In this piece, we take a look at the past, present and likely future state of the retirement savings vehicles offered by private sector employers in America. Much has been written about the death of the defined benefit (DB) plan and the rise of the defined contribution (DC) plan in its place. Are DB plans going the way of the dinosaur? What has been the impact of the movement to defined contribution plans? Are Americans saving enough for retirement?

To get a better sense of the overall trends in the retirement benefits offered by corporate America, we turned to the Private Pension Plan Bulletin issued by the Employment Benefits Security Administration . In it we see that the number of employer-sponsored pension plans peaked in 1983 at roughly 175,000 and have been declining ever since to roughly 39,600 in 2020 (the last year data was available).1

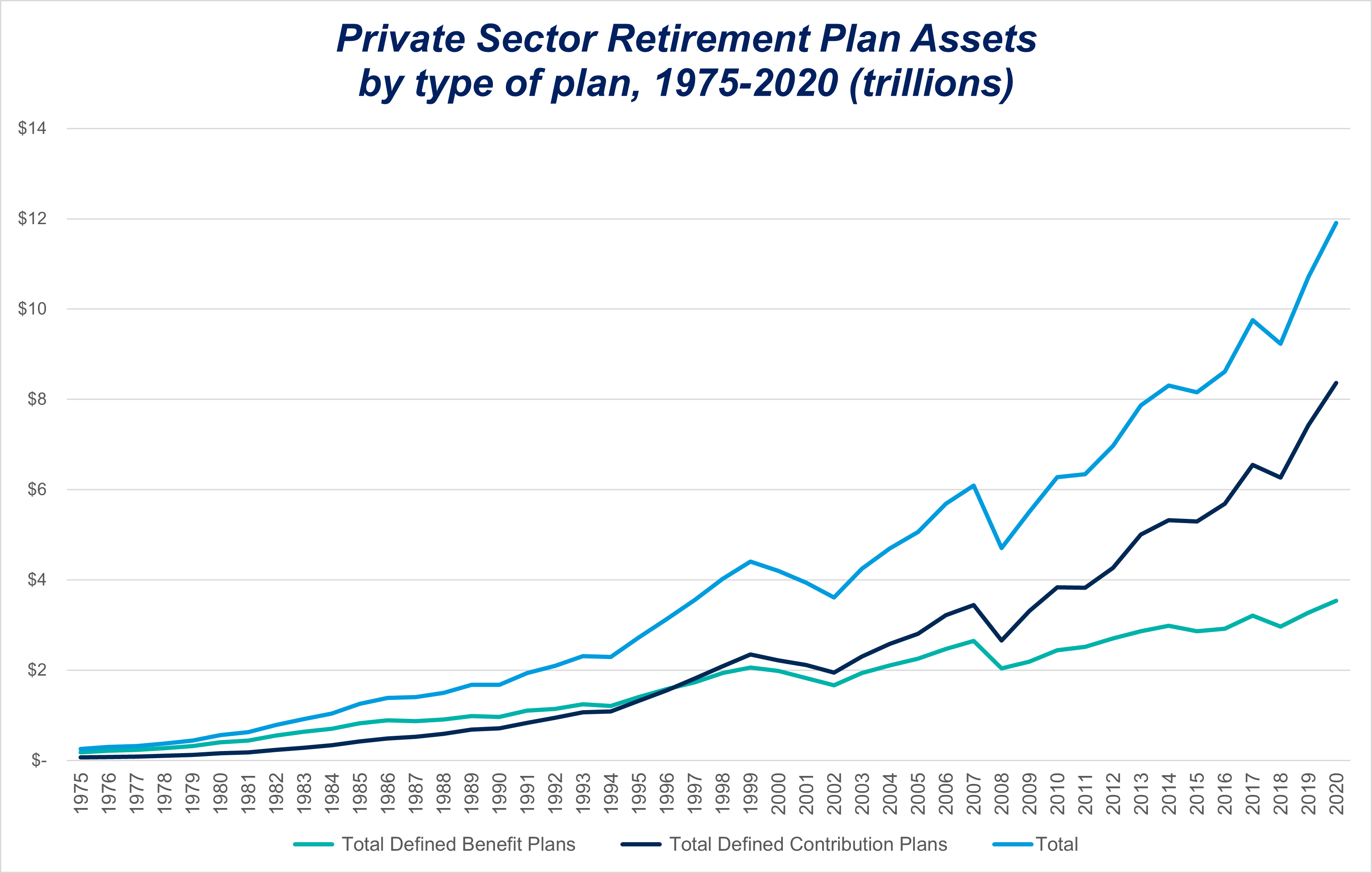

Despite the massive decline in the number of DB plans, the number of participants in DB plans shows a much more modest decline, from 40 million in 1983 to 31.9 million in 2020. Moreover, DB assets have actually increased from $642 billion in 1983 to $3.5 trillion in 2020.1

