Searching for Opportunities in a Stabilized Market

Key Observations

AI (artificial intelligence) continues to reshape venture capital across sectors, driving unprecedented concentration and valuation growth. This surge reflects investor prioritization of AI-driven innovation but also signals a narrowing funnel of capital toward a few dominant players. These same AI dynamics have also led to improved fundraising levels within the Real Asset sector.

Fundraising across private markets is increasingly concentrated among large, established managers, as LPs continue to prioritize scale, track record and simplicity. This trend raises barriers for emerging managers but may create inefficiencies in the lower middle-market, where fewer capitalized players could lead to overlooked opportunities.

Liquidity constraints are helping drive creative exit stategies and secondary market activity. Private equity GPs are increasingly relying on NAV loans, continuation vehicles and structured exits, while venture secondaries are gaining traction as LPs seek liquidity at discounts.

Fundraising Friction and Deal Uncertainty

As attention continues to focus on private markets, the environment remains challenging across many fronts. Fundraising remains a challenge as timelines extend and, in many cases, GPs need to show progress on early deals before they can gain fundraising momentum. Deal activity started the year on a very optimistic note and then slowed significantly during the second quarter as buyers, sellers and lenders all grappled with uncertainty and unknowns around tariffs. As we have shared before, when volatility picks up in public markets, oftentimes deal activity grinds to a halt as parties try to determine how the new reality impacts their investments. Over the summer, as the band of outcomes around tariffs narrowed, processes resumed and deal activity regained some strength, coinciding with the added likelihood of a decreasing rate environment and improved strength in public markets.

Under the hood, as both more capital and investor types enter the private markets, the nuances increase and potential opportunities to generate outsized returns decrease. Historically, we have observed this phenomenon in other markets and continue to push ourselves to generate independent thought, utilizing our perspective we have across asset classes, investor types and expanding information networks.

