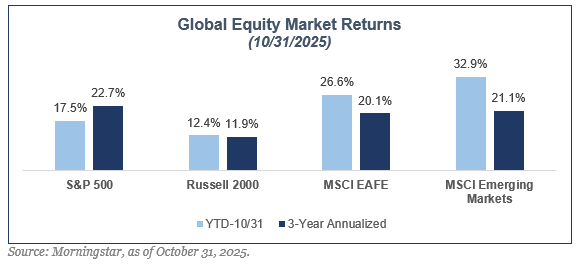

Admittedly, with global equities having generated significant gains over the last several years, investors may be left with few (if any) loss harvesting opportunities in taxable investment accounts, yet investors should still evaluate investment accounts for any unrealized losses.

Example*: Consider Barry and Susan Thomas, who have a joint account holding three actively managed equity mutual funds which collectively have $250,000 in unrealized losses. The Thomases sell the three positions and redeploy the sales proceeds to equity index funds. In doing so, they realize a $250,000 loss to offset current year (and/or future) realized gains, while their portfolio remains positioned to benefit from a subsequent market recovery.

*For illustrative purposes only.

Beware of the “wash sale rule,” which states that a loss cannot be realized for tax purposes if a substantially identical position was bought within 30 days before or after the sale.4

Analyze Mutual Fund Year-End Capital Gain Distributions

Mutual funds are required to pass along realized capital gains to fund shareholders. Regardless of whether the fund shareholder actually benefited from the fund’s sale of underlying securities, the shareholder will receive the capital gain distribution if the mutual fund is held as of the dividend record date.

Mutual fund families typically provide estimates for year-end dividend distributions over the course of October and November, with such distributions most commonly paid in December.

Capital gain distributions can be either short-term or long-term. Short-term capital gain dividends are treated as ordinary income and thus cannot be offset by realized losses. In contrast, long-term capital gain dividends are treated as capital gains and can be offset by realized losses.

Investors should compare a fund’s year-end distribution estimate against its unrealized gain/loss to determine if selling the position before the dividend record date would produce a tax savings.

In addition, investors should be careful with late-year purchases of actively managed funds in taxable accounts, as investing in a fund just prior to its capital gain dividend record date could result in additional taxes. An investor might instead choose to temporarily invest in a passive index fund and swap to the actively managed fund early the following tax year.

Estate Planning

Review Estate Plans and Consider Using the Lifetime Gift Tax Exemption

High-net-worth individuals received much-needed clarity as it relates to the federal estate exemption, as the One Big Beautiful Bill (OBBB) permanently set the basic exclusion amount (BEA) to a base of $10 million per person plus inflation adjustments.

The federal estate exemption is set at $13.99 million per person in 2025 and will increase to $15.00 million per person in 2026.5

While the fear of the favorable estate exemption sunsetting at the end of 2025 to a reduced base (possibly to $7 million per person) is no longer a concern, high-net-worth individuals should still review their current estate plans. It remains important to consider whether utilizing a portion of the lifetime gift tax exemption is appropriate, as a completed gift removes future appreciation from one’s taxable estate.

Make Annual Exclusion Gifts

Individuals are allowed to make “annual exclusion gifts” which do not have gift tax implications. In 2025, the annual exclusion is $19,000 per donee.6

For high-net-worth individuals with a potential or existing taxable estate, utilizing annual exclusion gifts can be an effective way to reduce one’s taxable estate while also providing financial support to loved ones.

Example*: Consider Jim and Mary Donaldson, a very wealthy couple with two married children (four spouses total) and six grandchildren. In 2025, the Joneses, as a couple, could gift $38,000 to each of the ten individuals for a combined total of $380,000, without such gifts counting against their lifetime gift tax exemption. By regularly making annual exclusion gifts, the Joneses are able to gradually reduce the size of their taxable estate, while also providing meaningful financial support to their family.

*For illustrative purposes only.

For those saving for future college expenses, special rules allow a donor to use up to five years of annual exclusion gifts for contributions to 529 college savings plans (a limit of up to $95,000 for a single taxpayer or up to $190,000 for joint taxpayers, as of 2025).7

It is worth noting that medical payments made directly to a medical provider do not count as taxable gifts. In addition, tuition payments made directly to an educational institution do not constitute taxable gifts. Tuition is narrowly defined as the cost for enrollment; it does not include books, supplies or room and board.

Plan for the Unexpected

A good estate plan should prepare for the unexpected. While it may be difficult to think about what would happen in the event of one’s incapacitation, it is critical to have documents in place which spell out who is entrusted to make important financial and medical decisions.

Important “must-have” estate planning documents include a durable power of attorney for finances, a health care proxy (essentially, a health care power of attorney) and an advanced care directive. Individuals with children who are minors should have a will which names a legal guardian.

Review Beneficiary Designations

Individuals should review financial accounts and insurance policies to ensure the recorded beneficiary designations align with their intentions. “Life events” such as marriage, divorce, birth/adoption, etc. should serve as an important point to review and update such designations.

Investment and Retirement Planning

Revisit Portfolio Allocations and Longer-Term Investment Objectives

Global equities (and U.S. Large Cap equities, in particular) have generated significant gains over the last several years.

