In late December 2022, Congress passed the Setting Every Community Up for Retirement Enhancement or SECURE Act 2.0 – a follow-up package to the initial SECURE Act which was passed in 2019. Although the majority of the legislation and associated headlines have focused on defined contribution plans, there are a small number of provisions that pertain to traditional and cash balance defined benefit plans.

An End to Inflation Indexing for PBGC Variable Rate Premiums

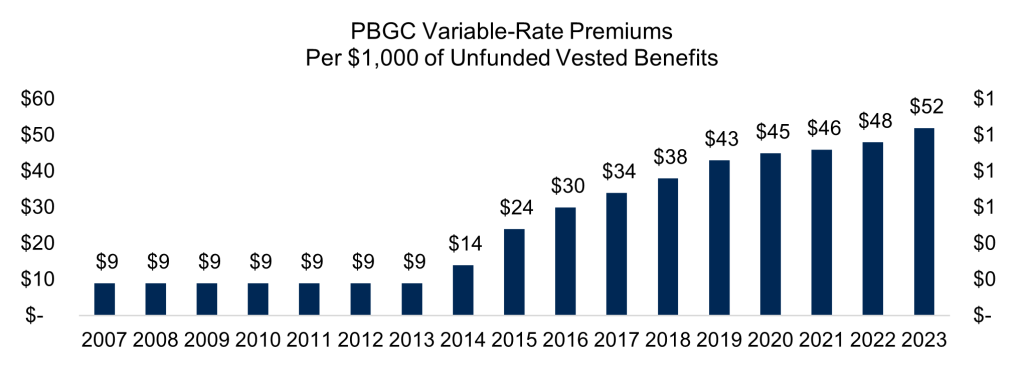

Relief for Plan Sponsors has been pursued for the past several years to no avail, but that changes with SECURE 2.0. In a significant positive development, SECURE 2.0 ends the inflation indexing of PBGC variable rate premiums, opting instead for a permanent premium of $52 per $1,000 of unfunded vested benefits going forward.1 Variable rate premiums have increased by nearly 500% since 2014 when 2012’s Moving Ahead for Progress in the 21st Century Act (MAP-21) both increased the rate to $14 per $1,000 of unfunded vested benefits in 2014 and added inflationary indexing.1 The Bipartisan Budget Acts of 2013 and 2015 subsequently added additional premiums before ultimately indexing the premiums to inflation in 2019.

Source: Pension Benefit Guaranty Corporation, March 17, 2023

While the end to higher future variable premium rates is welcome news, many Plan Sponsors and industry advocates had hoped not only for an end to indexation but a reversion to a lower variable premium rate altogether. Moreover, SECURE 2.0 does nothing to end the inflation indexing for the variable rate premium per-head cap or flat-rate premiums going forward which are $652 per participant and $96 per participant in 2023, respectively, though fewer plans are likely to hit the cap going forward with the removal of inflation indexing.1

Enhanced Participant Disclosures for Lump Sum Windows2

A 2015 Government Accountability Office (GAO) report found that informational packets for participants eligible for lump sum windows lacked key information needed to make an informed decision. This finding, along with the significance of the decision by participants on their retirement savings and the limited time window that participants must make an election, drove a new provision in SECURE 2.0 that requires Plan Sponsors to do the following for any lump sum windows payable after December 29, 2023:

- Give at least 90 days’ notice to window-eligible participants and beneficiaries before the election period begins.

- Provide detailed information about the lump sum offer, guidance on how to compare lump sum offers to lifetime annuity options, details about the election period, cautionary statements and recommendation to consult with a financial advisor.

- Provide information about the offer and a copy of the participant notice to the Department of Labor (DOL) and PBGC at least 30 days before the window opens.

- Send a report to the DOL and PBGC within 90 days after the close of the window summarizing participant elections and other information required by the DOL.