Taking a look at the pension risk transfer market, we see that 2022 was a record-setting year, with over $50 billion in pension risk transfer activity.2 However, when compared with the overall market, this amount is less than 2%. So, while traditional DB plans are indeed a dying breed, it is a slow death, and these plans are likely to be with us for the foreseeable future.

Another interesting data point from the EBSA study is that the number of DB plans offered by employers with less than 100 employees has actually increased, from a low of roughly 34,000 in 2012 to roughly 40,000 in 2020.1 In our opinion, this largely reflects the rise of cash balance pension plans. These hybrid plans offer many of the benefits of both DB and DC plans, while allowing for greater deferrals into tax-preferred retirement accounts.

In one high profile example, IBM recently announced that they are reinstating a defined benefit plan for their employees in the form of a cash balance plan. If IBM is any indication, we may actually see a resurrection in DB plans, albeit in the form of cash balance plans.

DC plans, on the other hand, have steadily increased from roughly 428,000 in 1983 to 700,000 in 2020. Participants in DC plans rose from 29 million in 1983 to 110 million in 2020 while assets ballooned from $281 million in 1983 to $8.4 trillion in 2020. In corporate America, DC assets exceeded DB assets in 1997 and they haven’t looked back since.1

Source: Private Pension Plan Bulletin Historical Tables and Graphs 1975-2020, Employee Benefit Security Administration, Department of Justice, October 2022; Form 5500 filings with the U.S. Department of Labor.

Employers tend to favor DC plans as they shift investment risk from the sponsor to the participant, are simpler to administer, and offer more predictable contribution requirements. Employees haven’t complained as they tend to favor the enhanced portability that comes with a DC plan. The fear here has always been that putting individuals in charge of their retirement will result in poor investment decisions leaving them unprepared for retirement. Has this been the case?

So far, the evidence is mixed. First the good news. A recent study performed by the Investment Company Institute analyzed a cohort of Americans who turned 55 in 2000 until they reached age 72 in in 2017. They found that for the typical individual, income in retirement represented more than 90% of the inflation-adjusted spendable income they had on average from ages 55-59.3 Even more encouraging: lower income Americans typically had higher income replacement ratios.

However, these conclusions stand in stark contrast to other studies4 that indicate roughly 50% of Americans are not on track to maintain their current living standards in retirement.

We believe there are steps employers can take to help their employees retire with dignity. It starts by ensuring access to a retirement plan. Small businesses have historically been much less likely to offer retirement plans to their employees. We’re optimistic that recent legislation may help change that. The next step is education – and here too, we are encouraged by the increase in financial wellness offerings that are offered to participants. Finally, plans must be well-run, offering important features such as auto-enrollment and auto-escalation along with attractive, low-cost investment options. By increasing access and education, and offering well-designed, low-cost plans, the odds increase meaningfully.

Fiducient Advisors is proud of the many ways we’ve worked with Plan Sponsors to help ensure a successful retirement for millions of Americans. Whether you are considering starting up a cash balance plan, dealing with a legacy pension plan or are focused on providing the best 401(k) plan you can for your employees, Fiducient Advisors is here to help.

Please contact us today to learn how our deep team of knowledgeable experts can help you structure and manage world class retirement plans for your employees.

1 Private Pension Plan Bulletin Historical Tables and Graphs 1975-2020, Employee Benefit Security Administration, Department of Justice, October 2022

2 Pension Risk Transfer Monitor, Legal and General, August 2023

3 2023 Investment Company Fact Book, Investment Company Institute, 2023

4 See for example: Retirement Savings Shortfalls: Evidence From EBRI’s 2019 Retirement Security Projection Model®, The retirement outlook: A national perspective on retirement readiness (vanguard.com), The National Retirement Risk Index with Varying Claiming Ages – Center for Retirement Research (bc.edu)

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.