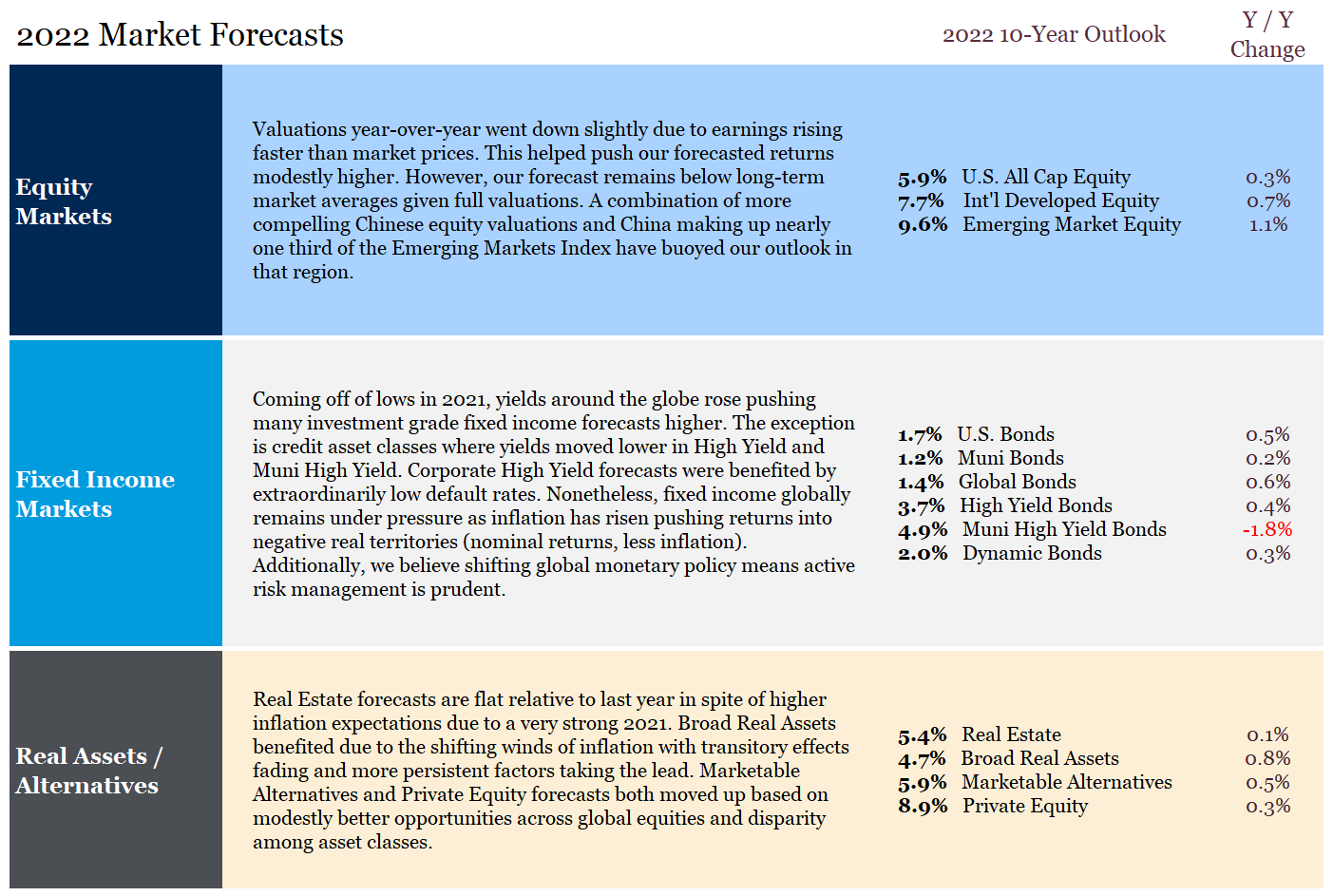

Our 2021 Outlook “Poised for Growth” did a fair job encapsulating last year as markets, economies and inflation (the current favorite word in the investing lexicon) all came roaring back. Looking to 2022, we continue to see opportunity, but with far greater moderation. Our 10-year market forecasts summarized below rose modestly year-over-year; however, our projections remain well below long-term averages.

