The retirement savings industry and the legislation that guides it has changed significantly over the past 40 years. As a result, the average American may face challenges when exiting the workforce and entering retirement, largely due to declining access to pension-like income.

If you retired today, would you know how much monthly income you could rely on to support your desired lifestyle? Would that income be sufficient to maintain the standard of living you’ve enjoyed over the years – particularly within the past five years? If not, do you know how much income you would require just to meet your basic spending needs?

If you cannot confidently and accurately answer these questions, it is time to strategize your action plan and gain some peace of mind. Before doing so, however, it is important to look at history and examine how we arrived where we are today.

A Changing Retirement Landscape

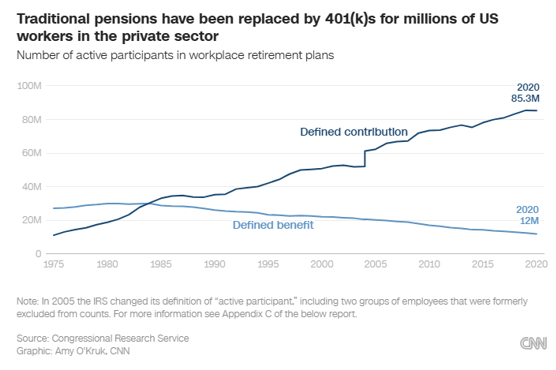

In the 1980s, Americans enjoyed high savings rates with little to no risk, alongside rapid technological innovation and the introduction of the 401(k) plan. Before that time, pensions were the primary retirement benefit employers offered to employees. The retirement transition, which began in the decades that followed, dramatically changed how employees prepare for retirement as companies restructured their retirement benefits programs.

While 401(k), 403(b) and 457 plans serve as excellent long-term savings vehicles, the emergence and growth of these defined contribution plans ultimately shifted the responsibility to plan and save for retirement to the employee. In a pension plan, employees could reasonably depend on the projections provided by their employer and confidently quantify the money they would receive at retirement age. Companies were also laser focused on this benefit; insurance was purchased, actuaries were engaged and investment managers were carefully selected.

An employee preparing to retire could often determine their monthly income by simply adding two figures together: Social Security and a company pension. While additional planning was always helpful, individuals already had a solid understanding of their cash flow and budgeting needs. They knew that at age 65, they could anticipate a certain amount of guaranteed income. This confidence supported early retirement planning, which was both empowering and exciting. Employers, in turn, could proactively plan for workforce attrition. In fact, during the 1970s, retirement by age 65 was often expected due to pension benefit structures at that time.1

Another pivotal moment in retirement history occurred with the passage of the Pension Protection Act of 2006. This legislation clarified that money market funds may not be the most advantageous option for long-term investors. With a touch of irony aside, the Act encouraged more prudent investment default options, such as target retirement date funds. Proper age-appropriate asset allocation and risk mitigation strategies through target retirement date funds have proven valuable, particularly during periods of market turbulence for investors nearing retirement.

Over the past four decades, the defined contribution market has continued to evolve, paving the way for new legislation and regulatory guidance. The SECURE Act of 2019 introduced a renewed focus on lifetime income, not only for investors and plan participants, but for the entire industry. Recordkeepers, the administrative and investment platform where the majority of retirement plans operate, were required to show retirement plan participants some form of lifetime income projection on their regular statement. Why? Because the industry recognized that if we don’t help participants forecast their retirement income, much like a pension once did, then we are only focused on one side of the equation, accumulation and not decumulation.

Strategic Financial Planning

The decline in pension benefits ushered in a retirement era of new challenges many retirees still face today. Individuals approaching retirement without sufficient savings are now forced to consider how to structure retirement income and plan accordingly for life after employment.

To accurately determine proper retirement income, comprehensive financial planning is essential. Can an individual investor confidently manage this process alone, or will professional guidance be necessary? If so, what type of advisor or financial planner should you seek? What investment strategy is appropriate? These questions are critical to informed decision-making and proper due diligence.

Equally important is determining how much to distribute from investment accounts. Is the 4% distribution rule applicable or appropriate when designing the right asset allocation?2 William Bengen developed this theory in the 1990s, suggesting that an investor may be able to withdraw approximately 4% annually from a properly invested portfolio without running out of money over time. While potentially helpful as a reference point, this rule is not universally applicable and must be evaluated within the context of each participant’s unique situation.

Identifying your required monthly cash flow is an essential step in designing an effective income strategy. The type of investment account you hold will influence which investment options and strategies are available to support that cash flow. When considered alongside your risk tolerance and the level of volatility your portfolio can withstand, you can begin by determining which investment funds and allocations are most appropriate. Fortunately, more solutions are becoming available within retirement plans that resemble the income features of traditional defined benefit pension plans.

For fiduciaries of employer-sponsored retirement plans, identifying and implementing educational pathways that help employees take advantage of this level of planning is both forward-thinking and prudent. Evaluating low-cost solutions and engaging experienced, intentional advisors to implement these strategies can enhance the overall retirement benefit offering. Ultimately, the goal is to create financial confidence.

How can Fiducient Advisors help? We deliver financial wellness services to retirement plan participants and individual investors through our team of experienced wealth management advisors. We strategically implement retirement income solutions designed to foster long-term security and positive outcomes as clients transition into retirement. Our approach is purposeful and client-focused, supporting employers in building strong organizational cultures while empowering individuals to become informed, confident investors.

If retirement income planning is important to you, our team of advisors is prepared to discuss strategies tailored to your specific situation. We encourage you to reach out to the professionals at Fiducient Advisors to discuss next steps.

1National Library of Medicine. (2025). Programs and Policies Related to the Older Workforce and Safe Work

2The 4% Rule No Longer Works for Retirees, Says the Man Who Invented It | Retirement | U.S. News

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.