Key Observations

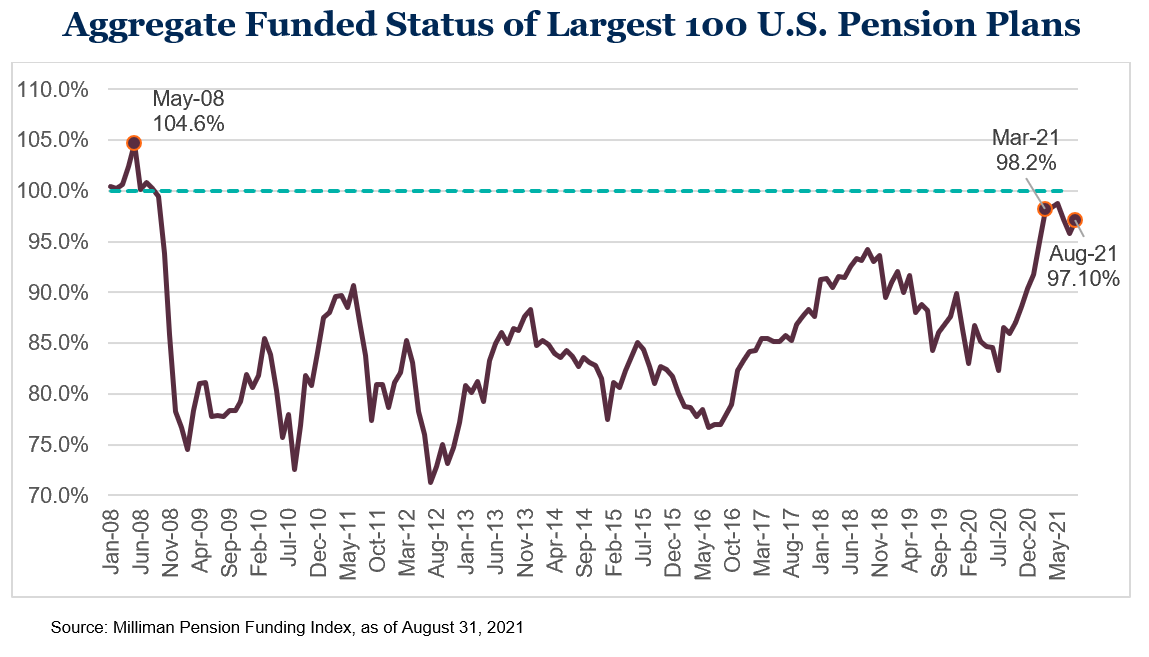

• A combination of strong asset returns and higher liability discount rates contributed to material improvements in funded statuses for many Defined Benefit (DB) plans since early 2020.

• The magnitude and speed of these market impacts caused many plans to reach funded status levels not seen in more than a decade.

• For many Plan Sponsors, becoming fully funded has gone from a distant dream to a current reality.

• Read further to learn more about what to do with improved DB status, including creating a decision-making framework surrounding the suite of opportunities available for Plan Sponsors.

Funded Status Revival

The funded status gains that began in mid-2020 continue to this day in 2021. As both asset prices and discount rates continue to rise, Plan Sponsors have seen funded statuses not only improve, but for many, reach levels not witnessed in more than 10 years. Not since 2008, just before the Global Financial Crisis, have the largest 100 U.S. pension plans possessed an aggregate funded status this high.

The Next Step in Evaluating De-Risking

For many Plan Sponsors, reaching fully funded status may have been a long-term goal that only recently became more tangible. In addition, Sponsors who are nearing fully funded status probably took some de-risking steps along the way. For instance, Sponsors might have done any of the following, among other management decisions:

• Changed the plan design by freezing benefit accruals

• Tweaked the investment strategy with tools like liability-hedging assets, such as long duration bonds

• Implemented a de-risking glidepath

Whatever actions that brought Sponsors to this point of having a high or surplus funded status, there are numerous additional options available to them for the next step in de-risking. Among these options, highlighted further below, are:

