With April here, there’s spring cleaning, then there’s annual health check-ups. Be it your annual physical or some other routine health check-ups, you might be busy with medical appointments as spring finally gets into full swing. While you’re taking care of those yearly doctor and dentist appointments to assess your health status and make adjustments to your health habits and lifestyle if necessary, also consider giving your financial well-being a good review as well. While it is true that getting a blood test or a skin exam might seem quite unappealing, completing annual wellness exams is a well-known best practice to maintain optimal health. Why not follow a similar protocol for your financial wellness? The sooner a check-in can reveal an area for improvement, the sooner an adjustment can be made. As true with the power of compounding, the longer the positive adjustment is in effect, the bigger the impact it makes. Whether accompanied with reluctance or dread, both health and financial check-ins are crucial for a long, prosperous life.

The Basics of an Annual Financial Wellness Check

Like health, finances are constantly changing and require routine monitoring. Over time, your goals and priorities change alongside both external and personal circumstance, which may impact even the most thoughtfully developed financial plans.

1. Assess what happened financially over the prior year.

2. Evaluate financial goals to ensure current and future decisions are on-target with long-term goals and make adjustments as necessary.

Typical starting points in gathering information for a review like this include the following action items:

- Compiling documentation on all relevant financial information, such as:Net worth

- Annual spending

- Annual income

- The prior year’s tax return

- Portfolio performance

- Asset allocation

- Depending on your comfort level, separating the review into smaller sections might be beneficial, especially if it simplifies the review and enables simultaneous evaluation of various elements.

- Throughout your financial wellness review, save pertinent documents for future wellness checks and to review annually, even though actionable changes may occur less frequently.

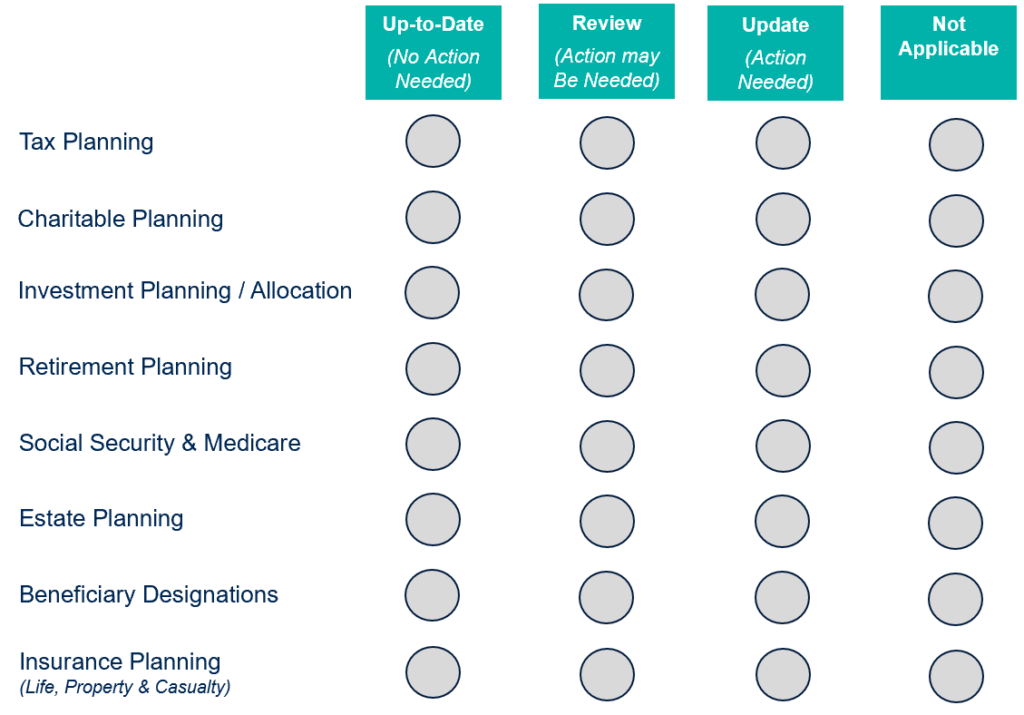

- Use the summary below, coupled with our 2022 Financial Planning Guide, to help protect your assets and maximize financial fitness.

Key Checkpoints of a Comprehensive Financial Wellness Check-in

✓ Tax Planning – Consider options for reducing taxable income, including but not limited to:

- Tax loss harvesting

- Contributing to a Traditional IRA or 401(k)

- Changing legal domicile to states with favorable state income tax, sales tax and estate tax.

- Also see items listed in charitable planning and retirement planning for additional tax considerations.

✓ Charitable Planning – Donate appreciated stock directly to organizations or utilize a specific charitable gifting vehicle. Additionally, accelerate multiple years of charitable contributions into one year (especially if possessing elevated income).

✓ Investment Planning – Rebalance to determined target asset allocation. As certain asset classes appreciate, sell those investments to target, while underweight asset classes should also be bought to target. Additionally, consider your life stage, risk tolerance and saving/spending needs. Upon review of this information, you can make overall allocation adjustments accordingly.

✓ Retirement Planning – Diversify savings among various buckets. For instance, categorizing savings into the following might be useful:

- Taxable (Individual/Joint/Trust accounts)

- Pre-Tax (Pre-Tax 401(k)/Traditional IRA)

- After-Tax (Roth 401(k)/Roth IRA)

- Take advantage of Roth IRA conversions and back-door Roth IRA contributions, as applicable.

✓ Social Security/Medicare – Consider income supplementation needs. Annual benefit increases by 8 percent per year for each year delayed after full retirement age, up to age 70.

✓ Estate Planning – Ensure clear transition of assets in a tax-efficient and private way. Advanced techniques can be used to preserve assets in excess of exemption up to $12,060,000, especially if objectives and intent may have changed.

✓ Beneficiary Designations – Direct the transition of retirement and other assets to heirs.

✓ Insurance Planning – Review for adequate coverage as assets appreciate/liability increases and needs change.

The Follow-up Appointment

After this initial assessment is complete, update and implement the best strategies, as well as continue to review and monitor your progress as needed as well as your financial wellness in future reviews. As circumstances change, you never know when you might need to improve your financial wellness with new strategies. During these “follow-ups,” consider the following:

✓ Tax Planning – Review taxable income, available deductions and legislation can change as often as every year. Review annually.

✓ Charitable Planning – Consult an accountant or financial advisor for advice and again if tax situation or goals change.

✓ Investment Planning – Review annually for broad allocation updates and rebalance as necessary.

✓ Retirement Planning – Consider consulting with the financial planning professionals at Fiducient Advisors to verify you are on target with your future retirement goals.

✓ Social Security/Medicare – Consider as early as five years before and up to five years after full retirement age (FRA). Medicare has a two-year lookback on income for premiums.

✓ Estate Planning – Review at least every five years and update legal documents with estate planning attorney as often as material changes require (i.e., exemption changes, other legislative changes and beneficiary/trustee changes).

✓ Beneficiary Designations – Requires updating as relationships and goals change.

✓ Insurance Planning – Review for adequate coverage annually and review for best premiums available at each agency every five years.

Many professionals can assist with the tasks on this checklist for any household in much the same way that a primary care physician tends to a variety of health needs ahead of reaching out to a specialist. We recommend engaging your team of trusted advisors for individualized advice on any of these topics. For more information, please contact any of The Wealth Office® professionals at Fiducient Advisors.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.