Global Fundraising and AUM

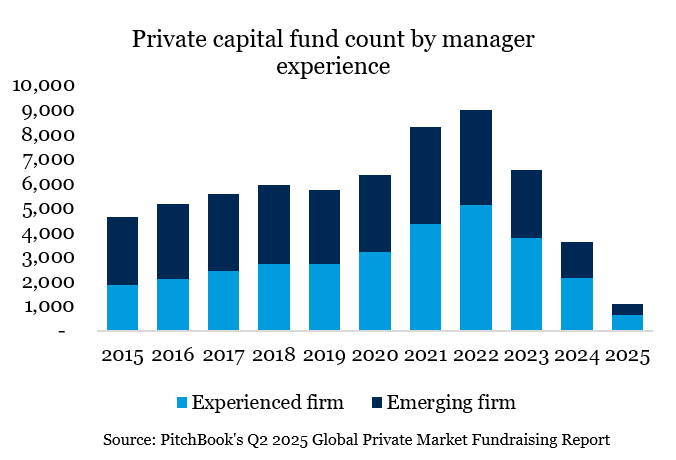

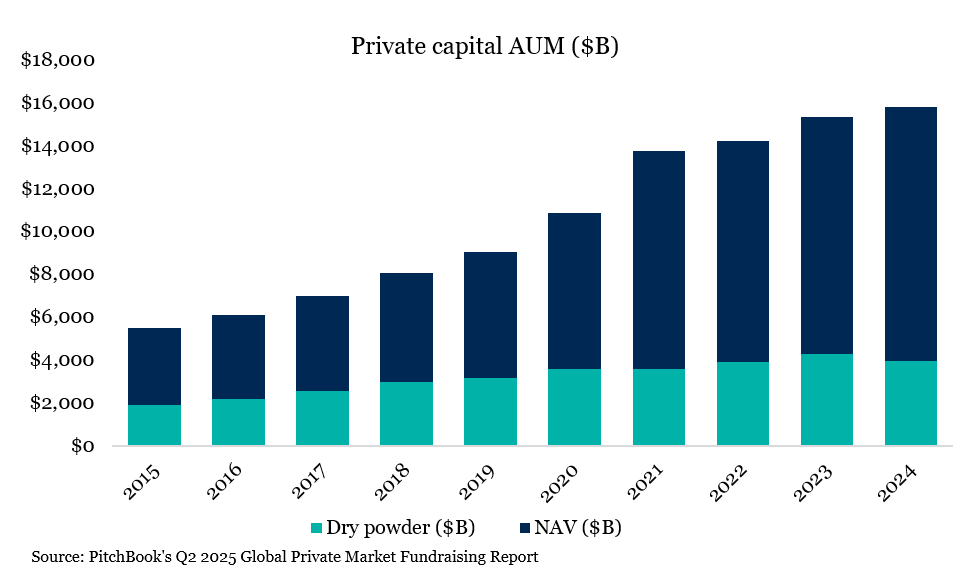

Ask anyone active in the market and they will tell you fundraising has not gotten any easier. If the anecdotes aren’t convincing, the numbers should be. Through the first half of 2025, global private capital fundraising totaled $640 billion across just over 1,100 funds, a sharp contraction from the $910 billion raised in 2023, and barely half of the $1.27 trillion closed in 20211. Fund count has been hit even harder, falling nearly 50% YoY with fewer than 3,000 funds globally holding a final close over the past four quarters, compared to almost 9,000 at the cycle peak.

The implication is straightforward: capital is consolidating into fewer, larger hands. In 2023, funds over $1 billion already accounted for nearly three quarters of all capital raised, and by 2025 that concentration only intensified. Experienced managers captured about 85% of capital in 2023, and that share has grown to 88% in H1 2025. For emerging managers, the bar to entry has rarely been higher. LPs continue to favor scale, track record and perceived safety, often citing the administrative burden of too many relationships and the recent memory of challenged distributions. The consequences are visible on both sides of the table. For more established firms, this dynamic reinforces a self-fulfilling cycle where they face similar challenges while also achieving greater success.

For high-performing individuals considering a spinout, the risks loom larger, as raising outside the brand halo of an established platform has rarely been more difficult. At the same time, LPs are slowing re-ups and extending diligence cycles, which has pushed the median fundraising timeline from about 12 months at the shortest cadence in 2021, to 18 months or longer in 2025. In addition, the growing need for robust back-office operations and expanded reporting requirements has increased the overhead burden, creating an added deterrent for smaller funds despite high capital needs.

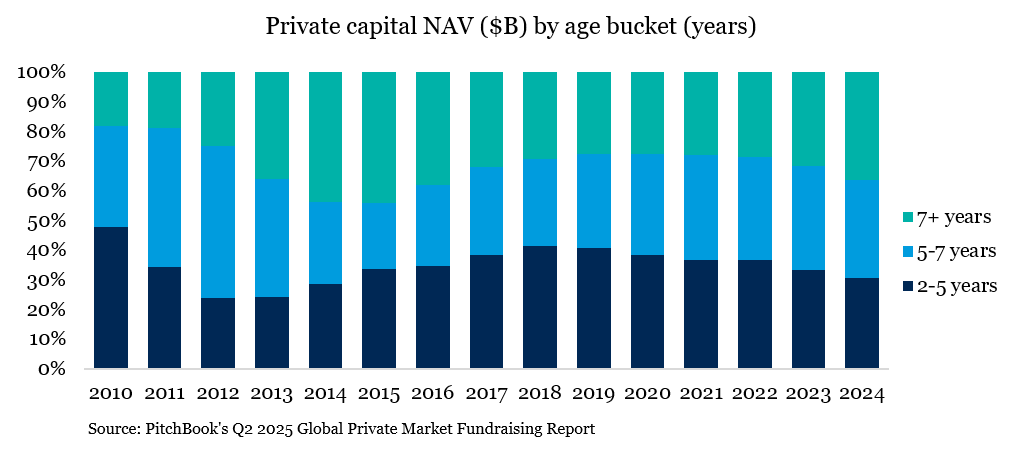

Public markets remain near record highs, private market return profiles are holding up, and investors continue to talk about pent-up demand. So, why does this disconnect persist? Liquidity remains the missing piece. While dry powder is still substantial, 2024 marked the first decline in dry powder since 2010, with balances falling by more than $300 billion year-over-year. Capital calls have outpaced distributions in six of the past seven years, leaving LPs cautious. To generate liquidity, GPs have leaned harder on tools like NAV loans, continuation vehicles and structured exits, which represent creative but imperfect solutions to a persistent imbalance.

