Key Observations

• Stable value is one of the most common capital preservation options within defined contribution plan investment menus, offered in approximately 68% of plans according to Vanguard’s How America Saves 2024 Report1.

• Historically, this asset class has typically garnered increased inflows during periods of market volatility.

• Q1 2025 saw some of the highest levels of participant trading activity in defined contribution plans since 2020, with significant asset flows going to fixed income and stable value2.

• It is estimated that current stable value assets total approximately $841 billion3.

Stable Value Refresh

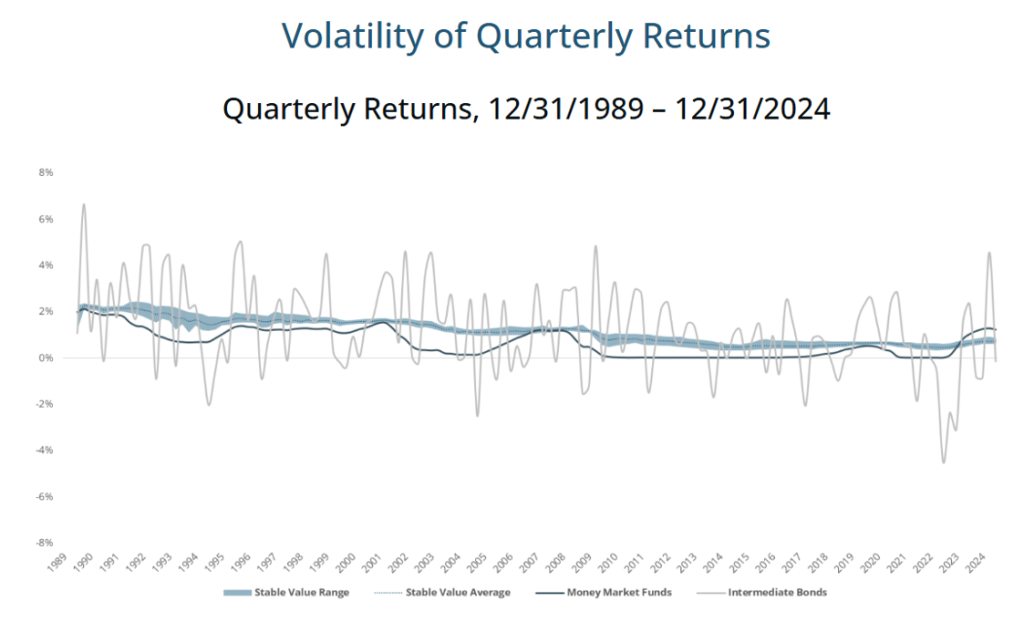

Stable value is an investment option focused on capital preservation. Its goal is to shelter participants from the impacts of rising interest rates and rate volatility, in comparison to similar short-term bond portfolios and money market funds. Stable value portfolios typically consist of high-quality bonds with duration profiles between 2-6 years, combined with an insurance component to help stabilize assets and smooth returns, creating an attractive profile for retirement plan investors. Because of the insurance component of stable value, the volatility of returns experienced by investors is historically significantly less than other fixed income offerings.

Source: Stable Value Investment Association. Data as of December 31, 2024. Past performance does not indicate future performance and there is a possibility of a loss.

Typically, stable value funds are only available in qualified plans, making them a unique opportunity for participants in employer-sponsored defined contribution retirement plans.

Equity Wash Provision

Given the recent market volatility and yield advantage that money markets have had compared to stable value, it is reasonable to assume that plan fiduciaries may elect to offer both capital preservation options to participants so they might select whichever is performing better. While this approach is counter to the trend of streamlining and simplifying investment menus for participants, there is also an operational hurdle to consider, which is known as an equity wash provision.

What is it?

Equity wash is a provision in a stable value investment option that requires any transfer a participant makes from the stable value investment option to a competing option must first be re-directed to a non-competing investment option for a specific period of time (usually 90-days).

Why?

