A brief review of Fed Independence

Key Observations

Markets Warm with the Weather – May brought a more constructive tone as trade tensions eased, lifting sentiment and encouraging a rebound in risk assets.

Fixed Income Buyers Remain Cold – While equities priced in potential fiscal stimulus, bond markets focused on long-term deficit risks, pushing yields higher across most of the curve.

Fed Independence Under the Spotlight – The Fed has held rates steady this year while calls from the Executive Branch grow louder to ease policy. Investors wonder yet again how independent the Fed truly remains.

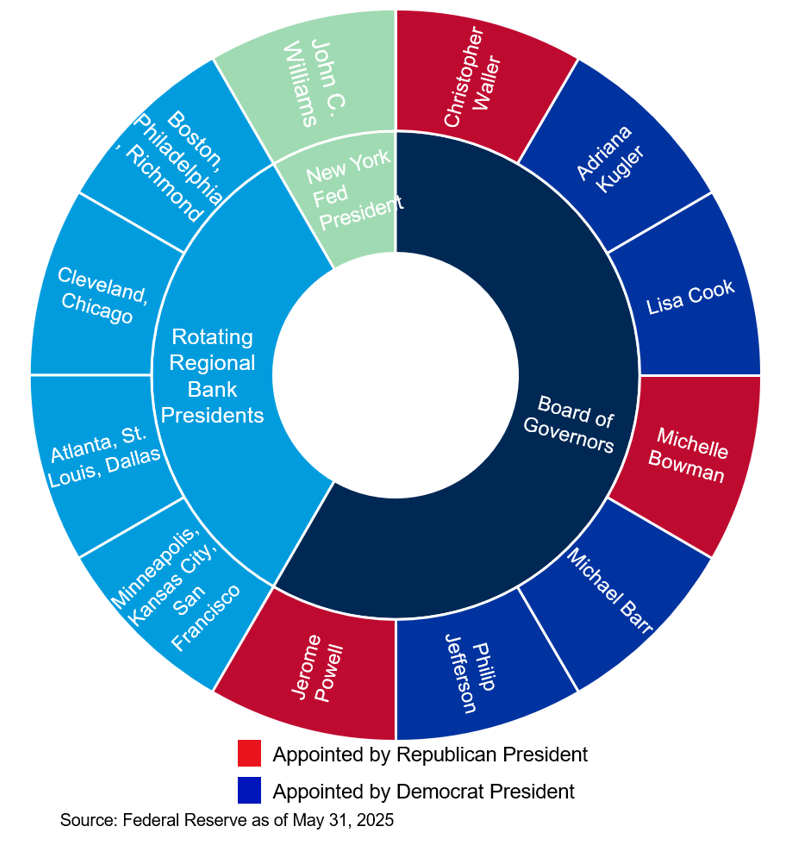

Fed Structure Limits Political Control – Fed governors serve staggered 14-year terms and require Senate confirmation, but average tenure is only about seven years. While this structure gives presidents some influence, it falls short of control. This is especially true given that the full voting Federal Open Market Committee (FOMC) includes five regional presidents unaffiliated with the Executive Branch.

Imperfect Independence – Despite renewed debate around Fed leadership and independence, there is no current evidence to suggest investors should shift positioning. The Fed remains an imperfect yet vital anchor for monetary stability.

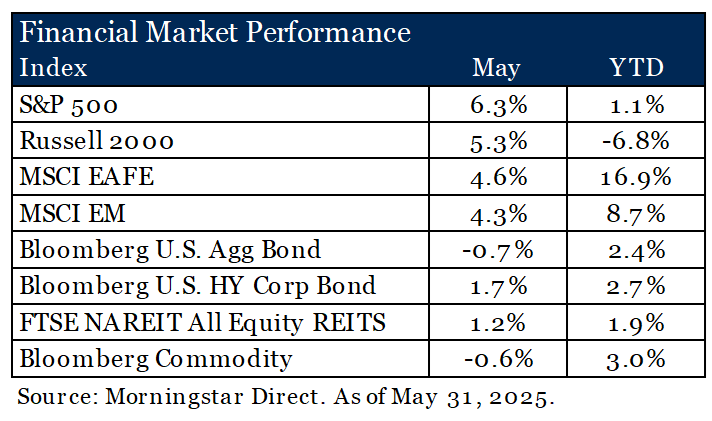

Market Recap

May brought a welcome change in tone, both in the weather and the markets, as the warmth of spring settled across North America. The initial jolt from April’s tariff announcements faded into more tempered discussions and signs of de-escalation. Investors responded in kind, especially in the growth-oriented corners of the market.

