For more than 10 years, investors attained double-digit gains by investing in the stock market. As a result, 401(k) balances and other investment pools achieved high material growth. This environment also drove the advent and growth of a uniquely attractive type of retirement plan: market rate of return cash balance plans.

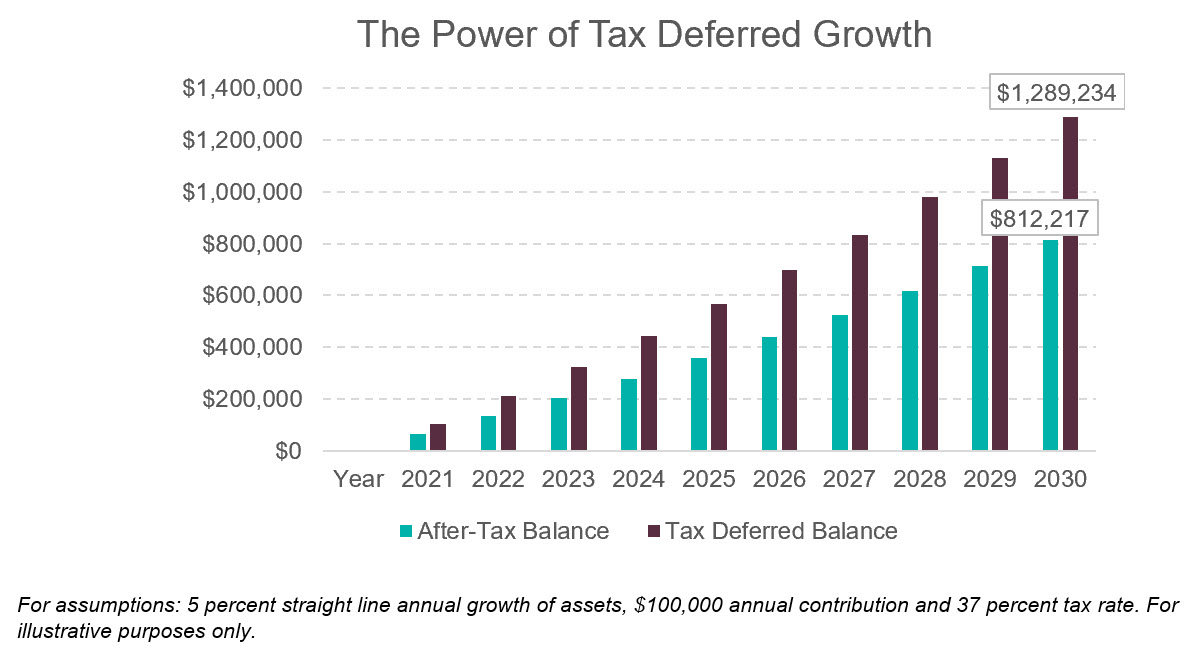

These plans aid savers by facilitating higher tax-deferred retirement contribution levels than with a traditional 401(k) plan alone. Unsurprisingly, given the key benefit involves higher retirement savings and reduced taxable income, the popularity and growth of these plans takes root mainly in professional service firms. Firms such as law firms, accounting firms and medical practices, where a material portion of the business is composed of highly compensated employees, have much to gain from these plans. After all, with higher compensation comes higher tax brackets, making the tax sheltering potential of these plans quite attractive.

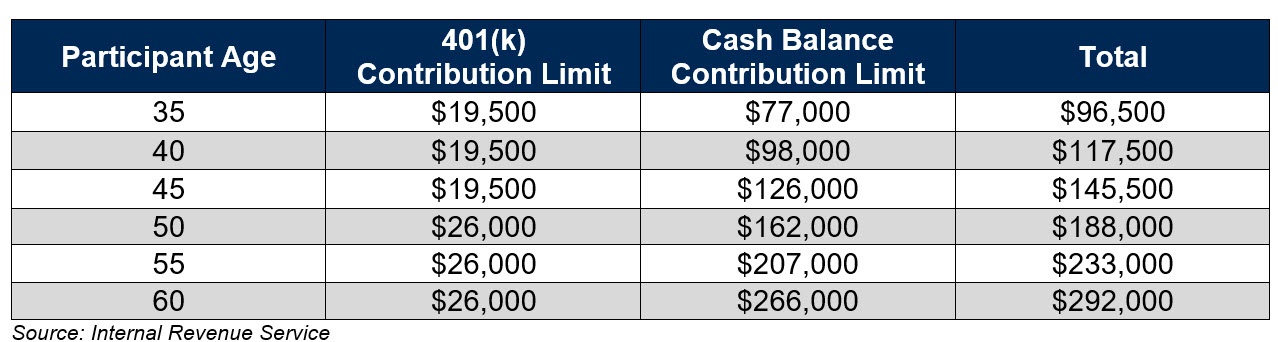

Cash balance plans offer participants significantly higher deductible limits than traditional 401(k) plans, thereby helping to reduce taxable income through higher maximum contribution levels while simultaneously enabling an increase in retirement savings. The benefit of higher contribution limits, while likely most beneficial for the partners or executives of these firms, typically benefit all employees as firms can broadly maximize contributions and pass discrimination testing.