2022 Themes

In our view, navigating moderation takes preparation, a mental shift and thoughtful risk management. Diverging monetary policies globally, shifting winds in inflation and meeting market expectations around earnings require consideration. With these potential headwinds in mind, we continue to warn against market timing or making narrow “bets.” In today’s environment, where uncertainty is higher, dispersion of outcomes is wider and timing is as important as ever, we believe a thoughtful long-term approach remains the best recipe for success. In our view, the following topics will help provide a framework for how to approach markets in 2022.

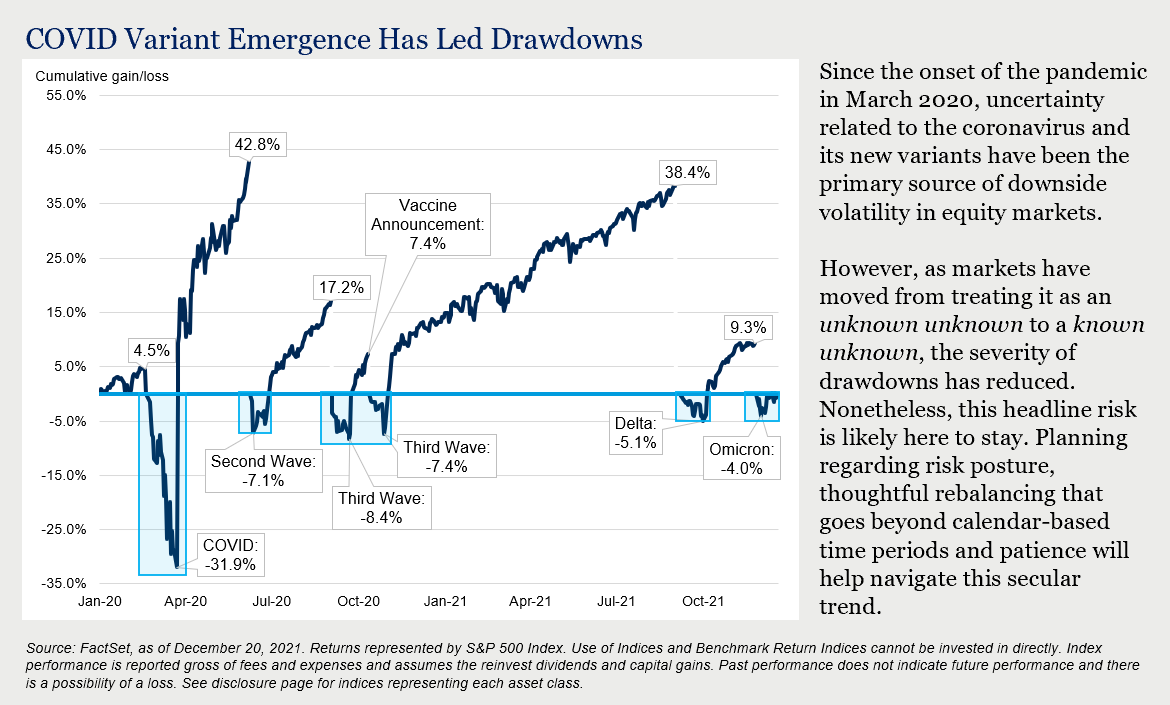

From Pandemic to Endemic

The 1918 Great Influenza wreaked havoc around the world and upended the lives of millions of people. Over 100 years later, variations and mutations of that distant virus are still present in the modern flu.