Improved Clarification on Cash Balance Pension Plan Crediting Rate Rules

In only one brief but critical sentence of SECURE 2.0, the legislation succeeds in simplifying the rules that guide variable or market-based cash balance plan crediting rates and could lead to potentially better outcomes for participants. The new guidance clarifies that for a plan that “provides variable interest crediting rates, the interest crediting rate which is treated as in effect and as the projected interest crediting rate shall be a reasonable projection of such variable interest crediting rate, not to exceed 6%.”3 This guidance and the 6% cap, which was recommended by the Society of Actuaries, helps cash balance plans by making it easier to pass the IRS’s backloading tests and gives greater certainty for how the backloading tests work.3 The guidance also allows plans to provide larger pay credits for older, longer serving workers who are closer to retirement. Prior IRS guidance required that backloading tests “be performed assuming the current rate” leading to difficulties in maintaining reasonably age-graded schedules of pay credits that would not fail backloading tests. The updated guidance will hopefully incentivize Plan Sponsors whose participants might benefit from a cash balance plan but were wary to start one due to the prior complexities to take a fresh look.

Higher Involuntary Cash Out Limit

For plans that elect to have a voluntary cash out provision, the current $5,000 maximum a plan can distribute without a participant’s consent will increase to $7,000 for distributions after December 31, 2023.4 This change will be particularly attractive for plans seeking to pay small lump sums to terminated vested participants with smaller balances in an effort to reduce PBGC premiums.

Increased Age for Required Minimum Distributions5

In an effort to help older participants keep their assets in retirement accounts for longer, SECURE 2.0 increases the age for required minimum distributions (RMDs) from 72 to

- 73 for a person who reaches age 72 after December 31, 2022 and age 73 before January 1, 2033.

- 75 for an individual who reaches age 74 after December 31, 2032.

SECURE 2.0 also cuts the excise tax on missed RMDs in half from 50% to 25% for taxable years starting after December 29, 2022.

Creation of Retirement Savings Lost and Found for Participants

In an effort that should aid both defined benefit and defined contribution plan participants, the DOL has been mandated to establish an online searchable database for participant retirement benefits.6 The DOL has until December 29, 2024 to create this Federal “lost and found” database which will enable participants and beneficiaries collect information on owed, missing or lost benefits and to search for the contact information of plan administrators for any plans in which a participant held a vested balance.6 Retirement plan administrators have until 2026 to provide contact information to the DOL and will be required to keep this information up to date going forward.

Mandatory Paper Benefit Statements

SECURE 2.0 will require that defined benefit plan statements be provided via paper statements once every three years.7 Employees will have the ability to opt into e-delivery instead of paper statements but will be required to be notified of this option through a one-time initial paper notice informing the participant of their right to receive all required disclosures by paper.

As with any change in the law regarding defined benefit plan, we recommend Plan Sponsors connect with their consultants, actuaries and ERISA counsel to ensure they are properly prepared to comply with and take advantage of any new regulations. As always, please reach out to any of the professionals at Fiducient Advisors with questions.

1SECURE 2.0 Act of 2022, part of the Consolidated Appropriations Act (CAA) of 2023, Title III – Termination of variable rate premium indexing, Section 349, BILLS-117hr2617enr.pdf (congress.gov)

2SECURE 2.0 Act of 2022, part of the Consolidated Appropriations Act (CAA) of 2023, Title III – Simplification and Clarification of Retirement Plan Rules, Section 342, BILLS-117hr2617enr.pdf (congress.gov)

3SECURE 2.0 Act of 2022, part of the Consolidated Appropriations Act (CAA) of 2023, Title III – Simplification and Clarification of Retirement Plan Rules, Section 348, BILLS-117hr2617enr.pdf (congress.gov)

4SECURE 2.0 Act of 2022, part of the Consolidated Appropriations Act (CAA) of 2023, Title III – Simplification and Clarification of Retirement Plan Rules, Section 304, BILLS-117hr2617enr.pdf (congress.gov)

5SECURE 2.0 Act of 2022, part of the Consolidated Appropriations Act (CAA) of 2023, Title I – Expanding Coverage and Increasing Retirement, Section 107, and Title III – Simplification and Clarification of Retirement Plan Rules, Section 302, BILLS-117hr2617enr.pdf (congress.gov)

6SECURE 2.0 Act of 2022, part of the Consolidated Appropriations Act (CAA) of 2023, Title III – Simplification and Clarification of Retirement Plan Rules, Section 303, BILLS-117hr2617enr.pdf (congress.gov)

7SECURE 2.0 Act of 2022, part of the Consolidated Appropriations Act (CAA) of 2023, Title III – Simplification and Clarification of Retirement Plan Rules, Section 338, BILLS-117hr2617enr.pdf (congress.gov)

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.