• Hibernating the plan

• Undertaking a pension risk-transfer transaction

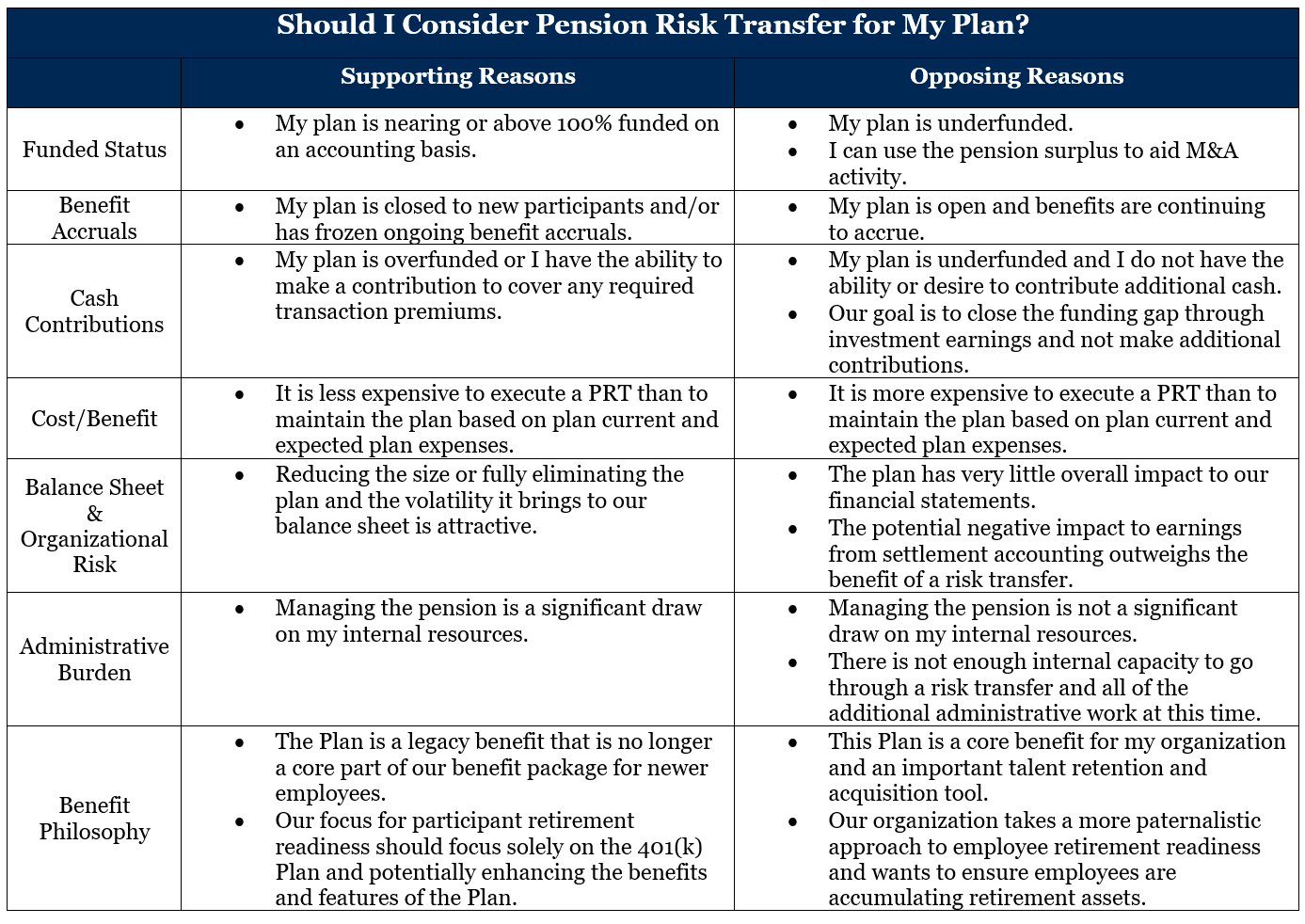

Is Risk Transfer Right for My Plan?

Before reviewing specific risk transfer options, Plan Sponsors must consider the overarching goals and constraints surrounding their pension plan to evaluate whether a risk transfer is advantageous to their specific circumstances.

Risk Transfer Strategies and Options for Well-Funded Plans

There are several options for Plan Sponsors with strong funded statuses, including numerous risk transfer strategies.

Hibernation

Hibernation is not a type of risk-transfer transaction but rather an investment and operational strategy for Plan Sponsors with funded statuses greater than 100 percent who may not be ready to take on a risk-transfer transaction at this time. In other words, hibernation is a gradual risk-transfer strategy that does not require an additional transaction; but rather transitioning the plan to become as self-sustaining as possible. Sponsors can think of it as either one of the following:

• An additional step between de-risking via a glidepath, taking on a full plan termination

• A complete alternative to undertaking a risk transfer transaction

A successful hibernation essentially entails:

1. Tailor the portfolio to hedge all or at least the vast majority of projected liabilities with the goal of reducing as much funded status slippage as possible.

2. Continue to pay monthly benefit amounts.

3. Allow plan liabilities and duration to naturally dissipate while paying out benefits as employees leave the company, all the while increasing the certainty of future benefit payments. Doing so has the potential to reduce premiums for a future risk transfer transaction.