In short, private capital fundraising today is defined by concentration, longer timelines and constrained liquidity. Until exits improve meaningfully and LPs regain confidence in cash flows, the cycle will remain challenging.

Private Equity

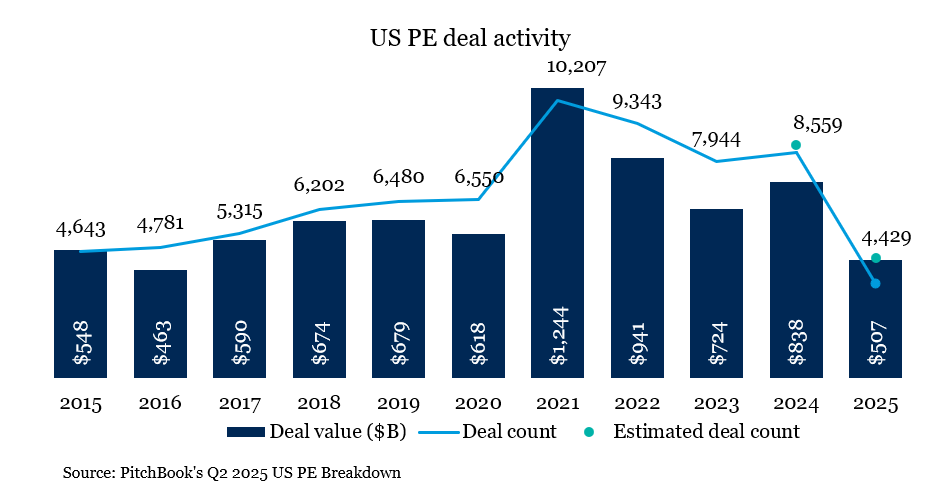

Deal activity in private equity (buyout, growth equity and turnaround strategies) continues to grow off its lows in 2023. In the first half of 2025, deal value bounced almost 29% year over year driven by heightened larger deals, while deal count was up only 8% compared to last year. Two of the largest deals that helped drive growth were Blackstone’s $11.5B acquisition of TXNM Energy and 3G Capital’s $9.8B acquisition of Sketchers. After a strong and optimistic start to the year, tariff uncertainty put a pause on most deals as all parties had to evaluate new risks that hadn’t existed before. As one GP said to us, “It’s as if everyone just rolled over and hit the ‘Snooze’ button on everything.” Throughout the summer, as the market became more comfortable with where ultimate tariffs may land, most deals have re-engaged with confidence. Private deal activity value, which had picked up in 2023 and parts of 2024, experienced a year-over-year decline of 58%, while public markets remained strong. When broken out by sector, deal activity remains relatively unchanged over the past few years, with B2B and B2C, along with IT, continuing to be the lion share.

Add-ons continued to dominate the overall transaction activity volume, approximately 3% above the five-year average of 72.5%. While add-ons are an effective way to grow a business quickly, particularly if organic growth looks meager, they present their own challenges as it pertains to integration. In today’s market, roll-ups that haven’t sufficiently integrated are facing steeper challenges in the exit market, putting pressure on GPs to do more work. US add-on value is predominately driven by B2B at approximately 35%, while other sectors like healthcare and IT make up 14% and 22% respectively.

The trend of businesses at the lower end of the market, trading for less relative to the upper end of the market, continues with global EV/EBITDA multiples of deals $1B – $2.5B at 18.3x while deals under $25MM were 4.3x on a trailing twelve-month basis. While $25 million is considered a relatively small deal, there continues to be a significant disparity in pricing between the most efficient sales and those that are less efficient.

Venture Capital

The venture landscape in 2025 continues to be shaped by AI-driven transformation, a surge in down rounds, heightened capital concentration and persistent uncertainty around the IPO market. Among these dynamics, AI remains the dominant growth engine, fueling optimism and attracting the lion’s share of capital. Year-to-date, AI startups have accounted for 64% of total deal value, consistently outperforming non-AI peers in valuation growth across all stages of funding, according to Pitchbook data.

