Surviving and Thriving During Market Volatility & Uncertainty

From Pillar to Post

April 2, 2025 marked “Liberation Day” and the unveiling of a slew of tariffs on foreign nations in varying degrees of intensity. Soon after came the market reaction, with a week of red days and, more importantly, constant bombardment of news headlines reacting to the market decline and the proposed tariffs. The CBOE Volatility Index spiked to its highest level since the initial outbreak of COVID-19 back in 2020.1 Despite the negative headlines and tumultuous markets, most of our clients’ portfolios were in positive territory on a year-to-date basis when April came to a close. This came as a surprise to many folks, who were expecting to see their portfolio values having declined precipitously. Here at Fiducient Advisors, we recognize that periods of significant market volatility can be unsettling, but with a long-term perspective and proper diversified investment strategies for endowments and foundations, investment consultants can help you weather the financial storm.

Shelter in Place

So, what should you do when faced with market volatility? How do you navigate these waters as investment committee members, Board Directors or Trustees or staff members at a nonprofit? There are common tenants that all investors can employ to put their minds at ease and keep things in perspective.

Time in the market beats timing the market.

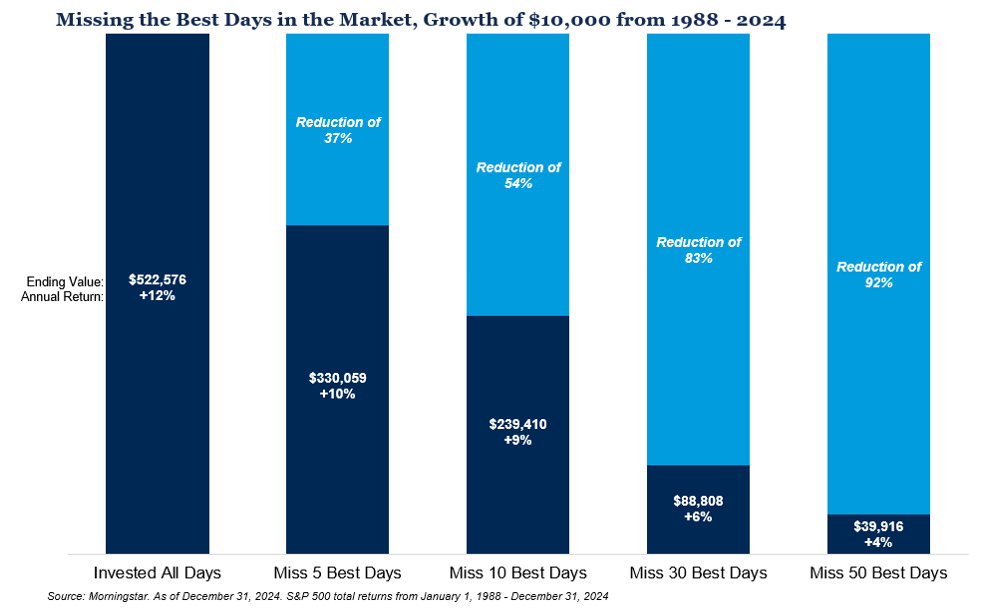

This is one of our favorite sayings, which has been validated time and time again. Strong portfolio returns don’t come from swing trading, or day trading or trading of any kind, really. There is considerable danger in jumping in and out of the market in an attempt to earn the best returns because, more often than not, you will make mistakes. You will get either the entry or exit point wrong, and those mistakes can be costly. The following exhibit is a strong illustration of how missing just a handful of the market’s best days has a significant impact on the long-term success of a portfolio. In fact, missing just the five best trading days over the past 36 years would result in a 37% reduction in ending portfolio value; a theoretical loss of almost $200,000, given an initial investment of $10,000. Importantly, many of the market’s best days occur in close proximity to the worst days.

Case in point, the S&P 500 had its third largest single day gain for the index on April 9, exactly one week after Liberation Day and directly on the heels of several significantly negative market days. If an investor had pulled their money out of the S&P based on the negative response to the tariff announcements on April 2, they would have missed the rebound experienced just a few trading days later.

Keep a cool head.