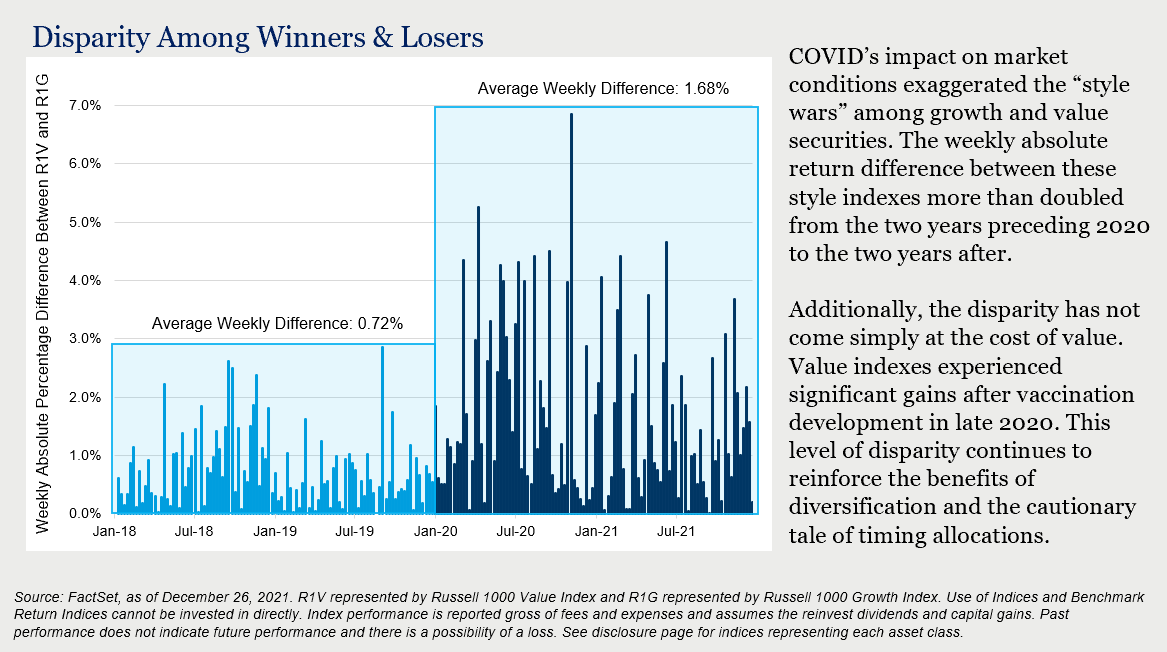

The hopes for fully eradicating COVID have faded and the reality is COVID seems likely to be a secular virus, not a transitory one. This shift in mentality has several implications for investors. Market volatility around current and future unknown variants should be expected and the disparity among the winners and losers in such bouts may be wider than it has been in the past.

Portfolio Impact

Headline risk is here to stay. Thoughtfully assessing risk posture ahead of future events can help avoid costly emotional decisions during bouts of volatility. Additionally, given the disparity of winners and losers in a volatile environment, diversification matters as much now as it ever has before. Finally, a more active approach to rebalancing may be warranted. It is unlikely COVID-induced volatility will fit neatly in a calendar year or quarterly cycle. Plan ahead to take advantage.