Competing fund restrictions are implemented to prevent participants from transferring out of a stable value fund to short-term fixed income or money market offerings, in order to take advantage of changes in short-term interest rates. This type of selling activity by investors could result in significant investment losses for stable value funds because fund managers may be required to sell securities (potentially at inopportune times) to meet the redemptions. In short, equity wash provisions exist to protect long-term stable value investors.

What are the impacts?

One benefit of today’s landscape and improved technology is that operational monitoring of these equity wash provisions is typically done by the plan recordkeeper.

While the list of “competing options” differs among stable value providers, y the list of competing or restriction investments has generally decreased in recent years.

Today, competing funds are typically other fixed income offerings with durations under two years, including money market, short-duration bond funds and (in some instances) self-directed brokerage accounts.

Reaction Time

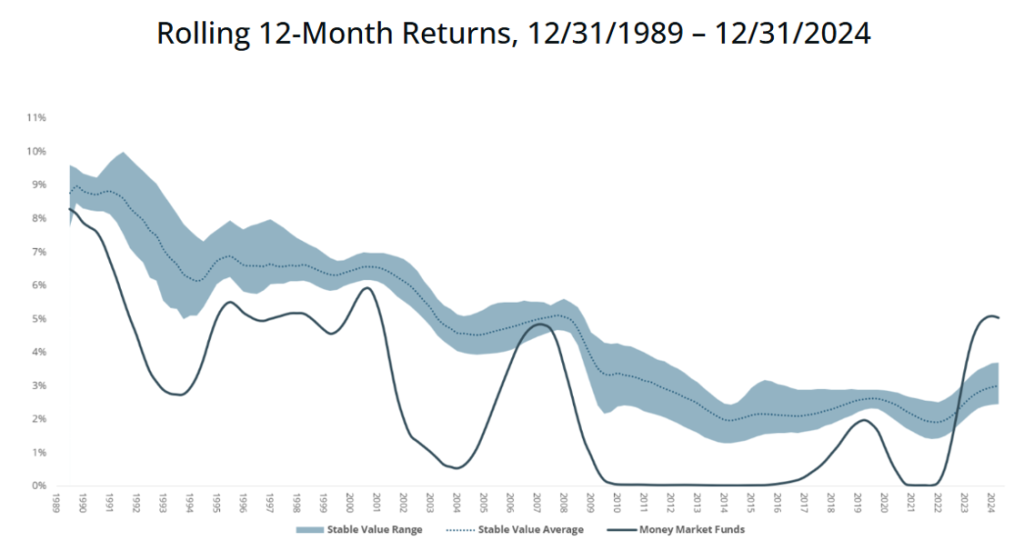

During periods of rapidly rising interest rates, the shorter durations of money markets can potentially allow those portfolios to reflect higher market yields more quickly. However, this phenomenon is typically temporary, as stable value portfolios tend to outpace money market strategies over longer time periods due to their exposure to longer duration assets and the typically upward-sloping nature of the yield curve.

Source: Stable Value Investment Association. Data as of December 31, 2024. Past performance does not indicate future performance and there is a possibility of a loss.

While the interest-rate environment has been challenging for stable value funds recently, wrap providers (insurers) and portfolio managers who spoke at the 2024 SVIA Fall Forum in October contend this is actually a key time to be promoting the asset class and its role in capital preservation.

The challenges to stable value were the result of a sharp uptick in short-term interest rates from early 2022 and throughout 2023, which sent money market fund yields soaring. As expected in a rising rate environment, stable value market-to-book value ratios fell, challenging stable value managers as this resulted in a drag on crediting rates. This environment further drove stable value assets to competing asset classes, resulting in greater headwinds for stable value portfolio managers who were forced to manage the outflow of assets4.

Outlook

Considering the market volatility in early 2025, it comes as no surprise that investors have sought safe-haven asset classes. Given that stable value is the most common capital preservation option in defined contribution plans, it has been one of the asset classes to garner the greatest amount of inflows amid this period of volatility. One recordkeeper, TIAA, shared that as of early April 2025, their flagship stable value offering, TIAA Traditional, has seen its greatest inflows since March of 2020, representing a five-year high, including record daily and monthly inflows5. While equity markets continue to show signs of heightened volatility in 2025, we might reasonably expect stable value to continue to garner significant participants inflows. However, there can be no guarantee the market trends described will continue.

