Key Observations

• Long-term falling interest rates and modest inflation have left many investors complacent about the risks and opportunities within their fixed income portfolios.

• We believe investors using history as a guide to how fixed income will weather a rising interest rate cycle may be missing a key difference from the past: punitively low yields.

• Regarding fixed income, if sized appropriately, diversified sufficiently and/or used with other asset classes, investors may be able to achieve favorable results despite these headwinds.

The last time inflation was seven percent and The Federal Reserve’s Fed Funds Rate was rising was 1979. For those keeping track, an investor in current markets who participated in such an environment would be 73 years old, or older, today. While rising interest rates, inflation and changing fixed income markets is not new, it may feel that way. Recent and even long-term history lulled some investors into fixed income complacency. To combat this, we will illuminate how fixed income works, look at where we are today and provide practical strategies for investors to employ in this environment.

Laying the Foundation: How Bonds Work

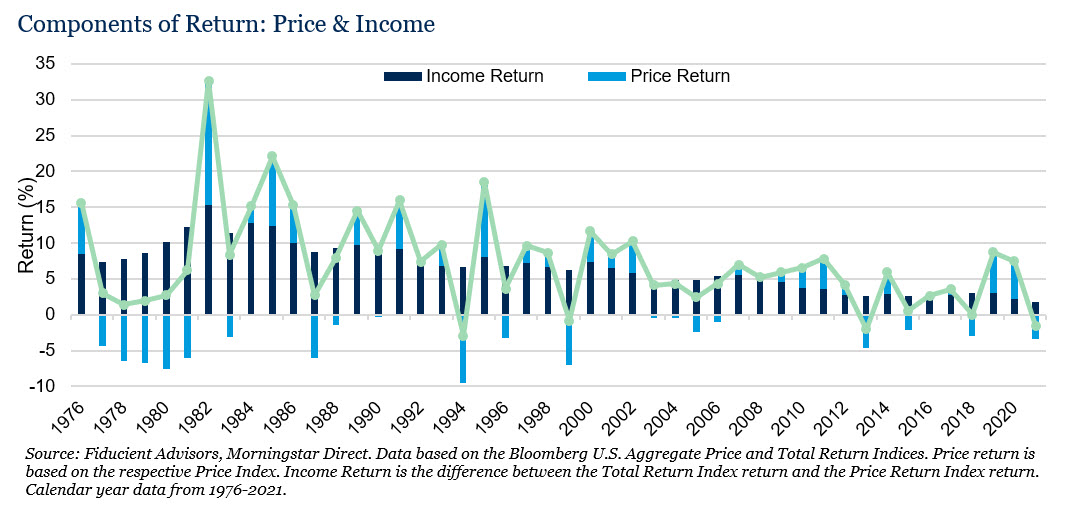

The primary source of returns from bonds comes from yield (often referred to as the coupon or the income from a bond). This makes the current yield of a fixed income portfolio both important and potentially predicative of future outcomes. The income component of fixed income securities also contributes to mitigating volatility and offsetting periods of time where the price return of bonds may be negative.

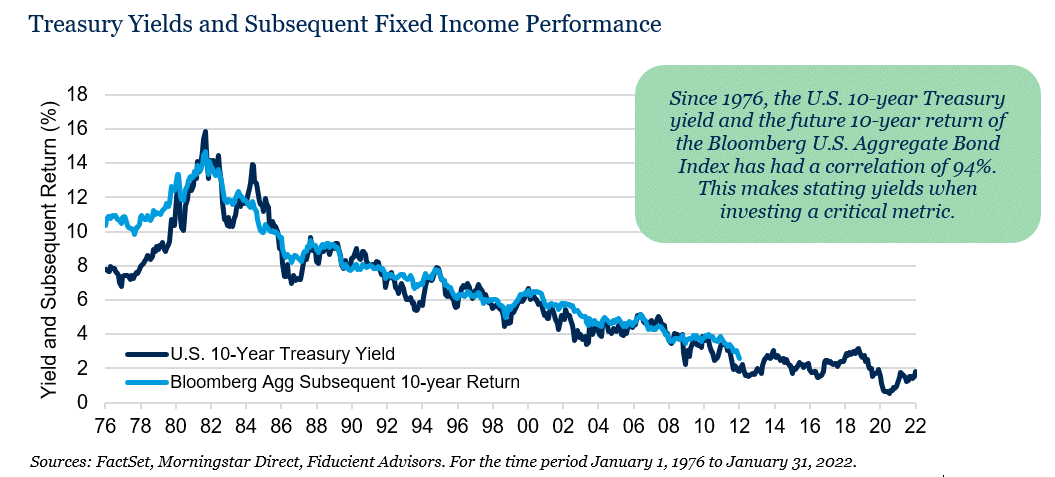

A bond’s starting yield is a strong indicator of future return. As demonstrated below, we map the 10-year U.S. Treasury yield with the future 10-year return of the Bloomberg U.S. Aggerate Bond Index (the “Index”). There is significant connection between yield and future return. In fact, since 1976, the 10-year U.S. Treasury yield and the future subsequent 10-year return of the Index had a 94 percent correlation.

Past, Present & Future

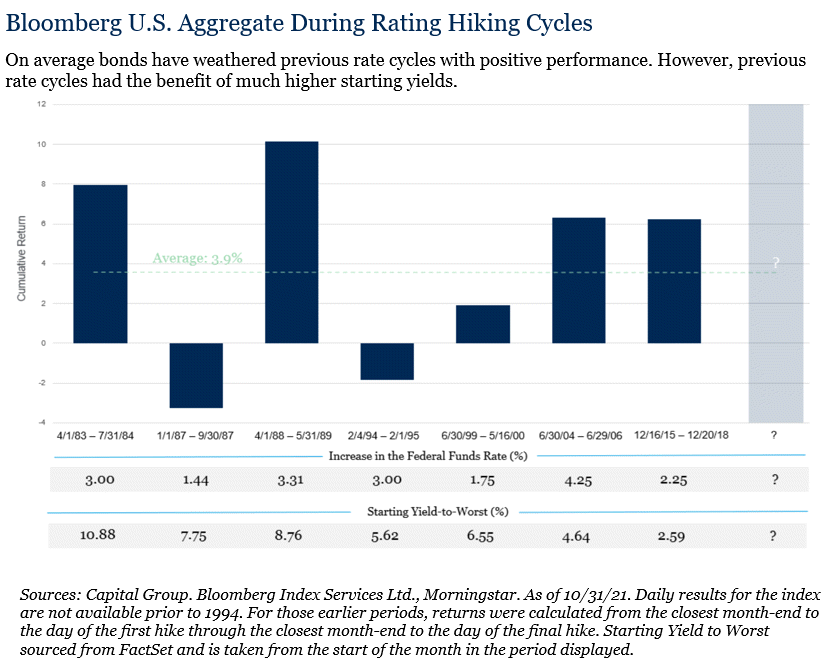

This is not the first time we have gone through a rate rising cycle. Since 1983 there have been seven rate rising cycles and as outlined below, markets have reacted differently in past periods. On average, the Index returned 3.9 percent during these rate rising periods. However, let us examine these time periods a bit more before we use this historical analog to quell our concern. As demonstrated above, yield is an important variable to future outcomes. The difference between today and the past is the average starting yield-to-worst was 6.7 percent. This gave fixed income investors a significant head start to positive outcomes.

Today, we do not have the same luxury. Yields are materially lower and moreover, the duration of the Index is higher than it has been in recent past. As a result, the Index is more sensitive to interest rate movement than in previous environments yet is offering investors less compensation in return for that risk.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.