Key Observations

• Plan Sponsors and advisors historically assisted participants in the accumulation phase of retirement planning. More recently, greater attention is being placed on the decumulation phase. According to the U.S. Census Bureau, “The 65-and-older population grew by over a third (34.2 percent or 13,787,044) during the past decade [2010-2019].”

• Participants are more reliant on their defined contribution assets than ever before and are beginning to look to their plans for solutions on the decumulation side of retirement.

• Various structures of retirement income solutions exist today with varying degrees of trade-offs. Education is crucial for both Plan Sponsors and participants, and likely no single solution is right for all participants.

• While many retirement income solutions have been available for decades, some solutions have only recently come to market with even more in the pipeline to come to market over the coming years.

“Retirement Income” is a buzz phrase within the defined contribution (DC) landscape as decades of talk around retirement income is turning to action as pensions continue their secular decline and aging DC participants are nearing retirement. This paper offers a framework to organize the different products available, primary considerations for Plan Sponsors and key trends including new products and education.

Framing Retirement Income

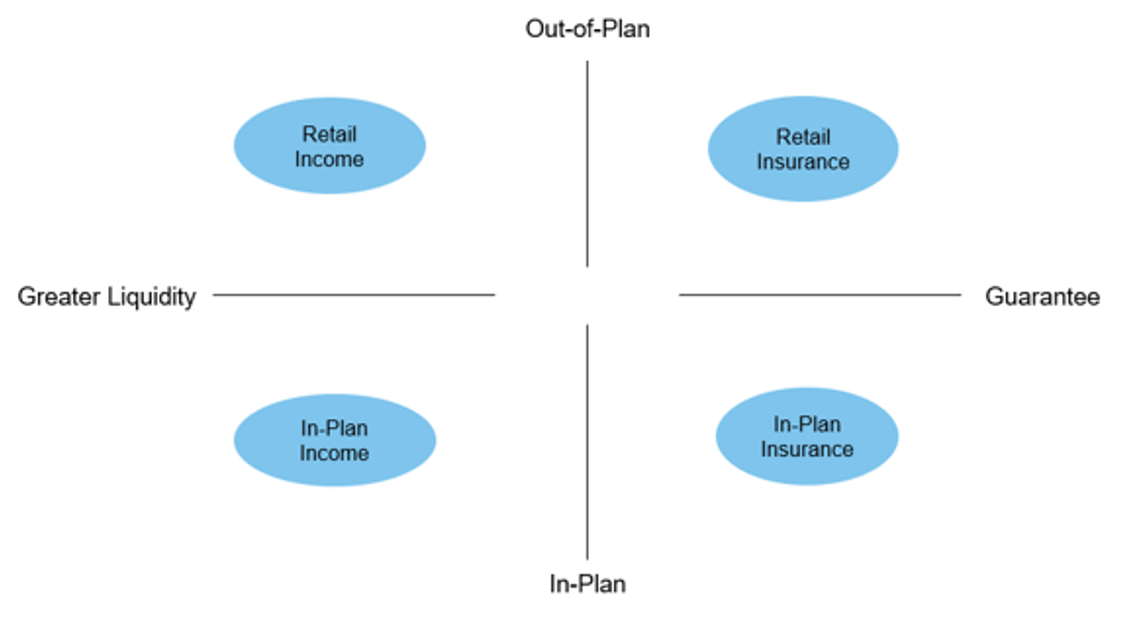

Retirees can seek to replace pre-retirement income in a myriad of ways. We organized the retirement income landscape into a two-dimensional framework; in versus out of plan and guaranteed versus greater liquidity. We focus on the in-plan retirement income solutions and the key considerations for Plan Sponsors to know.

In-Plan Retirement Income Solutions

In-plan and liquid solutions are comprised of investments commonly found in lineups today and up and comers such as target date funds with decumulation offerings, risk-based funds, managed accounts with decumulation offerings and managed payout funds. These solutions also share a common trait as a “do it for me” offering in which participants may lack the time, interest or knowledge to make investment decisions on their own and would prefer professional guidance.

Managed payout products offer participants various forms of systematic income. Some investments pay a fixed percentage of assets, others a varied withdrawal rate, or even a dynamic spend similar to an endowment model in which spending is based on recent returns of the portfolio. In addition, some managed accounts and target date investments have begun to incorporate decumulation tools so participants can withdraw capital from a familiar and existing investment already in the plan.

On the spectrum of retirement income solutions, these types of investments provide participants with the greatest flexibility, portability and are more often understood by participants. However, like any retirement income solution, they still require necessary education and tools to assist with proper usage. Fees are generally competitive relative to other in-plan solutions but can vary by investment and structure. The most common drawback relative to other in-plan solutions is the lack of a guarantee. With the secular decline of pension plans and the potential concerns of changes to social security benefits, many retirees are seeking stability and guarantee to replace these once common sources of income.

In-Plan Retirement Income Insurance Solutions

The word “annuity” has caused heartburn for many Plan Sponsors based on complexity, administrative burden and lack of familiarity. However, as Plan Sponsors continue to ponder solutions meant to fulfill the needs of their current and former employees, many have given annuities additional consideration. In-plan annuities are not a new phenomenon nor are they one size fits all. Additional products include:

• Immediate Annuities

• Deferred Annuities such as Qualified Longevity Annuity Contracts (QLACs)

• Guaranteed Minimum Withdrawal Benefits (GMWBs)

There are several benefits and drawbacks to these structures, some being more apparent than others. The ability to have a guaranteed income stream, such as with social security or a pension, is clearly an attractive attribute, as is the potential modeling aspect when incorporated into target date or managed account solutions. These solutions may also reduce market volatility for participants and have the potential to provide excess returns relative to fixed income. However, these benefits come with some additional considerations.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.