Technology stocks, once again led by the “Magnificent Seven,” surged ahead. In May, the sector climbed an impressive +10.9%, making it the only sector to notch double-digit gains and distinguishing it as the clear winner of the month.

Not all sectors shared in the rally. Healthcare, in contrast, struggled under the weight of renewed political scrutiny. Concerns over drug pricing rhetoric and uncertainties tied to pending tax legislation dragged the sector down -5.5%, making it the only U.S. sector to post a decline for the month.

Optimism was most concentrated in U.S. markets which helped them pull ahead of their international peers. The S&P 500 outpaced the MSCI EAFE and MSCI EM by +1.72% and +2.03%, respectively, for the month. Still, allocations outside the U.S. remain in the lead year-to-date, bolstered by solid local market returns and a weak U.S. dollar year-to-date.

Not all investors were comforted by the easing of trade tensions. Bond markets responded more cautiously. While equities leaned into the possibility of new fiscal stimulus, fixed income investors focused on the long-term implications for the federal deficit. Yields rose across most of the curve, except at the short end, as the Federal Reserve kept rates unchanged and signaled its ongoing inflation vigilance. The backdrop for bondholders remains complex, shaped by policy uncertainty, legal challenges to tariff plans and the broader fiscal outlook.

To that end, May marked the one-year countdown for Federal Reserve Chair Jerome Powell’s term as chair, which will end in 2026. While his seat on the Board of Governors ends in 2028, the question of leadership, and by extension Fed independence, is back in the spotlight. Add to this the open interest from President Trump for lower rates and investors are again asking: how insulated is the Fed from political pressure, really?

What’s at Stake

Fed independence is not about optics or tradition. It is foundational to stable prices and economic growth. When it falters, the fallout is real. History shows us that political interference in monetary policy can fuel inflation, destabilize asset prices and increase the cost of capital. The risk is not a theoretical concern; it is existential for allocators. If investors lose confidence in the Fed’s impartiality, global demand for U.S. Treasuries could soften and the margin of safety that underpins valuations across all asset classes, from growth stocks to municipal bonds, could erode.

Fed Structure

The Fed is designed to resist political overreach. The seven-member Board of Governors serve staggered 14-year terms, and appointments require Senate confirmation. At face value, this would indicate very modest influence in any one term for a sitting President. However, only about 17% of governors serve out their full term, with the average tenure being seven years since 19141. This built-in turnover gives sitting Presidents the potential for more influence, but far short of control. Even with board turnover (which is no guarantee) and the existence of term limits, history suggests that appointing more than four governors in a single presidential term would be highly unusual. Moreover, the appointed board is not the full committee.

The 12-member Federal Open Market Committee (FOMC) includes five regional Fed presidents who are not appointed by the White House. Seven votes are needed for a majority. The regional presidents serve as a structural buffer, mitigating the potential for appointee influence.

Independent, Not Infallible

There are notable historical examples of the Fed’s wavering independence. In the 1940s, the Fed suppressed interest rates to help finance war spending. The Fed voluntarily acted to do so in such an extraordinary time, but clearly this policy extended beyond purely economic intent. Inflation surged post-war until the breaking point came in 1951 when the Treasury-Fed Accord freed the Fed from rate pegs. This act is now regarded by some as the true birth of modern monetary independence.

Chair Arthur Burns yielded to political pressure to cut rates in the 1970s, a move that when combined with other macro factors contributed to runaway inflation. Conversely, Paul Volcker’s resolve in the face of political threats during the 1980s exemplified why independence matters. Although his rate hikes were painful, they restored credibility and anchored long-term inflation expectations, leaving a lasting impact to this day.