This strategy makes the most sense for plans that are closed to new participants, have frozen their benefit accruals and have funded statuses greater than 100 percent on a GAAP basis. PBGC premiums are another consideration since the strategy assumes the plan will exist for many years in the future and the Sponsor will be responsible for payment of the annual premiums. Variable rate premiums based on unfunded benefits are unlikely to be a factor for well-funded plans considering hibernation. However, flat-rate premiums based on participant headcount should be taken into consideration when determining the benefits of employing hibernation as a strategy. One strategy Sponsors often explore in this case is the reduction of participant headcount to make hibernation a more cost-effective strategy as described in the next section.

Lump Sum Windows/Retiree Carveouts

Sponsors might reduce a portion of plan liabilities or participant headcount by offering a one-time option to take a lump sum payout, oftentimes to a specific group of participants. The most commonly targeted groups include terminated vested participants (participants with a vested benefit who are no longer with the company but still accrue benefits and likely have smaller balances) or retirees in pay status. The flat-rate, per-participant PBGC premiums paid for these participant groups are generally higher relative to the value of their benefit, especially if the plan has hit the per-head maximum. Therefore, targeting these individuals can be an efficient way of reducing these premiums without having to make significant payouts.

There are some potential disadvantages with these strategies to reduce the plan liabilities through a lump sum window or retiree carveout. Depending on the size of the liability reduction and the plan’s funded status, one-time settlement accounting may be triggered and/or minimum required contributions may increase.

The other potential disadvantage is a demographic risk that accompanies removal of these groups from the overall liability. Given the small balances and lack of ongoing accruals, these liabilities are some of the easiest to hedge and are thus viewed more favorably by insurance companies. If a pension plan were a batch of lemonade, these groups would be considered the sugar. In this sense, Plan Sponsors should undertake proper analysis to ensure that the benefits gained through a lump sum window outweigh the potential of being left with a less attractive cocktail of mostly lemon juice.

Buy-Outs

Buy-outs are likely what most Plan Sponsors think of when they think about pension risk transfers (PRT). Buy-outs require the termination of the entire plan via a purchase of a group annuity from an insurance company that covers all participants. Under a buy-out, the Sponsor irrevocably transfers all assets and liabilities, and eliminates the following:

• Investment risk

• Longevity risk

• Balance sheet volatility

• Administrative expenses

• PBGC premiums associated with maintaining the plan

While this sounds ideal, as mentioned previously, plans must either be well-funded enough to cover 100 percent of liabilities as well as the premium charged by an insurance provider to complete a buy-out transaction or be willing to make a cash contribution to bring plan assets up to this required level. Buy-outs also trigger settlement accounting, so while ongoing balance sheet volatility stemming from the pension’s funded status is eliminated, the one-time effect on the income statement could be material.

Unfortunately for Plan Sponsors, all of the work and effort to get the plan into the position to undertake a buy-out does not end when the option becomes viable. Buy-outs require significant administrative resources before the plan can be ultimately terminated, including the coordination of multiple associated parties, such as:

• Actuaries

• Consultants

• Asset managers

• Legal counsel

• An annuity placement specialist

• A qualified and independent expert to evaluate the candidate annuity providers

• And, potentially, a transition manager to manage portfolio risk during the transfer to the insurance company

As a result, overall, a buy-out often takes more than a year from start to finish. The number of factors to be addressed in order to prepare for a buy-out is even more complex than shown here, but for Sponsors who want to get out of the pension management business, understanding the costs involved in order to do so is an essential first step.

Buy-Ins

Pension buy-ins are a lesser-known alternative to traditional, full buy-out transactions. Though both transactions offer Sponsors the benefit of transferring investment and liability risk to insurers, their nuanced differences are critical to the decision-making process when determining what might be a better fit for your particular plan. Unlike a buy-out transaction in which an insurance company is paid a premium to take on full responsibility for the payment of participant benefits, with liabilities being removed from the Sponsor’s balance sheet, a buy-in transaction keeps plan assets and liabilities with the Plan Sponsor; the Sponsor retains responsibility for the payment of benefits and plan administration; and the insurer “reimburses” the plan monthly in the amount of all benefit payments paid to participants over that period. The insurance company takes on responsibility for the investment and longevity risk, similar to a buy-out transaction; however, a buy-in does not trigger settlement accounting, allowing Sponsors to avoid any potential accounting charges that may negatively impact company earnings statements.

Sponsors are still responsible for ongoing administrative expenses and PBGC premiums under a buy-in but typically retain the option to convert the buy-in to a buy-out at a later date. Therefore, a buy-in could be considered an intermediate step between maintaining the plan and undergoing a full risk transfer that can buy a Sponsor time to complete the required data clean-up and re-composition of the investment portfolio necessary for a buy-out without having to worry about investment and longevity risk in the interim.

