The 2022 bear market and 2023’s Federal Reserve’s rate hiking cycle are likely impacting trends in ESG investing – not to mention changes in regulation. All the more reason to keep watch.

Play/Pause… Resume?

Earlier this year, we wrote about the heightened controversy concerning environmental, social and governance (ESG) investing that seemed to be pervading the headlines of major financial and news journals on a daily basis. We noted such debate is unsurprising given the subject’s still early development and complexity. While headlines suggest some market participants want ESG investing to press the stop button, it is more likely the debate will continue and more certain the concept of ESG investing is here to stay.

Market selloffs like we saw in 2022 and the current rate hiking cycle are certain to impact trends in ESG/sustainable investing, as these assets are no less immune to the effects of traditional market/business risk. All the same, meta-data studies have shown that the management (good or poor) of certain factors connected to ESG issues has the potential to affect company performance and thereby the long-term business value.1 To that end, we must keep watch.

For investors, the question remains: How can one sufficiently account for the risk/opportunity that ESG factors introduce – when distinct from business risk or other market risk?

For companies and regulators, the question looms: When might the industry achieve consensus on how ESG risk factors are addressed with adequate transparency?

The former question can be tackled initially by following a process outlined in our Guide to Mission-Aligned Investing; the latter remains ongoing and is largely contingent on growing the availability and accuracy of data and sustained efforts from regulators, lawmakers and other market participants.

When is Trend Your Friend? When It Displays More Accuracy

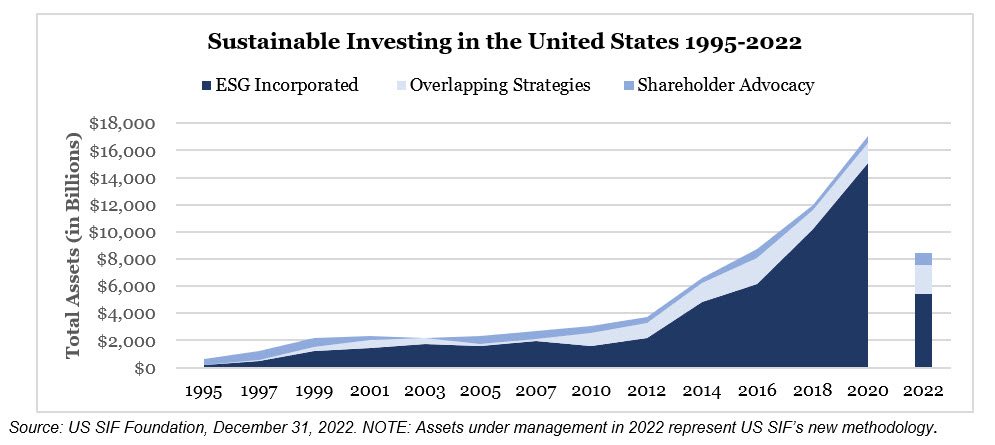

The US SIF Foundation produces a bi-annual trend report detailing the changes in assets connected with sustainable investing. From 1995 to 2018, the trend showed strong and robust growth. However, the 2022 Report used an adjusted and arguably more conservative methodology and, as a result, saw the aggregate level of assets invested sustainably drop quite precipitously. The modified calculation method essentially recalibrated a new anchor point from which to chart future trends.

Does this imply investors suddenly and dramatically abandoned interest in sustainable investing? Doubtful. It suggests organizations like US SIF are trying to improve the data and in doing so will offer market participants a more accurate representation of the views of sustainable investing as exemplified by the level and characterization of invested assets. Overall, this is a good and positive development.