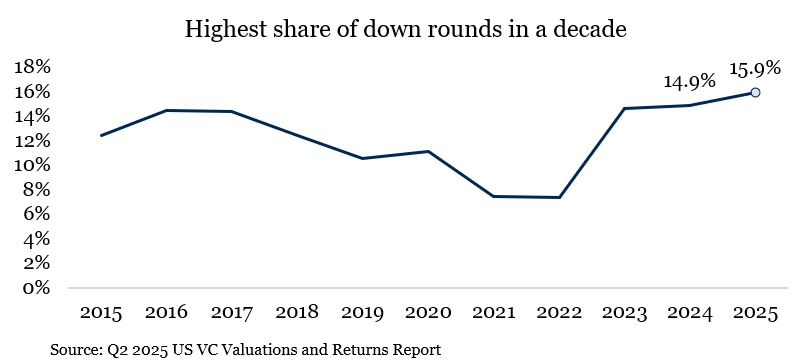

While AI-centric start-up companies have propelled deal activity, the broader market tells a different story. Many mature, venture-backed businesses have faced valuation pressure, with 2025 marking the highest share of down rounds in a decade. Nearly every major listing in Q2 priced below prior private valuations, underscoring some of the challenges for late-stage companies navigating today’s environment. In many ways, however, the reset has created more capital efficient and resilient startups as they have recently seen how capital supply can evaporate.

2025 is also emerging as one of the most concentrated venture markets in the last decade. In Q2 alone, the top five deals captured 37% of total funding, which is more than double their 17% share in 2024, according to Pitchbook. The largest transactions, led by OpenAI’s record-setting raise as well as significant rounds from Anthropic, xAI, Binance and Infinite Reality, highlight the strategic priorities shaping the next phase of the venture capital landscape.

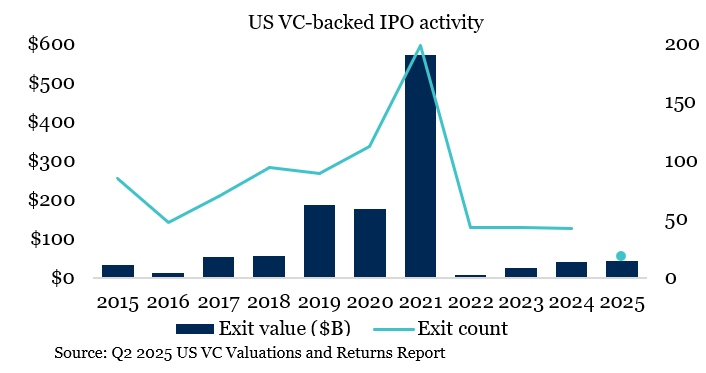

While the narrative going into 2025 was increased optimism around the IPO market, just 18 companies have completed a listing, pacing the year for the lowest in a decade. So far, the year can be described as quality over quantity for VC backed IPOs. While the volume of deals fell short of optimistic forecasts, the aftermarket performance of those that did list has been exceptional, signaling strong investor appetite for high-growth, innovation-driven companies. The market is cautiously optimistic heading into 2026, but the IPO window remains selective, favoring companies with clear paths to profitability and exposure to AI or digital infrastructure.

Finally, venture secondaries have emerged as a compelling theme. As companies remain private for longer and traditional venture funds deliver limited distributions, many LPs find themselves over-allocated to VC and seeking liquidity, often willing to sell at discounts. In contrast to the broader secondary market which only continues to increase in efficiency, venture investors with strong relationships to Tier 1 VCs maintain a natural moat as a small handful of potential secondary buyers. This dynamic has created opportunities for secondary buyers to acquire stakes in high-quality, VC-backed companies at attractive valuations. With optimism around a reopening IPO window in the coming years, these strategies may offer a compelling way to gain exposure to fast-growing businesses ahead of potential public listings.