The asset allocation of these plans is directed by the Plan Sponsor, with employees ultimately being credited annual contributions based on a pre-determined formula. The magnitude of the crediting rate as well as the formula by which it is determined are instrumental when considering how to create an asset allocation for a cash balance plan.

Plan Design

The most common options for a crediting rate formula are:

• Fixed Rate

• Variable Treasury Rate

• Actual/Market Rate of Return

Although fixed and variable treasury rate plans are still viable options for cash balance plans, most Plan Sponsors establish new plans with a market rate of return crediting rate. The key driver of this trend stems from the additional variability accompanying fixed and variable treasury rates, specifically around the “funded status” of the plan. The volatility of this status can lead to more uncertain contribution requirements. In contrast, a market rate plan offers a capital preservation floor and potentially a cap that can aid in reducing the variability of “funded status” or contribution levels.

The benefits of market rate plans include an added degree of complexity, such as the need for a tailored investment solution based on your participants’ and organization’s risk/return philosophy. As a practical matter, market rate plans tend to be conservatively invested with 40 percent to 70 percent generally allocated to fixed-income asset classes. This more conservative starting point aligns with the main benefit of the plan: achieving a high level of tax-deferred income through higher contributions into the plan.

While Plan Sponsors generally view the higher potential returns that typically involve more equity-focused allocations favorably, over time, they can result in participants being able to contribute less due to the IRS 415 max limits. This is a maximum benefit limit that a participant can accumulate in the plan that currently approximates to $2.9 million.

At first glance, investing for a cash balance plan may seem straightforward and relatively simple. However, many cash balance plans take too general of an approach that focuses solely on the plan’s crediting rate. At Fiducient Advisors, our proprietary approach to cash balance plan investing is more thoughtful and can be completely customized to reflect your plan-specific demographics and unique objectives. At a minimum, your demographics should be considered on an annual basis and, along with the cumulative rate of return of the plan, should be used to adjust your asset allocation mix, taking into consideration the current capital market environment.

Evolving Your Asset Allocation

The vast majority of existing cash balance plans have historically structured their design to earn the total plan return across all participants. Many sponsors probably observed this perceived limitation and wondered, “Which participants are we investing for anyway?”

General sentiment in retirement savings strategy dictates that younger participants can and should take on more risk while older participants near retirement should gradually decrease the overall risk levels of their portfolios. Similarly, in cash balance plans, participants who are near their contribution limit would likely benefit more from a different asset allocation compared to participants far below the limit. This can lead to a conundrum for cash balance Plan Sponsors, making them determine the “sweet spot” for their plan asset allocation, knowing it will not be ideal for part of their participant population.

While a “one-size-fits-all” approach to asset allocation has been standard practice in the cash balance industry, it is certainly not a necessity and may not be the best approach for your plan moving forward. At Fiducient Advisors, we help new plans forge ahead toward the new frontier of cash balance investing by implementing individual participant account credits. This bespoke approach annually evaluates the age, contribution level, 415 contribution limit and investment return for each individual participant to determine if they should be more conservatively or more aggressively invested based on their individual experience and background.

Under this model, Plan Sponsors retain ultimate decision-making responsibility regarding asset allocation, but they can benefit from our proprietary modeling, which allocates participants’ different risk-based portfolios based on their unique characteristics.

While we believe that this more individualized approach is the way forward for cash balance plans, we also understand that some plans may not want to take on any additional administrative responsibilities. Luckily, plans can also adopt a similar framework without the administrative complexity of allocating to individual participants. We can provide analytics at the plan level that evaluate plan demographics to ensure the asset allocation chosen for the plan is aligned with the optimal solution for the majority of participants.

For example, if most participants are at or approaching the 415 contribution limit, a more conservative allocation could be selected while a more aggressive allocation could be selected if participants are well below the contribution limit. The time horizon, contribution level and room until max are used as inputs with our Frontier Engineer® asset allocation framework to determine how participants should be allocated along a theoretical glide path.

If you would like to learn more about the Fiducient Advisors approach to investing for cash balance plans, please reach out to any of our Professionals and please click here to watch our recent webcast “Cash Balance Plans – Three Things You Need to Know.”

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.