Market timing and interest rate predictions are difficult, and we do not encourage this behavior for participants or Plan Sponsors. We believe stable value continues to play an important role as a capital preservation option, even during periods where money market funds offer a yield advantage. It is important to remember that stable value returns have historically exceeded money market returns over the long term as the interest rate yield curve is typically upward sloping. Retirement plan committees often require long lead times before making changes to plan design or investment menus. This delay could be beneficial in the long term for individuals who maintained stable value investments rather than opting for higher-yield securities in recent years.

Consider the Options

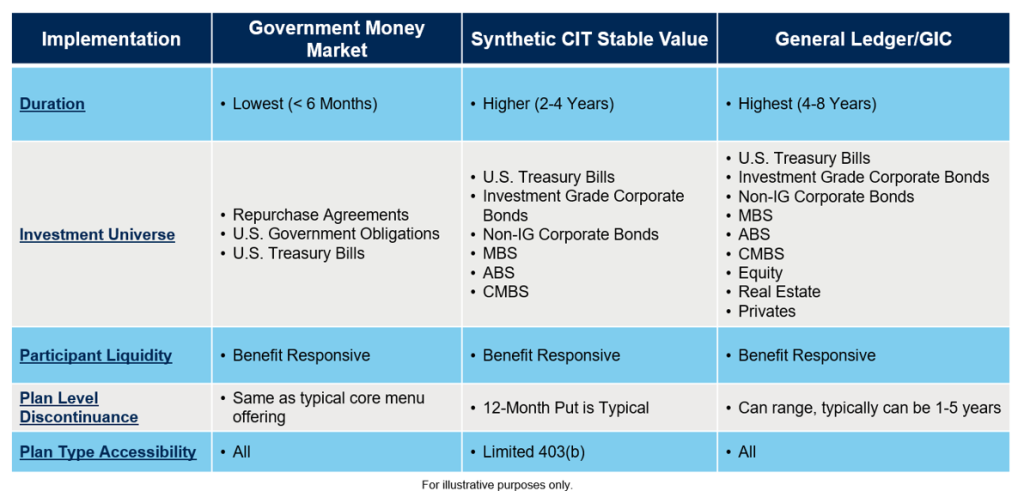

The heightened market volatility that kicked off 2025 has provided a tailwind for stable value asset levels, further solidifying their position within plan investment menus. Aging participant populations with larger account balances may place an even greater emphasis on the capital preservation options utilized in defined contribution plans. Plan fiduciaries are encouraged to closely monitor their capital preservation offering(s), to be educated on the different solutions and to set return and volatility expectations accordingly.

When evaluating capital preservation options, Plan Sponsors may consider the following factors:

- Long-term volatility and return expectations

- Counter-party or insurer

- Equity Wash provisions

- Flexibility and definitions of competing investments

- Plan-level discontinuance/liquidity provisions

- Recordkeeping pricing

For questions or to learn more about stable value investment strategies, please contact any of the professionals at Fiducient Advisors.

1How America Saves Report 2024 | Vanguard Institutional. December 31, 2023.

2Alight Solutions 401(k) Index™: Q1 2025 Observations | Alight. March 31, 2025.

3Stable Value at a Glance – SVIA. April 10, 2025.

4Capital Preservation: Reiterating the Case for Stable Value – Stable Value. February 6, 2025.

5PlanSponsor: Inflows Into TIAA Traditional Hit 5-Year High. April 22, 2025.

This report does not represent a specific investment recommendation. Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that actual returns or volatility will be similar to the indices. Indices cannot be invested in directly. Unmanaged index returns assume reinvestment of any and all distributions and are reported gross of any fees and expenses. Any forecasts represent future expectations and actual returns; volatilities and correlations will differ from forecasts.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.