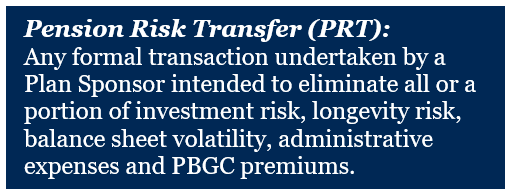

Below is a quick guide to help Sponsors differentiate between the different strategies and risk transfer strategies detailed in this section:

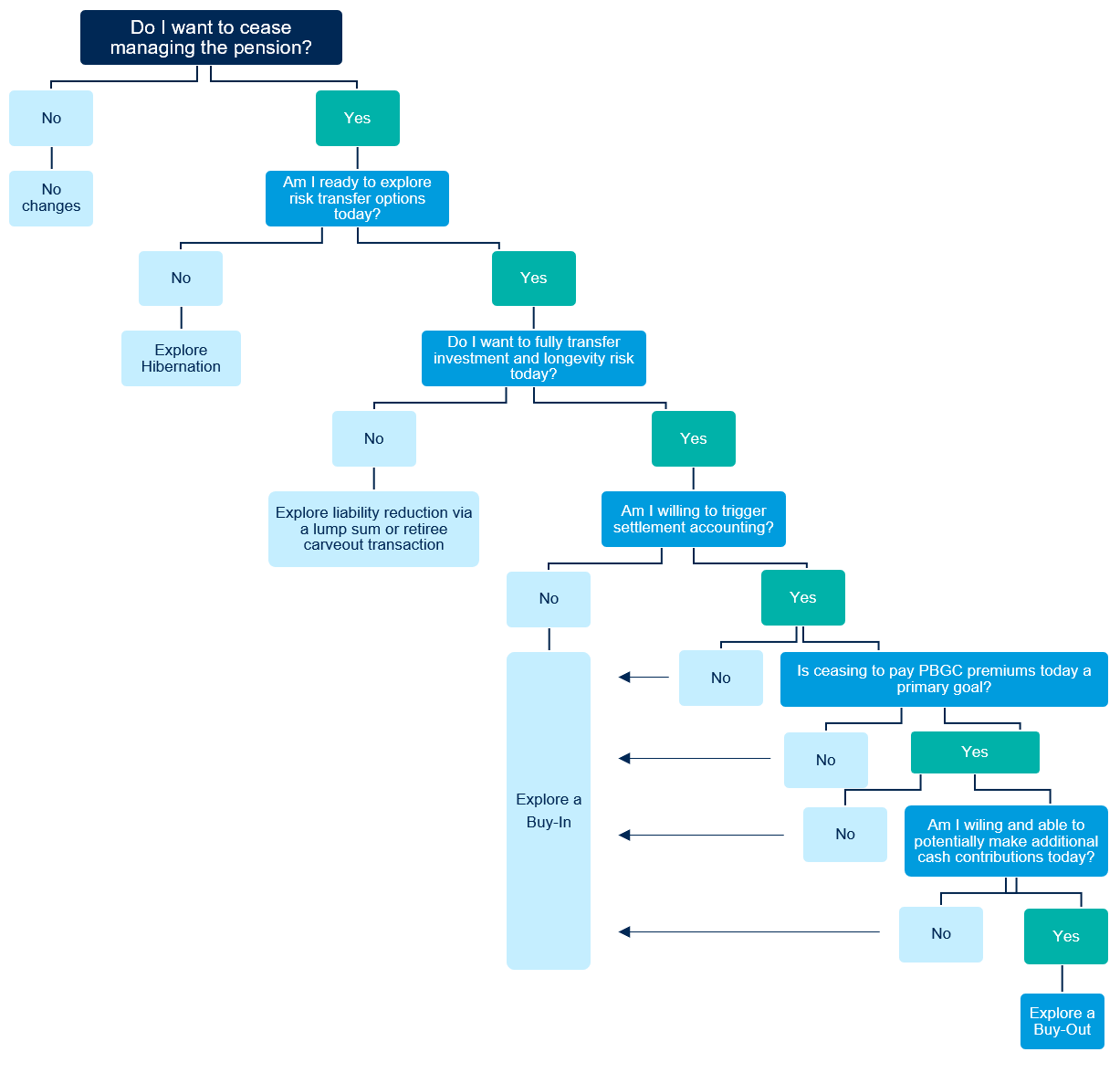

For Plan Sponsors who are relatively new to such topics, the following flow chart helps streamline the decision-making process when determining the best fit for your Defined Benefit plan depending on current circumstances.

The decision to undertake a risk transfer transaction, let alone the specific type, can be daunting for Sponsors whose main focus is their organization and not the Defined Benefit marketplace. The consultants at Fiducient Advisors are here to help answer your questions.

To discuss which options may be a good fit for your plan, contact any of the professionals at Fiducient Advisors or reach out to Brian Samuels directly at bsamuels@fiducient.com.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.