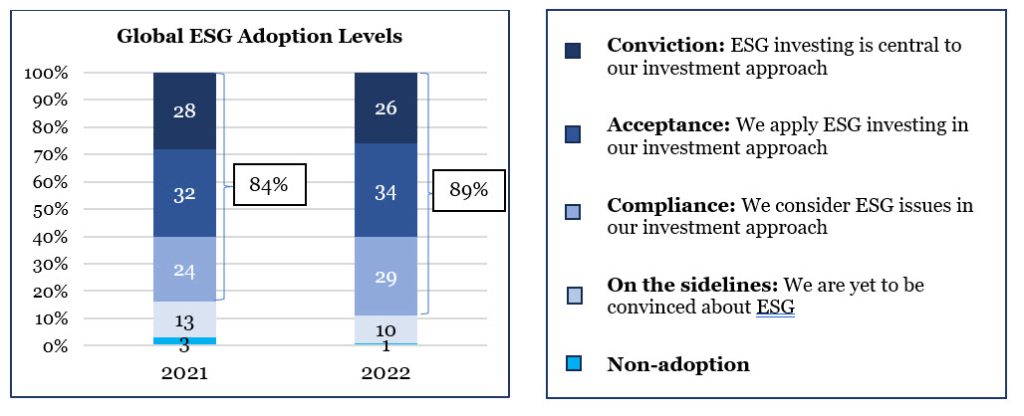

Conversely, according to another 2022 study produced by Capital Group2, the percentage of investors who are “on the sidelines” or “non-adopting” to ESG is trending lower globally. Does that mean the debate is nearing an end? No, but it underscores the recognition that consideration for ESG continues to advance and become more broadly accepted. We note the North America cohort remains higher relative to other regions and saw a marginal uptick from 2021-22.

Source: Capital Group, as of December 31, 2022.

A More Simplified Approach to ESG Regulation

In November of 2021, the International Financial Reporting Standards (IFRS ®) board announced the creation of the International Sustainability Standards Board (ISSB).3 Akin to the efforts that started decades ago to consolidate Generally Accepted Accounting Principles (GAAP) with IFRS, the ISSB is tasked with developing a global set of standards for ESG disclosure. The overall outcome and goal of these efforts is to improve company financial statements and disclosures to be more consistent, transparent and comparable to a global investor base.

The ISSB established two-year work plans and recently completed their first research projects this past June. These research projects resulted in the first two IFRS® Sustainability Disclosure Standards, IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and IFRS S2 Climate-related Disclosures, with effective dates for annual reporting periods beginning on or after January 1st, 2024.4 IFRS S1 establishes the general disclosure requirements for sustainability related risks and opportunities. IFRS S2 builds upon the requirements set in IFRS S1 and specifically address climate related risks and opportunities.

The ISSB recently requested feedback (until September 1, 2023) for its agenda priorities for its next two-year work plan. The potential research projects include exploring sustainability related risks and opportunities tied to biodiversity, ecosystems and ecosystems services, human capital, human rights, as well as exploring how to further build upon the financial reporting requirements set forth in IFRS S1 and IFRS S2.5

A Look Ahead

As ESG investing evolves, we will continue to follow trends and market developments. The evolution of this subject is likely to display continued dynamism but also some fits and starts. The one constant we expect will be change. Data should continue to improve, regulation advance, and (with those) greater transparency and understanding of risk should develop.

All the same, we do not anticipate our philosophy or process toward ESG to change much, if at all. For investors seeking help in aligning their investment portfolios with personal or organizational values, we offer our Guide to Mission-Aligned Investing.

For further insights and comprehensive information on ESG or mission-aligned investing, please contact any of the professionals at Fiducient Advisors.

1CFA Certificate in ESG Investing Curriculum 2023, page 50.

2Capital Group – ESG Global Study 2022

3IFRS – IFRS Foundation announces International Sustainability Standards Board, consolidation with CDSB and VRF, and publication of prototype disclosure requirements, November 3, 2021

4IFRS – ISSB issues inaugural global sustainability disclosure standards, June 26, 2023

5IFRS – Consultation now open: The ISSB seeks feedback on its priorities for the next two years (May 2023)

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.