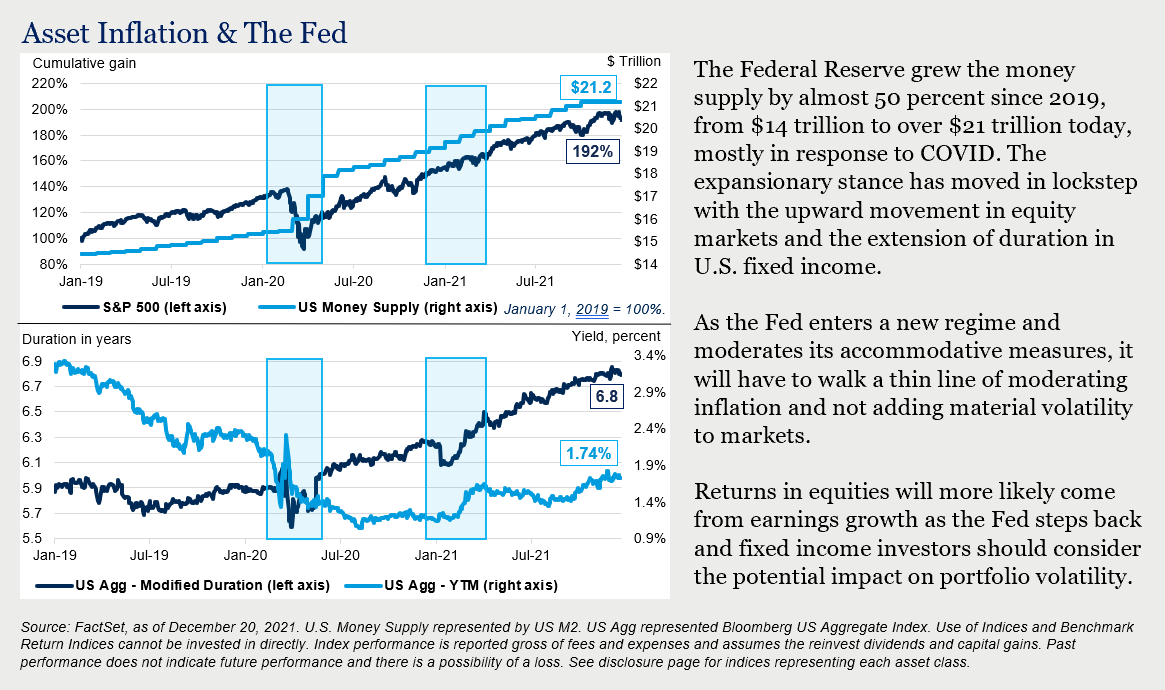

Policy Maker Tightrope

The U.S. Federal Reserve recently acknowledged the persistence of inflation with the majority of FOMC members now expecting to raise the Federal Funds rate three times in 20221. In fact, to combat higher inflation, 38 central banks globally already raised rates in 20212. However, the era of global coordination among banks is beginning to fade as policy makers evaluate economic growth and price stability in their markets. Recently the European Central Bank said it is unlikely to raise rates in 2022 but will modify its bond buying program3 while the People’s Bank of China cut rates and injected liquidity into the system in response to slowing growth and market volatility after recent regulation changes. These crosscurrents provide both opportunities and challenges for investors looking ahead.

Portfolio Impact

Diverging inflationary dynamics and monetary policies between countries have implications across asset classes. We believe this environment is attractive for active fixed income management, providing a greater opportunity to add value. Additionally, management of interest rate risk is prudent in such a macro-environment. Within equities, we believe maintaining an allocation to Emerging Markets is warranted, particularly on the heels of Chinese market volatility. Increasing regulatory oversight appears to be reflected in the recent market pullback and stimulus measures from the People’s Bank of China provide near-term support. There may be opportunity ahead.

Inflation: Coming or Going?

The Consumer Price Index (CPI) rose 6.8 percent year-over-year as of October 31, 2021 – the largest increase since 19824. Inflation was initially attributed to the proverbial doors swinging open after shelter in place orders while heightened demand pushed prices higher. Demand remains high with consumer net worth at an all-time high5 and wages rising6, but the story moves beyond just the buyer. Supply chain disruptions and fragility, rising energy prices and housing demand all support an environment for above average inflation compared to the most recent two decades.

1CNBC, “The majority of Fed members forecast three interest rate hikes in 2022 to fight inflation,” December 15, 2021, https://www.cnbc.com/2021/12/15/the-majority-of-fed-members-forecast-three-interest-rate-hikes-in-2022-to-fight-inflation.html

2BIS, Central Bank Policy Rates, https://www.bis.org/statistics/cbpol.htm

3MSN, “European Central Bank Cuts Pandemic Bond Buying, but Pledges Further Stimulus,” https://www.msn.com/en-us/money/markets/european-central-bank-leaves-interest-rates-unchanged-cuts-bond-buying-further/ar-AARSmLP?ocid=uxbndlbing

4Federal Reserve Bank of St. Louis, “Consumer Price Index for All Urban Consumers,” https://fred.stlouisfed.org/series/CPIAUCSL

5Federal Reserve Bank of St. Louis, “Household Net Worth,” https://fred.stlouisfed.org/series/BOGZ1FL192090005Q

6Federal Reserve Bank of St. Louis, “Household Net Worth,” https://fred.stlouisfed.org/series/CES0500000003

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.