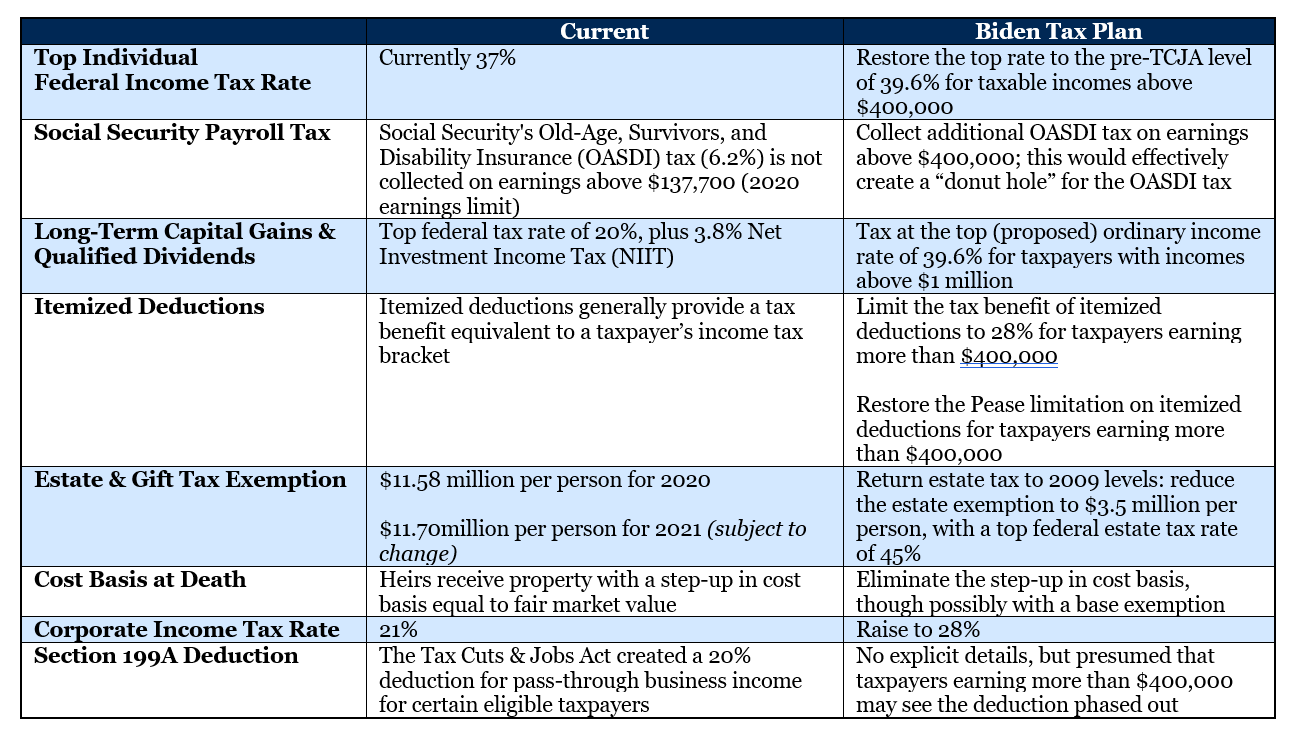

During his presidential campaign, Joe Biden outlined his tax policy proposals1, which included rolling back key provisions from the Tax Cuts and Jobs Act (TCJA). An analysis by the Tax Foundation estimated the Biden plan would raise tax revenue by $3.3 trillion over the next decade.

In order to achieve these tax policy proposals, Democrats would likely need to have control of both the House and the Senate. While Democrats ended up retaining control of the House, the path to gaining control of the Senate appears challenging. As it currently stands, Republicans have a narrow lead (50-48) in the Senate, with special run-off elections slated for January 5, 2021 for Georgia’s two Senate seats. If Republicans win at least one of the run-off elections, Republicans would maintain control of the Senate.

So where does this ultimately leave taxpayers? The safest bet is to execute certain tax and estate planning strategies prior to year-end 2020 to avoid risks associated with potential tax reform. For those that would prefer a ‘wait-and-see’ approach to see if tax reform legislation gains traction in 2021, we would offer the following insights:

1 The Tax Foundation – “Details and Analysis of President-elect Joe Biden’s Tax Plan” (October 22, 2020)

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.