Plan Sponsors have seen no shortage of ERISA lawsuits over the past 15 plus years with many leading to large settlements. Breach of fiduciary duty is a common theme identified in these lawsuits, especially involving excessive fees and/or actively managed fund expenses. A new wave of ERISA lawsuits allege Plan Sponsors breach their fiduciary duty by offering low-cost, passively-managed Target Date Funds (TDFs).

If you are scratching your head right now, you are not alone. Over the last few weeks, several lawsuits targeted large defined contribution plans where the Qualified Default Investment Alternative (QDIA) are a suite of low-cost, passively-managed TDFs. As of August 9, 2022, a Connecticut-based law firm filed nine such suits alleging fiduciary misconduct by Plan Sponsors for selecting low-cost, passively-managed TDFs instead of higher-cost, actively-managed TDFs with better historical performance.

Why are low-cost Target Date Funds being targeted?

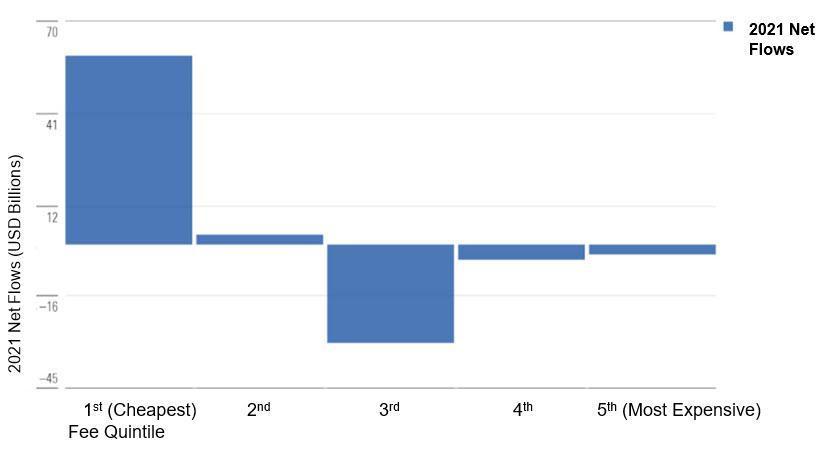

Plan Sponsors have been implementing passively-managed TDFs at much higher rates than generally higher cost actively-managed counterparts over the past several years. The chart below illustrates the cheapest quintile of TDFs receiving nearly 60 percent of inflows in 2021.1 Consequently, Plan Sponsors who may have selected passively-managed TDFs solely based on fees may potentially find themselves the target for future litigation. As we are seeing with this new wave of litigation, providing TDFs that offer lower costs does not necessarily insulate you from litigation.

Several articles have already been published about the baselessness of the claims and the dangerous precedent these lawsuits could set if not dismissed. Instead of recapping those articles and dissecting the intricacies of those claims, it is more productive at this time to focus on what is in our control as fiduciaries: the evaluation, selection and ongoing monitoring of this unique asset class.

A Fiduciary Playbook

The Department of Labor (DOL) published Target Date Retirement Funds – Tips for ERISA Plan Fiduciaries in February 2013 to better assist plan fiduciaries as it pertains to evaluating TDFs.2 Key takeaways from the release are as follows

- Establish a process for comparing and selecting target date funds, including reviewing participant population information.

- Understand the fund’s investments – asset class allocation, individual investments and how these will change over time.

- Review the fund’s fees and investment expenses.

- Inquire about whether a custom or non-proprietary target date fund would be a better fit for your plan.

- Take advantage of available sources of information to evaluate the target date fund and recommendations you receive regarding the target date fund selection.

- Document the process.

However, you may have noticed there were two items not addressed in the DOL publication:

- Sponsors are not required to have the lowest-cost TDFs.

- Sponsors are not required to have the best-performing TDFs.

TDFs are one of the most complex investment options found in defined contribution plans.

TDFs are an asset allocation vehicle designed to invest in multiple asset classes at different weights to create risk-appropriate portfolios for participants at different stages of their career based on a single datapoint: the participant’s age. Fiducient Advisors’ Deputy Chief Investment Officer Brad Long discusses in our research paper Target Date Funds: Evaluating and Selecting, the objective of TDFs is trying to solve for one of two main risks: market risk or longevity risk.3 Market-risk TDFs attempt to limit volatility or drawdowns at or near retirement. Longevity-risk TDFs attempt to limit the risk of outliving your accumulated assets.

A Plan Sponsor may choose a more conservative or more aggressive suite of TDFs (market-risk or longevity-risk) to best suit most of their plan participants. Plan Sponsors should consider any number of datapoints (participant demographics, participant behavior and plan design metrics, to name a few) to determine which is most applicable to their unique population.