Real Assets

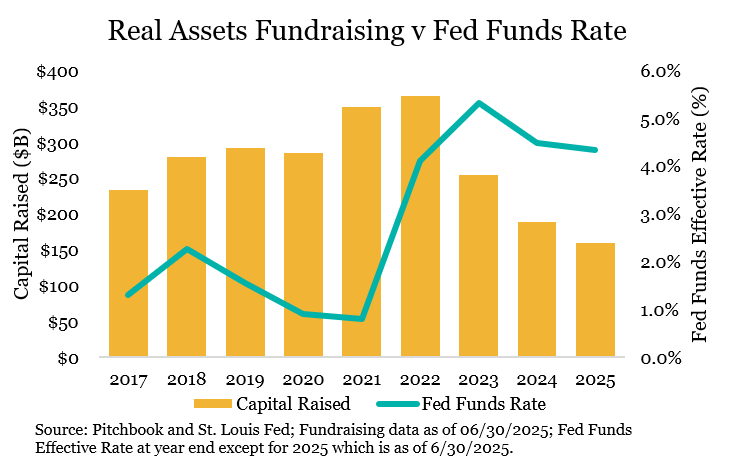

Although elevated interest rates since 2022 have broadly slowed fundraising, early signs of recovery are emerging in 2025, particularly within Real Assets (excluding real estate) and to a lesser extent within more traditional Real Estate. In Real Assets, capital raised in the first half of 2025 nearly matches the total raised in all of 2024, while Real Estate has already secured 68% of its 2024 total. This rebound is likely supported by expectations of lower future interest rates and asset owners gradually accepting recent asset repricing.

Real Assets broadly continue to benefit from favorable long-term secular trends including digitalization, electrification and rising power demand, especially driven by AI. We remain constructive on the sector, though elevated valuations, particularly within the digital segment, call for a more selective investment approach. This could include favoring certain power-related investments and non-data-center investments that can service a broader array of economy needs. Traditional energy, long overlooked due to its cyclical nature and shifting policy mandates, is now experiencing renewed investor interest. This resurgence is primarily driven by the escalating energy demands of AI, alongside a recent more accommodating policy environment. Despite the potential for accommodating policy reversal, an inherent challenge given the long-term nature of the asset class, investors are increasingly open to traditional energy given strong expectations for near-term cash flows to meet AI needs. Within the traditional energy mix, we continue to favor natural gas as a preferred option due to its cost efficiency, operational reliability and essential role in stabilizing a grid increasingly reliant on intermittent renewable sources. Amid rising AI-driven energy demand which has been lifting all forms of traditional energy lately, natural gas stands out among other traditional energy forms for its diversified fundamentals.

In Real Estate, rising rates in recent years have led to broad repricing, with significant declines from peak valuations. A slowdown in new construction is a positive development, but oversupply in certain sectors and regions may take years to absorb. Despite widespread value compression, fundamentals in select markets and subsectors remain resilient, offering opportunities to acquire quality assets at discounted prices. We continue to see potential in repriced assets with strong fundamentals, particularly in retail, senior housing, and select industrial and multifamily segments. As traditional real estate increasingly resembles commodities and office challenges persist, investor interest is shifting toward niche sectors such as self-storage and manufactured housing. We are actively evaluating niche opportunities with long-term potential, while remaining disciplined amid elevated pricing, which has become more prevalent in the sector.

Looking ahead, we expect compelling opportunities in upcoming Real Estate fund vintages. Capital structure pressures, tighter lending standards and looming debt maturities are likely to drive transaction activity. Managers with fresh capital will be well-positioned to acquire high-quality assets from sellers facing refinancing constraints.

Private Debt

Private debt continues to build on its fundraising momentum and has established itself as the second-largest asset class in the private capital landscape, surpassed only by private equity. Private debt has taken center stage in capital raising within the insurance and private wealth segments, thanks to the rise of evergreen structures. These vehicles now represent a substantial portion of the capital raised by top US managers, reshaping how credit strategies attract long-term capital.