Following an extended rally among risk assets, investors may fall into a sense of complacency over portfolio risk or, worse yet, may “chase returns” at an inopportune time.

Ideally, an investor should have an investment plan anchored to risk tolerance, time horizon and longer-term goals to avoid making emotional, reactive investment decisions based on the current market environment.

Investment goals can change over time and a portfolio’s allocation should be flexible to adjust accordingly. The changing market landscape can also make certain investments which were less appealing previously to be more actionable at other times. Regularly reviewing a portfolio’s allocation among cash, fixed income, global equities, real assets, and, if applicable, alternative investments against longer-term goals is a critical exercise for investors.

Assess Portfolio Tax-Efficiency

Investors should think of their portfolio as an allocation among several different buckets: after-tax (taxable investment accounts), pre-tax (traditional retirement accounts) and no-tax (Roth retirement accounts).

Rather than holding similar investments across all investment accounts, an investor should instead consider the “asset location” of investments designed to minimize tax drag to the greatest extent possible.

First, high-growth investments (such as global equities) should be allocated to Roth retirement accounts, given the favorable tax treatment afforded to Roth accounts. Actively managed equity mutual funds may be given additional consideration as capital gain dividends will not have tax consequences while produced inside the Roth account.

Next, traditional retirement accounts (such as an IRA, 401k/403b, etc.) should hold less tax-efficient asset classes, such as taxable bond funds and REITs which produce non-qualified dividends, which are taxed at ordinary income rates.

Finally, taxable accounts should be structured to “round out” the portfolio to get to a desired target allocation. In general, taxable accounts should hold more tax-efficient investments, such as equities which generally produce favorably taxed income (qualified dividends), and should evaluate whether to hold taxable or tax-exempt bonds, depending on an individual’s tax bracket.

Maximize Retirement Contributions

According to Vanguard’s “How America Saves 2025” report, only 14% of Vanguard plan participants contributed the maximum amount to their 401(k) plan in 2024.8

Individuals who are still actively employed should review their year-to-date retirement contributions and evaluate whether to make additional contributions prior to year-end.

- The basic employee 401(k)/403(b)/457 contribution limit is $23,500 for 2025.9

The catch-up 401(k)/403(b)/457 contribution limit for employees age 50 or older is $7,500 for 2025)10 - The IRA contribution limit is $7,000 for 2025.8

Under SECURE Act 2.0, effective for January 1, 2025, some individuals may have an increased retirement savings opportunity. In 2025, individuals 50 or older will have a 401(k)/403(b)/457 catch-up limit of $7,500; however, SECURE Act 2.0 includes a new provision for employees aged 60-63 to utilize an enhanced catch-up contribution limit of $11,250 (instead of $7,500). It is important to note that each Plan Sponsor will decide whether to implement this enhanced feature in their retirement plan.

Finally, individuals who are still working should assess whether to increase their contribution percentage for their 401(k)/403(b) for the next year and should consider whether to save to their employer retirement plan on a pre-tax basis (traditional contributions), on an after-tax basis (Roth contributions), or a combination of both pre-tax and after-tax contributions.

The Wealth Office® at Fiducient Advisors provides financial planning and investment consulting services to wealthy individuals and families, retirees, corporate executives and other professionals. With offices across the country, our team of credentialed and experienced advisors oversee approximately $34 billion of assets as of June 30, 2025, with the goal to help clients achieve their financial goals.

To unlock the full potential of your year-end planning, connect with our team at Fiducient Advisors. Explore our website for a wealth of additional resources on financial planning. Our seasoned professionals and insights are ready to help guide you toward financial success.

1Source: Schwab – “Is a Private Foundation Right for You?” (October 15, 2025)

2Source: Forbes – “IRS Announces Retirement Contribution Limits Will Increase In 2025” (November 1, 2024)

3Investopedia: “Capital Loss Carryover: Definition, Rules, and Example” (September 4, 2025)

4Source: Investor.gov – “Wash Sales”

5Source: Forbes – “Estate Planning and The Final OBBBA: Key Changes High-Net-Worth Individuals Must Know” (July 3, 2025)

6Source: IRS – “IRS releases tax inflation adjustments for tax year 2025” (October 2024)

7Source: Fidelity – “529 contribution limits for 2024 and 2025” (February 28, 2025)

8Source: Vanguard – “How America Saves 2025”

9Source: Forbes – “IRS Announces Retirement Contribution Limits Will Increase Will Increase In 2025” (November 2024)

10Source: IRS – “401(k) limit increases to $23,500 for 2025, IRA limit remains $7,000” (November 2024)

Disclosures & Definitions

Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that actual returns or volatility will be similar to the indices. Indices cannot be invested in directly. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect our fees or expenses. Market returns shown in text are as of the publish date and source from Morningstar or FactSet unless otherwise listed.

- The S&P 500 is a capitalization-weighted index designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

- Russell 2000 consists of the 2,000 smallest U.S. companies in the Russell 3000 index.

- MSCI EAFE is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the U.S. and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

- MSCI Emerging Markets captures large and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.