Another Good Year For Pension in 2025

This year was marked by significant events that reshaped both the markets and the global economy. This began with rapid policy changes, notably the tariff announcements on April 2, which triggered the sharpest one-week decline in U.S. stocks since the pandemic. Despite this volatility, global equities proved resilient, ultimately closing the year with robust double-digit gains for the third consecutive year. Notably, international stocks outperformed their U.S. counterparts in 2025. Bonds also delivered strong results, benefiting from the U.S. Federal Reserve’s move to reduce short-term interest rates. Defined benefit plans also experienced another good year in 2025 largely due to investment returns outpacing liabilities. In 2025, FTSE estimates that plan liabilities increased by 6.8%1, excluding benefit accruals. Investments diversified across fixed income and equities generated returns 3% in excess of the liabilities, leading to improvements in pension plans’ funded statuses broadly.

1FTSE Pension Liability Index – Short as of December 31, 2025.

260% MSCI World Index annual return plus 40% Bloomberg U.S. Aggregate Index annual return as of December 31, 2025.

320% MSCI World Index annual return plus 80% Bloomberg U.S. Long Gov/Credit Index annual return as of December 31, 2025.

Sources: Factset; FTSE Russell.

Cash Balance Plans

Cash balance plans are qualified retirement plans that offer the stability of a pension plan with the ability for more transparency and portability similar to a 401(k) plan. A well-designed cash balance plan offers the ability to defer significantly more toward retirement savings than a 401(k) plan alone, without the funded status volatility of a traditional defined benefit plan on a Plan Sponsor’s balance sheet.

Cash balance plans continue to gain traction among many organizations, but professional service firms in particular are taking note – law firms, medical/dental practices, accounting/consulting groups, asset management firms and other closely held businesses look to cash balance plans to turbocharge tax deferral and retirement savings for employees and owners.

Innovative plan designs incorporating tiered investment options tailored to employees’ diverse risk and return profiles have been a topic of growing interest from Plan Sponsors. These enhancements underscore the flexibility and strategic value of cash balance plans in modern retirement planning for both employers and participants.

Please be on the lookout for upcoming webinars by Fiducient experts exploring the trends in the cash balance plan space and the benefits of these defined benefit plans for employees and employers.

Traditional Pension Plans

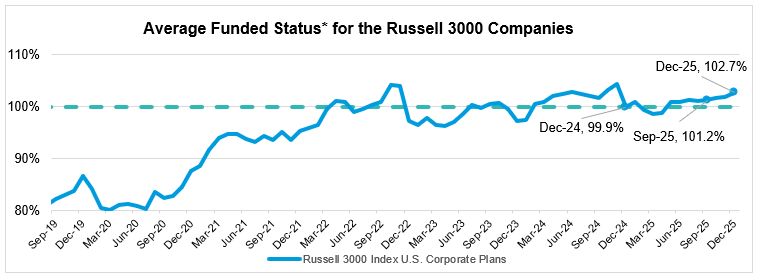

Throughout 2025, pension plans generally experienced notable improvements in their funded statuses. Among the Russell 3000 companies that maintain pension plans, the average funded ratio – which measures assets relative to liabilities – reached 102.7%. This represents a 2.8% increase over the course of the year (see chart below).

Pension plans with greater allocations to equities and shorter duration fixed income achieved more pronounced gains in funded status; plans that were more heavily invested in longer duration, liability-driven strategies maintained relatively stable funded statuses.

Source: Wellington Asset Management as of December 31, 2025.

Read our entire January 2026 edition of The Pension Pulse Newsletter for more insights. Click below!