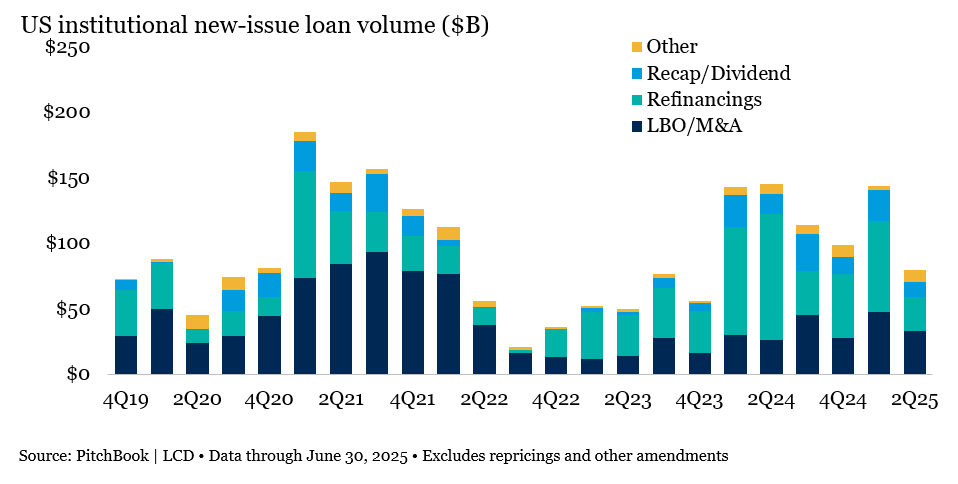

While capital raising has been strong, deployment has been more challenging. Loan volumes are down 23% year-over-year through June, driven by policy uncertainty, valuation mismatches and higher financing costs. That said, managers remain optimistic that activity will rebound as market conditions stabilize.

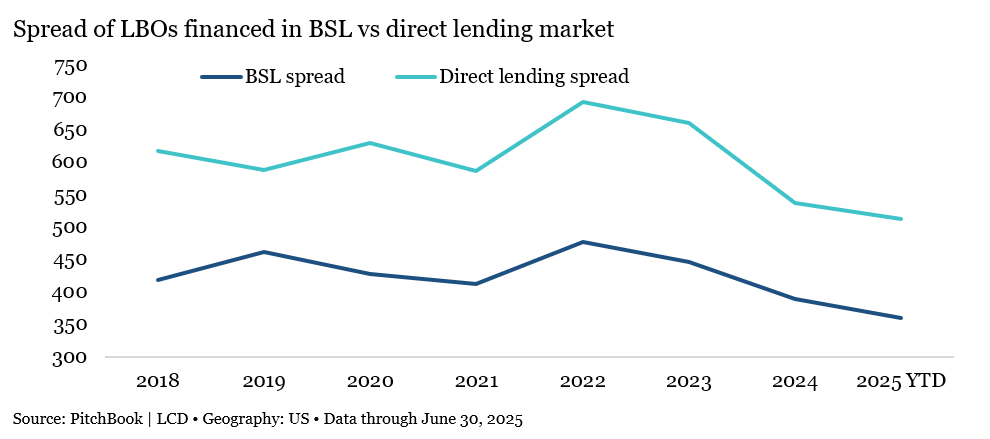

With M&A and LBO activity lagging behind the capital raised for these strategies, private credit lenders are facing fierce competition for high-quality opportunities—pressure that’s increasingly evident in tightening spreads, particularly on larger loans. Borrowers are also exhibiting some signs of stress as reflected in lower interest coverage ratios alongside an increasing rate of payment-in-kind. According to Houlihan Lokey performing private credit index, average interest coverage ratio in private credit loans has declined from a peak of 3.2x in 2021 to ~1.5x in recent months and the proportion of borrowers with Interest coverage ratios <1.5x now stands at 47%, up from just 7% in Q4 2020. Investors could expect continued strength in fundraising, but near-term returns will hinge on disciplined underwriting amid rising borrower stress.

Adapting to Change

A lot has changed in private markets over the past several years, highlighted by significant trends and developments that are shaping the future of this sector. As more capital flows in, the herd mentality may continue to grow, potentially increasing market efficiency and decreasing alpha opportunities. Moving forward, it is crucial for investors to remain vigilant and adaptable, leveraging innovative strategies to navigate the evolving landscape. By staying attuned to market dynamics and maintaining a proactive approach, we believe stakeholders can continue to drive growth and achieve sustainable success in the private markets.

1Pitchbook’s Q1 Report

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.