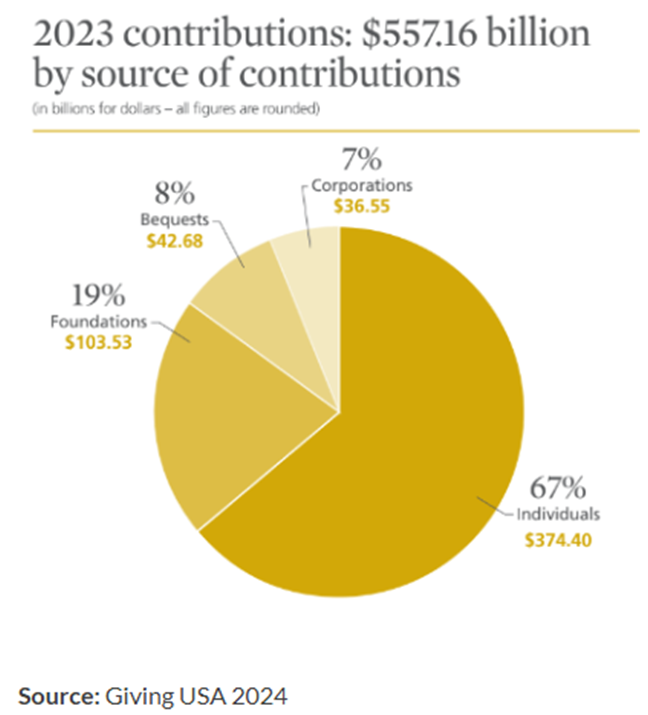

Corporate Giving

According to Giving USA, corporate giving is a growing piece of overall charitable giving1. In terms of corporate dollars donated, most corporate foundations operate as pass-through entities, disbursing a portion of annual pre-tax profits to charity. Corporate giving may come in many forms (in-kind product donations, pro bono volunteering and matching gifts from employees and vendors). With the recent passing of the “One Big Beautiful Bill,” this will set a 1% pre-tax profit floor for corporate charitable deductions beginning in 2026. Hopefully, this will not disrupt the current giving trend.

Corporate Foundation Considerations

Regardless of the market environment, a corporation may experience meaningful changes to pre-tax profits in any given year for a variety of reasons. In economic downturns, corporate profits tend to shrink along with the economy at a time when donations are needed the most. While some larger corporations on national levels have seen success stories with matching gift responses, this may not always be the case for your corporation. For some, profits and national partnerships can be hard to come by so another charitable strategy may be needed. One consideration might be to commit a portion of pre-tax profits from strong years into a diversified foundation portfolio, which can help offset leaner years during times of economic and market downturn. Many charities run year to year by relying on multi-year commitments from corporate donations. From a giving perspective, diversified investment pools could be a more reliable source of funding than pre-tax profits and can offer a smoother level of spending over the long term.

As Foundation Assets Grow, Your Allocation Can Evolve

With growth of the foundation corpus and the help of a financial advisor, the foundation can begin to include less correlated asset classes and become a more diversified investment portfolio. Higher levels of assets will open up broader diversification opportunities within alternative investments with the intent of reducing correlation to market and corporate profit swings. Corporate giving from pre-tax profits is not designed to keep up with inflation, but a well-diversified portfolio, including elements such as real assets and real return strategies, can help to improve these outcomes. For some perspective, envision a $50 million diversified portfolio invested in hundreds of equities (domestic and international), fixed income, real asset/real return, marketable alternatives and its own private markets program, spending 5% or $2.5 million per year. Fiducient Advisors annually publishes our strategic themes on asset allocation. For more, please visit: 2025 Outlook – Bridging the Divide.

Timely Local Impact

When natural disasters strike, a more nimble portfolio with a dedicated full-time philanthropic team could be an improvement over a corporate pass-through model, as pass-throughs tend to operate on a more annual basis. As an additional benefit, a larger defined foundation can raise your corporate philanthropic awareness and continue to galvanize engagement with employees, vendors and the community. While galas and golf are familiar initiatives, the ability to be flexible to direct funds on a local level in times of need will be most valued. Taking the investments a step further, a more established portfolio could also undertake impact investing to make an even deeper imprint on local communities. As an example, opportunities in local low-income housing can raise the corporate profile beyond larger national programs.

Corporations by nature are competitive and a diversified foundation can serve as a significant differentiator. We respect the generosity of charitable donations in all their forms and understand that the foundation approach may not be the practical answer for everyone. It is not without the immediate drawbacks of time and money spent on staffing and governance; however, in-house legal counsel coupled with engaged employees can be a great start. Engaging a qualified Outsourced Chief Investment Officer can provide further support for oversight and management of corporate giving strategies.

How Fiducient Advisors Can Help

Outsourced Chief Investment Officer (“OCIO”) services have come a long way in the last decade to help institutions offload investment discretion, research and maintenance from board and committee responsibility. An investment advisor well-versed in fiduciary governance and backed by a middle office team to handle foundation cashflows can act as an extension of your charitable team.

Through our OCIO services, Fiducient Advisors:

- Selects and terminates investment managers and strategies.

- Proactively makes asset allocation adjustments.

- Handles day-to-day administrative and management responsibility.

- Provides your committee and board with timely education and quarterly reporting on asset allocation, investment management fees, performance attribution, spending and cashflow modeling.

- Creates a structured process for fiduciary governance.

For more insight, please visit: Key Considerations for Investment Oversight of Endowments and Foundations.

Ready To Examine This Further?

Please contact any of the professionals at Fiducient Advisors regarding your corporate giving to assess whether it might be a good idea to endow your foundation for the long-term.

1Giving USA 5 Takeaways and Next Steps from the Giving USA 2024 Report, July 2, 2024

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.