The decision to choose a TDF suite to solve either market-risk or longevity-risk can lead to wildly different outcomes on an absolute performance basis but still accomplish the objectives of the Plan Sponsor. This makes comparing performance from one TDF provider to another quite complicated.

Fiduciaries have an ongoing duty to monitor investment options.

In January 2022, the Supreme Court of the United States ruled on Hughes v. Northwestern University.4 The suit alleged that Northwestern offered more than 240 investment options, later reduced to 32 investment options, that utilized expensive share classes when cheaper share classes were available to the plan. It also alleged the plan, which at the time was valued at more than $2 billion in assets, failed to negotiate reasonable recordkeeping fees or solicit bids. In addition, the complaint also alleged that Northwestern offered higher than reasonable administrative costs and failed to consolidate to one recordkeeper.

To keep consistent with the previously decided Tibble v. Edison International, the Supreme Court ultimately sent this case back to the lower courts.5 The key takeaway, as it pertains to the most recent wave of litigation, is that Plan Sponsors have an ongoing duty to monitor all funds in the investment menu.

Ongoing Monitoring

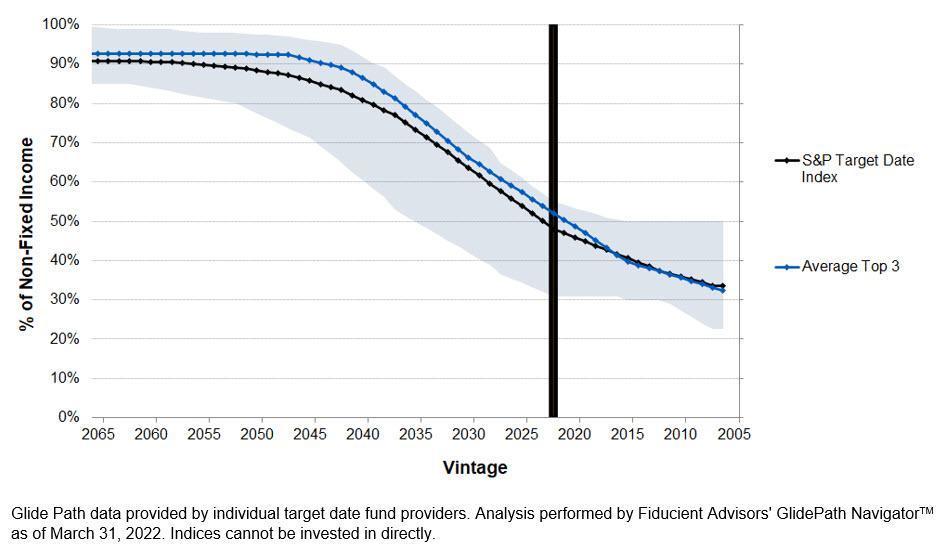

Reviewing TDFs is not as simple as reviewing the performance of one 2030 fund versus another. The graph below shows the dispersion of non-fixed income (read: equity) assets throughout the glidepath.6 The glidepath represents the changing of investments (i.e., stocks to bonds) throughout time. For younger participants, the dispersion is rather tight, ranging from 85 percent to almost 100 percent in non-fixed income. Despite this fact, that gap widens as participants get closer to (and through) retirement. As seen via the shaded area within the graph below, at retirement there is an approximate 25 percentage point difference between the most aggressive and most conservative glidepaths. Plan Sponsors that understand the goals and objectives of their TDF provider have greater ability to determine whether the TDFs are meeting their outlined objectives.

Target Date Funds are currently a focus area for ERISA litigation and, barring a favorable dismissal from the most recent wave of litigation, will likely continue to be an area of focus.

