The Largest Wealth Transfer in History

Over the next two decades, an estimated $84 trillion in wealth will move from Baby Boomers and Generation X to their heirs and charities1. Of that amount, more than $72 trillion will go directly to beneficiaries[1]. While this unprecedented shift presents opportunities, it also highlights risks.

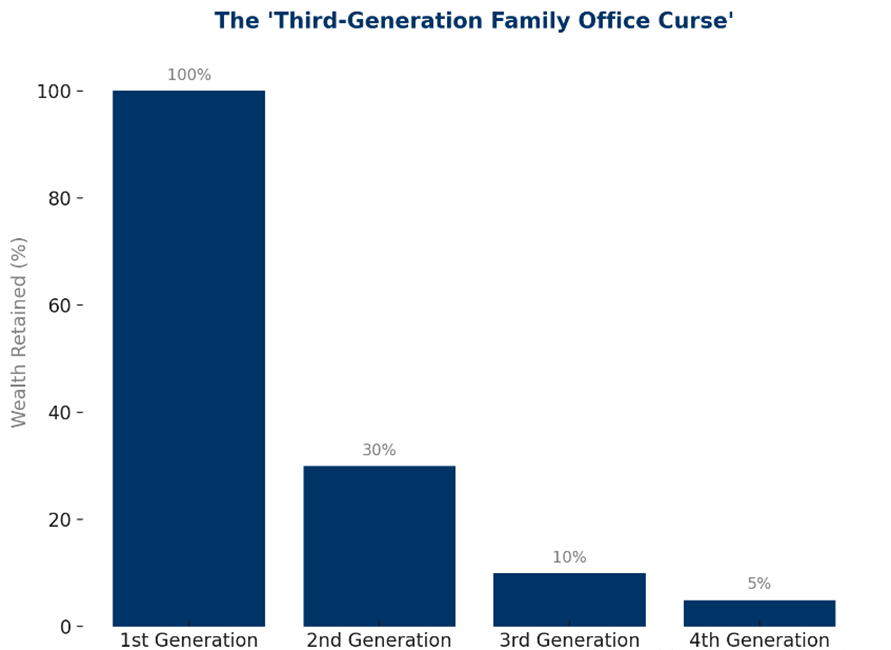

Research indicates that 70% of family wealth is lost by the second generation, and 90% by the third[2]. The cause is rarely poor investment strategies alone. Instead, the erosion of wealth often comes from a lack of preparation, financial literacy and communication within families.

As fiduciary advisors and investment consultants, we know that preserving wealth is not simply about portfolio management. It also requires multi-generational wealth management that includes education, dialogue and tailored guidance for every member of the family.

Source: Fiducient Advisors; The Williams Group, 20-Year Study on Family Wealth Dissipation, 2023.

Family Conversations that Matter

Education is most powerful when paired with family dialogue. That is why we facilitate family meetings that bring generations together to discuss wealth, values and goals. These conversations are often where the most meaningful progress occurs.

We believe a well-run family meeting creates a forum to:

- Introduce younger members to the family’s mission and legacy.

- Share stories that highlight how the family built its wealth and why stewardship matters.

- Allow heirs to ask questions in a supportive, structured setting.

Depending on the family’s needs, these meetings can also include philanthropy discussions, governance frameworks or multi-generational planning exercises. Importantly, meetings are tailored to the family and coordinated with their consultant, helping to ensure alignment with the broader investment and estate plan.

Tailored Guidance for Heirs

Every generation approaches money differently. Millennials and Gen Z, for example, often value impact investing, financial independence and sustainable strategies, while Baby Boomers may focus more on retirement income and estate planning.

That is why we believe one-size-fits-all approaches rarely work. For heirs ready to take on more responsibility, we provide personalized coaching that meets them where they are. This may include guidance on:

- Managing credit and debt responsibly.

- Saving for major life goals, such as purchasing a first home.

- Evaluating career decisions in the context of long-term wealth planning.

- Understanding how investments align with values and risk tolerance.

Personalized attention helps younger generations feel seen and supported, while reinforcing strong habits early.

Gifting with Intention

Another effective tool is “gifting with a warm hand.” Instead of waiting to pass on wealth through an estate, families can transfer smaller amounts during their lifetime. This allows heirs to practice managing resources, with the benefit of guidance from parents or grandparents.

For example, a family might provide a gift earmarked for starting a business, contributing to a down payment on a home or engaging in philanthropic work. These experiences teach financial responsibility and provide lessons that last far longer than the gift itself.

Estate and Legacy Planning

Even with education and coaching, a sound wealth transfer requires current estate planning. Many families delay this step. According to a recent report, 41% of Baby Boomers and 45% of Gen Xers do not have a will, and nearly half of those who do have not updated their documents in more than three years[3].

In our client meetings, we work alongside your consultant to ensure these important pieces remain up-to-date. This often includes reviewing wills and trusts, establishing or revisiting powers of attorney and ensuring tax-efficient strategies are in place. We treat these conversations as ongoing rather than one-time events, recognizing that families, laws and priorities evolve over time.

Tracking Progress and Accountability

Education and planning only succeed if families stay engaged. That is why we encourage regular progress reviews. These may include updates on portal usage, participation in family meetings or completion of planning milestones such as establishing a budget or reviewing estate documents.

Accountability helps ensure that heirs not only absorb information but apply it. We believe over time, these small, measurable steps build confidence and competence.

Building a Foundation Through Education

The first step in preparing heirs is helping them develop financial confidence. Our NextGen by Fiducient Advisors’ digital portal serves as a practical entry point for younger generations. It provides:

- Learning modules on topics such as budgeting, debt management and investing.

- Tools and calculators to help with saving, student loans and mortgages.

- On-demand webinars covering core issues like retirement planning, risk management and insurance.

The advantage of a digital platform is flexibility. Younger family members can engage within their own schedule; revisit lessons as needed and begin to see how financial decisions affect their future. The goal is not to overwhelm, but to aim to offer a foundation that builds gradually and sustainably.

Why It Matters

The $84 trillion wealth transfer is not just about assets. It represents opportunities for families to strengthen relationships, reinforce values and create impact for generations to come. Yet without preparation, those opportunities can quickly erode.

We believe that families that combine financial education, intentional conversations and tailored guidance, delivered in partnership with their fiduciary financial advisor, are better positioned to preserve wealth across generations.

As fiduciary advisors and family wealth management consultants, our role is to help ensure that heirs are not only recipients of wealth, but responsible stewards of it. By investing in education and engagement today, families can improve the odds that their legacy will last for decades, not just years.

Your legacy deserves more than good intentions – it deserves a plan. Reach out to a Wealth Office® advisor to start the conversation today!

[1] Cerulli Associates: Cerulli Anticipates $84 Trillion in Wealth Transfers Through 2045, January 2022

[2] Williams and Preisser, Preparing Heirs: Five Steps to a Successful Transition of Family Wealth and Values, January 2010.

[3] Legal Shield: New Study Finds America’s Largest Wealth Transfer Faces Unexpected Obstacle: The Family Dinner Table

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.