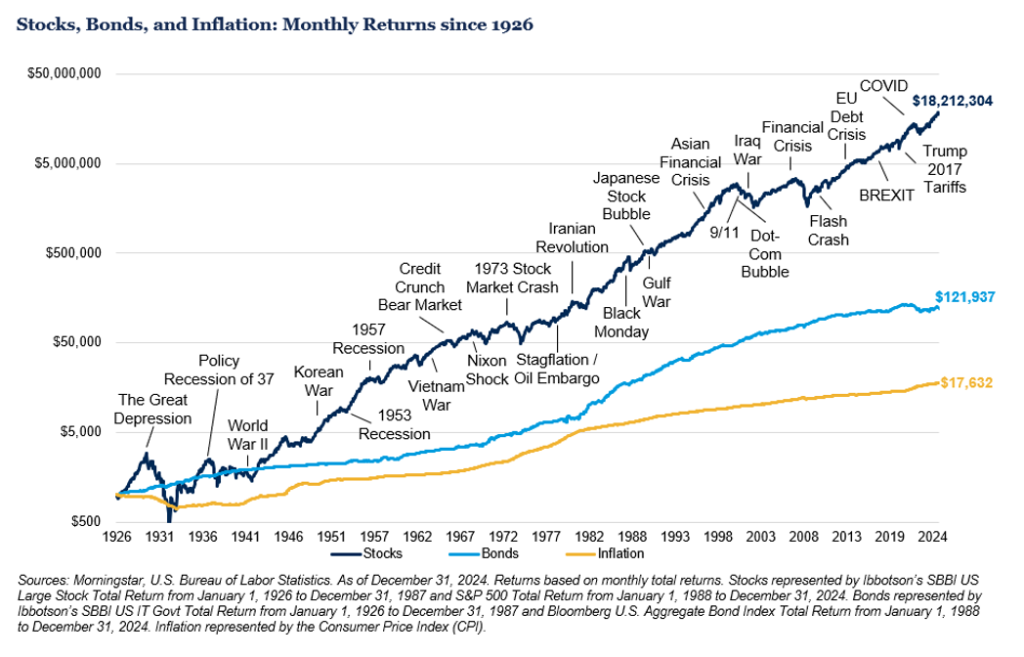

The figures can be scary and the headlines that pop up throughout the day are designed to be alarmist. There’s an old adage in journalism: “if it bleeds, it leads.” The more sensational a headline is, the more likely it will be read or clicked on. Sensational headlines or alarming news reports can lead to an emotional response on the part of an investor, which may result in poor trading decisions. As investment consultants, we recognize that it is important to be informed and keep a close watch on the markets. But it is equally important to recognize that (seemingly) calamitous market or economic events occur in the short term and join the long list of other calamitous events that have taken place over the course of history. When in doubt, zoom out. Having a broad historical perspective can help investors realize that short-term dislocations are par for the course, but over time the market moves up and to the right.

Don’t keep all your eggs in one basket.

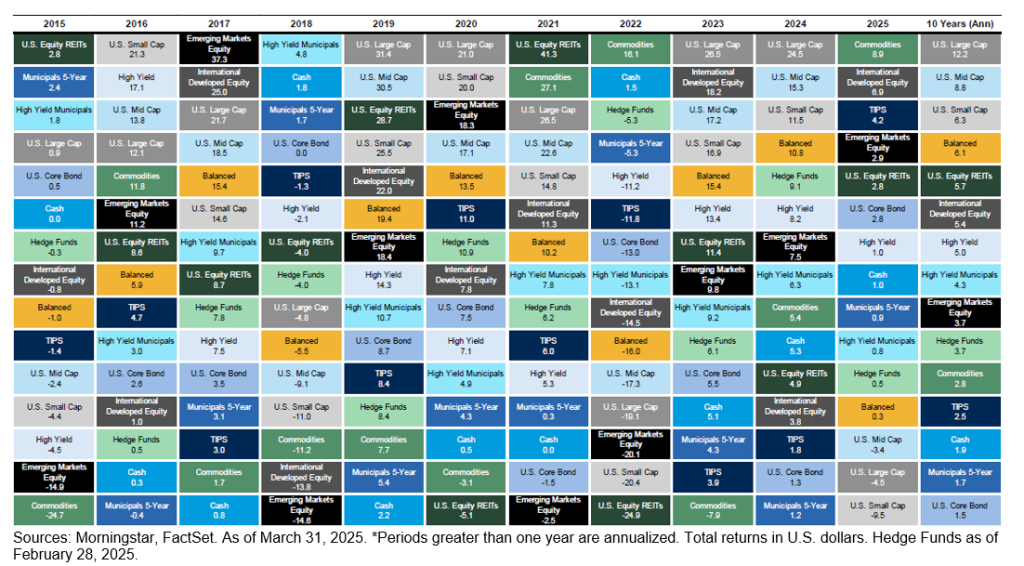

Although we are always proponents of broad diversification, in times of turbulence it is particularly important to remember not to keep all your eggs in one basket but to diversify your risk and to avoid the pitfalls of being overly concentrated. This year in particular has highlighted the benefits of diversification, as international equities have outperformed their U.S. counterparts by over 13% through May2. The chart below highlights the benefits of diversification. There is no discernable pattern to asset class returns; the best performing asset class one year might be the worst performing asset class the next year. However, broad diversification results in a steadier return stream and less volatility over time.

