Fueled by a litigious environment, the monitoring and benchmarking of fees has become an increased area of focus in Defined Contribution plans. ERISA requires fiduciaries to carry out their responsibilities prudently and solely in the interest of the plan’s participants and beneficiaries. One of these responsibilities is to ensure the services provided to their plan are necessary and that the cost of those services is reasonable.

As part of our Fiduciary Governance Calendar cadence, Fiducient Advisors provides an Annual Fee Review for clients. The Annual Fee Review utilizes our proprietary fee survey, The Institutional Consultant’s Plan Survey, which provides insights into fee trends for Defined Contribution plans and assists clients by benchmarking their fees against peers with similar plan demographics. This fee review helps clients understand plan fees, revenue sharing agreements, pricing models, compensation received by service providers and to help identify the costs of the plan. It also provides a documented Fiduciary Trail® that the sponsor is fulfilling their fiduciary responsibility as it relates to fees. It is recommended that a fee review is conducted annually.

Recent trends emerging over time have led to more encompassing fee reviews as detailed below.

Fee Leveling

Fee leveling or fee equalization refers to the concept of all plan participants paying the same amount, either assessed pro-rata or per capita, for recordkeeping fees. Fee leveling can be achieved by either having a full zero revenue sharing investment lineup or by debiting/crediting revenue sharing to a uniformed amount for all funds in the investment lineup. As more plans have moved away from using revenue sharing to cover recordkeeping expenses, the popularity of fee leveling has increased. To observe this trend, Fiducient Advisors utilized The Institutional Consultant’s Plan Survey1 to analyze the use of fee leveling by our clients from 2019 – 2023. During this time period, the use of fee leveling increased by approximately 38% and this fee structure has been implemented by over three quarters of clients1. Most clients use a debiting/crediting methodology to achieve fee leveling. Fee leveling continues to grow in popularity amongst our clients and the industry at large.

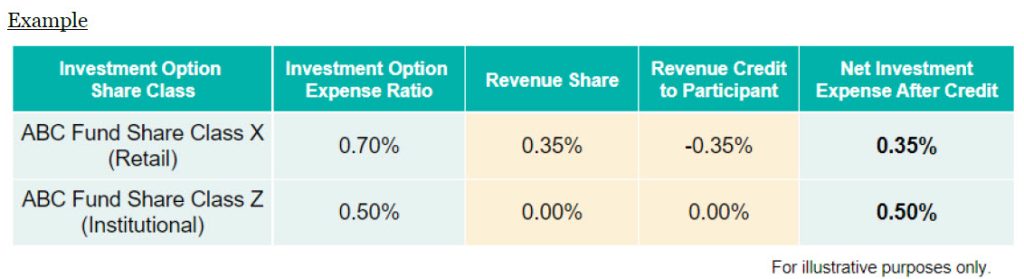

Lowest Net Cost

The concept of lowest net cost recognizes the arbitrage that may exist with certain investments by using “more expensive” retail share classes instead of “lower fee” institutional share classes. In these scenarios, revenue sharing, or a portion of the higher expense ratio, is credited to participants to create lower total costs. This concept has seen increased momentum but has not been widely adopted by Plan Sponsors.

Some considerations with lowest net cost include:

• Participant communications – revenue sharing rebates are typically not reflected on ERISA

404a-52

• Participant perception of increased fees, or billed fees because of a new pricing model

• Changes to expense ratios and revenue sharing amounts between share classes

• Timing – revenue sharing rebates typically occur after quarter end

• Published returns will not reflect revenue sharing credits

• Impact to Form 5500 filing

• Other fiduciary considerations

This approach should always be reviewed with your plan’s ERISA counsel.

Fee Structure

The defined contribution marketplace has seen a shift in the way recordkeeping fees are assessed in recent years. In the past, most plans paid for recordkeeping fees using the revenue sharing generated by the plan’s investments. With the increase in plans implementing fee leveling and the increased use of institutional share classes, most plans have moved from a bundled model, where recordkeepers collect all revenue sharing, to having a fixed pro-rata or fixed per-capita pricing structure.

In recent years, we have seen an increase in the use of the per-capita pricing structure. This pricing structure has seen increased popularity with plans with large amounts of assets and plan participants. The per-capita pricing model has a couple of benefits when compared to the pro-rata pricing model. One of the benefits is that the dollar amount assessed to plan participants for recordkeeping services is fixed and is not tied to market swings. In pro-rata pricing, participants who are charged a fixed basis point amount will pay more in dollars when the market is up and less in dollars when the market is down. Another benefit is that the per-capita pricing model aligns itself more with the profitability of the plan from a recordkeeper perspective than the pro-rata pricing model does.

Largely, recordkeepers incur costs with the addition of participants and not with the increase of plan assets. Because of this, a flat charge per participant can be seen as more closely aligned with the cost structure of the plan. The industry has seen changes in the way recordkeeping fees have been assessed over time, with a current preference for a per-capita pricing method.

Fee Compression

Fee compression for investment expenses and recordkeeping costs continues to occur in the defined contribution marketplace. To understand this trend, Fiducient Advisors analyzed The Institutional Consultant’s Plan Survey to observe the average total plan fees, inclusive of investment and recordkeeping and administration fees, of our clients from 2012 – 2023. The average total plan fees decreased by approximately 44% during this period3.