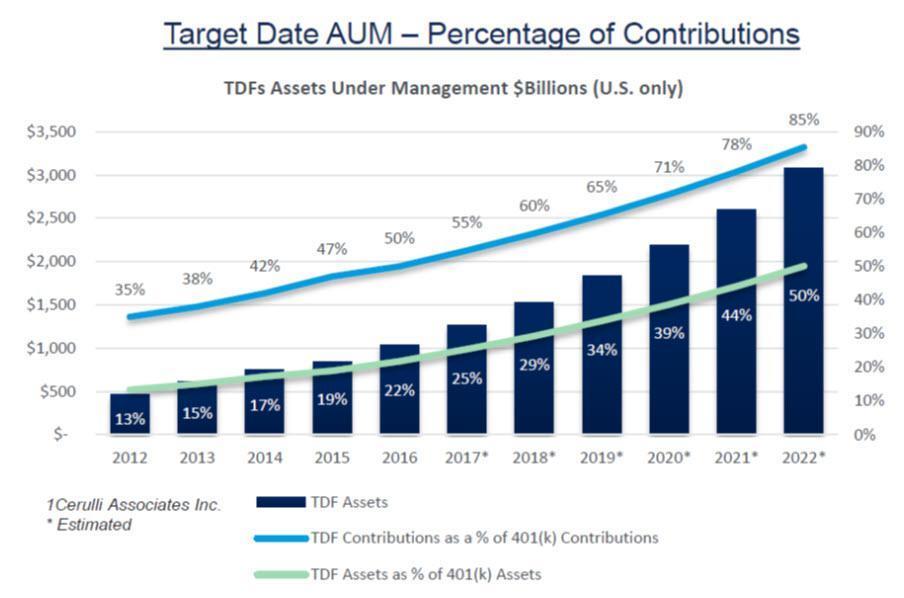

Class action lawsuits tend to follow the money… and TDFs have money. The total value of assets in the segment is massive and growing exponentially. Per the table below, it is estimated that TDFs account for approximately half of total retirement assets with more than $3 trillion in total value.7 Also, the number will likely continue to grow rapidly with approximately 85 percent of new 401(k) contributions investing in TDFs and rising.7

The Best Offense Is a Good Defense

Luckily, it is not all doom and gloom. In June 2022, a federal appellate court upheld the previous dismissal of claims that the Plan Sponsor should have replaced actively-managed funds with passively-managed funds characterized by lower costs and/or better returns.8 In Smith v. CommonSpirit Health, Chief Judge Sutton writes in his opinion, “the Employee Retirement Income Security Act, ERISA for short, does not give the federal courts a broad license to second-guess the investment decisions of retirement plans.8”

And later, “Merely pointing to another investment that has performed better in a five-year snapshot of the lifespan of a fund that is supposed to grow for fifty years does not suffice to plausibly plead an imprudent decision—largely a process-based inquiry—that breaches a fiduciary duty. Precipitously selling a well-constructed portfolio in response to disappointing short-term losses, as it happens, is one of the surest ways to frustrate the long-term growth of a retirement plan.”

This opinion highlights the importance for Plan Sponsors to formalize, follow and document their processes related to the evaluation, selection and monitoring of investment options.

As we previously referenced, the DOL provided Plan Sponsors with “tips” on how to evaluate, select and monitor TDFs in their publication, Target Date Retirement Funds – Tips for ERISA Plan Fiduciaries, which was released in February 2013. Best practices include periodic and detailed reviews of your TDFs and all core investment menu options.

Specifically, as it applies to TDFs, Plan Sponsors should evaluate the following, among other considerations:

- Performance Versus Relative Benchmarks

- Risk-Adjusted Returns

- Reasonableness of Fees

Fiducient Advisors helps our clients by conducting a deep-dive review of TDFs on an annual basis as part of our Fiduciary Governance Calendar, a standard process of ours that enables us to stringently and comprehensively document the review process.

Please join us on October 13 for our annual client conference at the Chicago Marriott on the Magnificent Mile. One of our afternoon breakout sessions will address Fiduciary Responsibilities in Today’s Regulatory Environment. Please reach out to any of the professionals at Fiducient Advisors at info@fiducient.com for additional details on how to register.

1 Morningstar Direct and author’s calculation. Data as of Dec. 31, 2021

2 https://www.dol.gov/sites/dolgov/files/ebsa/about-ebsa/our-activities/resource-center/fact-sheets/target-date-retirement-funds.pdf. Data as of February 2013.

3 https://www.fiducientadvisors.com/wp-content/uploads/2022/08/Target-Date-Funds-Evaluating-and-Selecting.pdf. Data as of February 2016.

4 https://www.supremecourt.gov/opinions/21pdf/19-1401_m6io.pdf Data as of October 2021.

5 https://www.supremecourt.gov/opinions/14pdf/13-550_97be.pdf Data as of October 2014.

6 Glide Path data provided by individual target date fund providers. Analysis performed by Fiducient Advisors’ GlidePath NavigatorTM as of March 31, 2022. Indices cannot be invested in directly.

7 RPAG Target Date, Morningstar 2022 Annual Target Date Strategy Landscape. Data as of March 2022.

8 https://www.opn.ca6.uscourts.gov/opinions.pdf/22a0134p-06.pdf. Data as of June 2022.

Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that actual returns or volatility will be similar to the indices. Indices cannot be invested in directly. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect our fees or expenses.

S&P Target Date Indexes are constructed using a survey method of current target date investments with $100 million or more in assets under management. Allocations for each vintage are comprised of exchange traded-funds that represent respective asset classes used in target date portfolios. The indexes are designed to represent a market consensus glide path.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.