Remember your why.

This recommendation is possibly the most important of all. During turbulent times, investors must keep their “why” at the forefront of their minds. Are you a university trustee overseeing an endowment with a perpetual time horizon, seeking to provide sustainable support to the university? Are you associated with an endowment or foundation trying to limit downside volatility to ensure smoother annual spending rates? Keeping long-term risk and return goals and objectives in mind can help investors avoid making reactionary moves, which are often based on fear, during turbulent times.

Weather the Storm

Navigating market volatility requires a balanced approach that combines long-term perspective, diversification, and emotional resilience. By keeping a cool head and remembering the fundamental principles of investing, such as time in the market (rather than timing the market) and broad diversification, investors can weather the financial storm and achieve their goals. It is essential to stay focused on the “why” behind your investments, whether you are managing an endowment, foundation or nonprofit. With the guidance of an unbiased financial advisor or outsourced chief investment officer or OCIO, nonprofit institutions, their staff and respective investment committees can confidently face market challenges and thrive in the ever-changing financial landscape.

1VIX Sourcing: https://finance.yahoo.com/quote/%5EVIX/

2https://finance.yahoo.com/quote/ACWX/

Disclosures & Definitions

Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that actual returns or volatility will be similar to the indices. Indices cannot be invested in directly. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect our fees or expenses. Market returns shown in text are as of the publish date and source from Morningstar or FactSet unless otherwise listed.

• The S&P 500 is a capitalization-weighted index designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

• Russell 2000 consists of the 2,000 smallest U.S. companies in the Russell 3000 index.

• MSCI EAFE is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the U.S. and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

• MSCI Emerging Markets captures large and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country.

• Bloomberg U.S. Aggregate Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

• Bloomberg U.S. Corporate High Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included.

• FTSE NAREIT Equity REITs Index contains all Equity REITs not designed as Timber REITs or Infrastructure REITs.

• Bloomberg Commodity Index is calculated on an excess return basis and reflects commodity futures price movements. The index rebalances annually weighted 2/3 by trading volume and 1/3 by world production and weight-caps are applied at the commodity, sector and group level for diversification.

Material Risks

• Fixed Income securities are subject to interest rate risks, the risk of default and liquidity risk. U.S. investors exposed to non-U.S. fixed income may also be subject to currency risk and fluctuations.

• Cash may be subject to the loss of principal and over longer periods of time may lose purchasing power due to inflation.

• Domestic Equity can be volatile. The rise or fall in prices take place for a number of reasons including, but not limited to changes to underlying company conditions, sector or industry factors, or other macro events. These may happen quickly and unpredictably.

• International Equity can be volatile. The rise or fall in prices take place for a number of reasons including, but not limited to changes to underlying company conditions, sector or industry impacts, or other macro events. These may happen quickly and unpredictably. International equity allocations may also be impacted by currency and/or country specific risks which may result in lower liquidity in some markets.

• Real Assets can be volatile and may include asset segments that may have greater volatility than investment in traditional equity securities. Such volatility could be influenced by a myriad of factors including, but not limited to overall market volatility, changes in interest rates, political and regulatory developments, or other exogenous events like weather or natural disaster.

• Private Real Estate involves higher risk and is suitable only for sophisticated investors. Real estate assets can be volatile and may include unique risks to the asset class like leverage and/or industry, sector or geographical concentration. Declines in real estate value may take place for a number of reasons including, but are not limited to economic conditions, change in condition of the underlying property or defaults by the borrower.

• All investing involves risk including the potential loss of principal. Market volatility may significantly impact the value of your investments. Recent tariff announcements may add to this volatility, creating additional economic uncertainty and potentially affecting the value of certain investments. Tariffs can impact various sectors differently, leading to changes in market dynamics and investment performance. You should consider these factors when making investment decisions. We recommend consulting with a qualified financial adviser to understand how these risks may affect your portfolio and to develop a strategy that aligns with your financial goals and risk tolerance.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.