This trend can be influenced by many factors, including regularly issued Requests for Proposals for recordkeeping services, increased assets invested in low-cost index funds, a general decrease in investment expenses, an increased utilization of Collective Investment Trusts and Separate Accounts and fee compression on the recordkeeping side. Additionally, as most plans have moved out of a bundled pricing agreement, we have seen an increase in recordkeepers instituting transaction level fees (e.g., loans, QDROs, distributions, etc.) for participants. This has allowed recordkeepers to reduce recordkeeping fees while charging for these services on an ad-hoc basis. Fiducient Advisors has continued to observe fee compression in the marketplace over time due to a variety of factors.

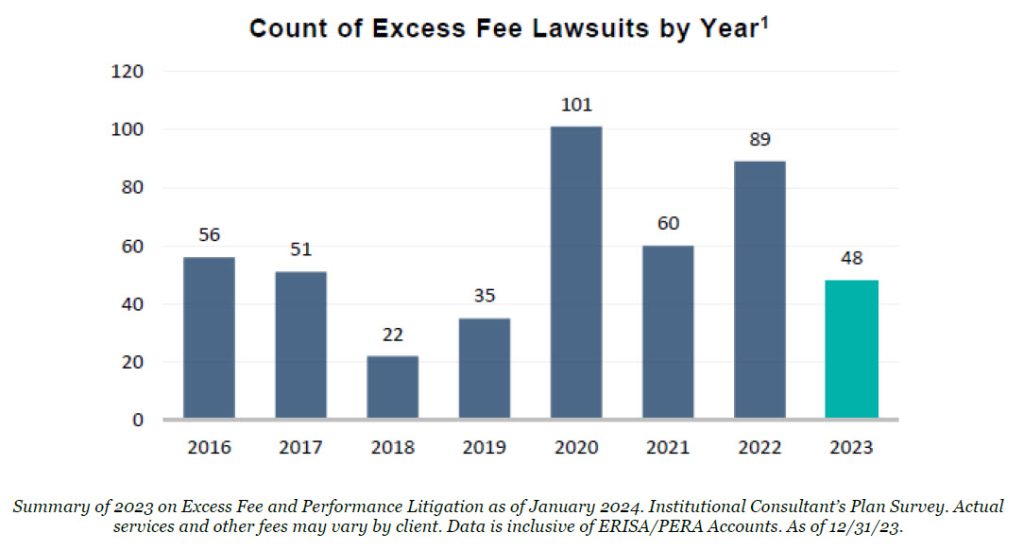

Litigation Trends and Best Practices

Defined contribution plans have seen an increased number of class-action lawsuits regarding fees in recent years. Allegations made by plaintiffs include the improper monitoring of investment and plan level fees, among other alleged fiduciary breaches. Many excess investment fee claims have claimed that failure to use the lowest fee share class is a violation. Some law firms are now acknowledging participant fee disclosures in excess fee lawsuits, a departure from previous practices that often relied on inflated Form 5500 numbers. This trend emphasizes the importance of accurate disclosure in evaluating excess recordkeeping fees.

To help prevent and defend against a lawsuit as a plan fiduciary is to have a strong Fiduciary Trail®, or documentation, of prudently fulfilling fiduciary responsibilities. As it relates to fees, fiduciaries should have strong documentation of regularly benchmarking plan fees and have robust processes in place that are followed. Plans should benchmark themselves against plans of similar sizes and demographics to help determine the reasonableness of fees. It is suggested that plans formally test the market and issue a Request for Proposal for recordkeeping services every 3-7 years. Fiducient Advisors provides Request for Proposal services on behalf of our clients, contact us to learn how we can help your organization.

Fiduciary Duty: How We Can Help

It is important to have a process in place when monitoring plan and investment fees. Plan investment performance and expenses are evaluated and reported on each quarter by Fiducient Advisors as part of the quarterly investment review. Fiducient Advisors assists plan fiduciaries in monitoring plan fees as a part of the Fiduciary Governance Calendar. Annually, Fiducient Advisors reviews the plan fees for all clients using The Institutional Consultant’s Plan Survey. Plans are benchmarked against plans of similar size and demographics. During this review, Fiducient Advisors benchmarks recordkeeping and plan fees, analyzes investment expenses, provides overall trend updates, and helps negotiations with recordkeepers for fee reductions when applicable. Fiducient Advisors is committed to assisting Plan Sponsors with the monitoring and benchmarking of investment and plan level fees and helping ensure all clients have a strong, well-documented, Fiduciary Trail® of their process.

1Source: Institutional Consultant’s Plan Survey. Actual services and other fees may vary by client. Data is inclusive of ERISA/PERA Accounts. As of December 31, 2023.

2ERISA 404a-5 refers to participant fee disclosures which show the fees and expenses of the retirement plan.

3Source: Institutional Consultant’s Plan Survey. Actual services and other fees may vary by client. Data is inclusive of ERISA/PERA Accounts. As of December 31, 2023.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.