Legal Precedent

The 1935 Supreme Court case Humphrey’s Executor established that independent agency heads cannot be removed by the President without cause. While not Fed-specific, the ruling underpins the legal architecture protecting the Fed’s autonomy. That does not mean political will won’t try to test it, but it does mean any attempt at structural overreach would face steep legal hurdles.

Outlook

The Fed is not infallible, but its design and legal safeguards meaningfully limit short-term political influence. That is not just a procedural win; it offers a structural advantage for long-term investors. Economic policy that bends to election cycles tends to deliver short-lived gains and long-term consequences.

As the market begins to price in potential leadership transitions and shifting policy postures, long-term allocators would do well to focus elsewhere. Structural drivers like fiscal policy, entitlement spending and the trajectory of U.S. deficits are far more likely to influence Treasury yields and capital markets than the next one or two Fed appointments.

Fed independence deserves attention, especially when headlines blur the lines between politics and policy. But perspective matters: history and institutional design suggest that the Fed remains an imperfect but resilient anchor of monetary stability. For now, we see no evidence that warrants a change in positioning based on this issue alone.

1Federal Reserve from August 10, 1914 to March 1, 2025

Disclosures & Definitions

Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that actual returns or volatility will be similar to the indices. Indices cannot be invested in directly. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect our fees or expenses. Market returns shown in text are as of the publish date and source from Morningstar or FactSet unless otherwise listed.

- The S&P 500 is a capitalization-weighted index designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

- Russell 2000 consists of the 2,000 smallest U.S. companies in the Russell 3000 index.

- MSCI EAFE is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the U.S. and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

- MSCI Emerging Markets captures large and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country.

- Bloomberg U.S. Aggregate Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

- Bloomberg U.S. Corporate High Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included.

- FTSE NAREIT Equity REITs Index contains all Equity REITs not designed as Timber REITs or Infrastructure REITs.

- Bloomberg Commodity Index is calculated on an excess return basis and reflects commodity futures price movements. The index rebalances annually weighted 2/3 by trading volume and 1/3 by world production and weight-caps are applied at the commodity, sector and group level for diversification.

Material Risks

- Fixed Income securities are subject to interest rate risks, the risk of default and liquidity risk. U.S. investors exposed to non-U.S. fixed income may also be subject to currency risk and fluctuations.

- Cash may be subject to the loss of principal and over longer periods of time may lose purchasing power due to inflation.

- Domestic Equity can be volatile. The rise or fall in prices take place for a number of reasons including, but not limited to changes to underlying company conditions, sector or industry factors, or other macro events. These may happen quickly and unpredictably.

- International Equity can be volatile. The rise or fall in prices take place for a number of reasons including, but not limited to changes to underlying company conditions, sector or industry impacts, or other macro events. These may happen quickly and unpredictably. International equity allocations may also be impacted by currency and/or country specific risks which may result in lower liquidity in some markets.

- Real Assets can be volatile and may include asset segments that may have greater volatility than investment in traditional equity securities. Such volatility could be influenced by a myriad of factors including, but not limited to overall market volatility, changes in interest rates, political and regulatory developments, or other exogenous events like weather or natural disaster.

- Private Real Estate involves higher risk and is suitable only for sophisticated investors. Real estate assets can be volatile and may include unique risks to the asset class like leverage and/or industry, sector or geographical concentration. Declines in real estate value may take place for a number of reasons including, but are not limited to economic conditions, change in condition of the underlying property or defaults by the borrower.

- All investing involves risk including the potential loss of principal. Market volatility may significantly impact the value of your investments. Recent tariff announcements may add to this volatility, creating additional economic uncertainty and potentially affecting the value of certain investments. Tariffs can impact various sectors differently, leading to changes in market dynamics and investment performance. You should consider these factors when making investment decisions. We recommend consulting with a qualified financial adviser to understand how these risks may affect your portfolio and to develop a strategy that aligns with your financial goals and risk tolerance

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.