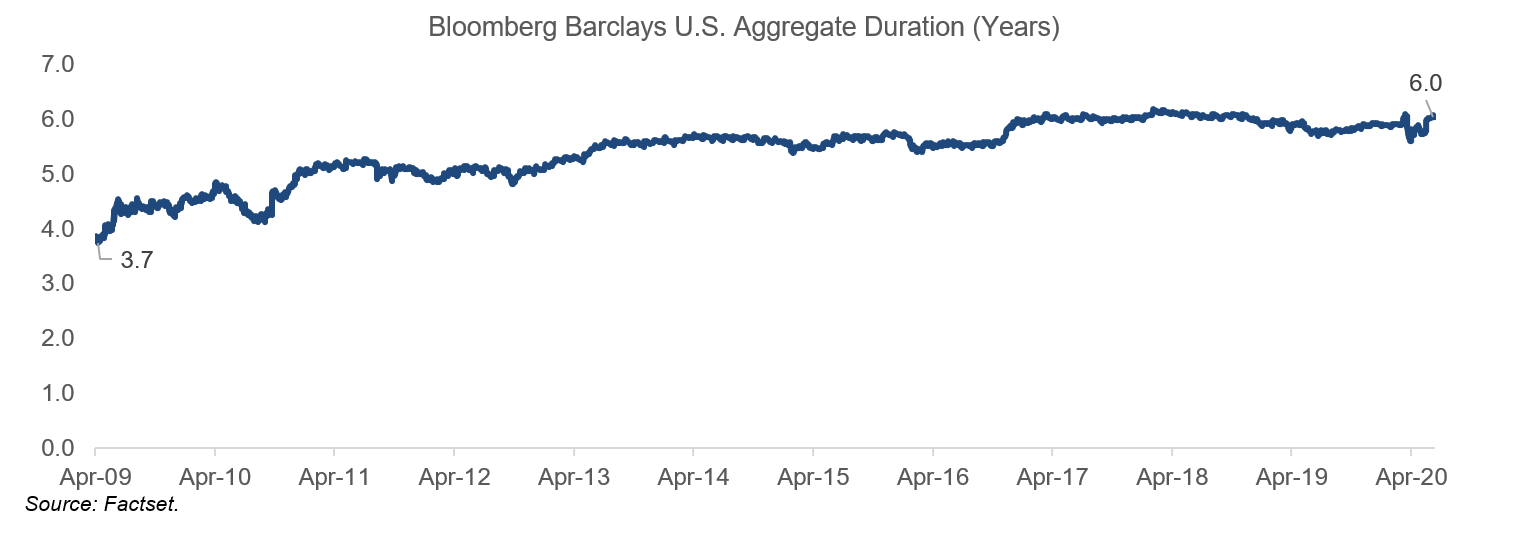

As fixed income markets evolved over the last cycle, we extensively examined and analyzed new risks present in benchmarks with a focus on increased interest rate and credit risks. The Bloomberg Barclays U.S. Aggregate Index (Agg), a benchmark of investment-grade, fixed income securities, has seen its duration (interest rate risk) increase by nearly 60 percent since March 2009. During that same period, the Agg’s corporate credit allocation increased from 17.4 percent to 23.7 percent, with BBB-rated securities increasing from 6.8 percent to 17.7 percent. Much of this may seem redundant in light of previous reports and analysis. However, the volatility experienced by markets in March 2020 introduced a new development in our study of fixed income benchmarks.

The growth in passive exchange traded and mutual fund strategies across fixed income portfolios has been meaningful over the last cycle. Passive assets currently account for 31 percent and $525 billion in assets of Morningstar’s investment-grade core and core plus bond mutual fund peer groups. And many of these portfolios are rules based, meaning if securities fall outside of their stated opportunity set (investment-grade securities), the funds are effectively forced to sell those securities in order to maintain alignment with the benchmarks they seek to track.

As benchmark providers, such as Intercontinental Exchange (“ICE”) and Bloomberg Barclays, sought to rebalance indices on the typical monthly schedule in March 2020, they were faced with an interesting challenge: Several “fallen angels” – investment-grade securities that were downgraded to below investment grade – were positioned to be removed from investment-grade benchmarks. Those securities issued by Occidental, Ford and Delta, accounted for roughly 1.2 percent of the Bloomberg Barclays Investment Grade Corporate Index as of February 29, 2020. In response to the market volatility and seizure in liquidity during the rebalance period, index providers made an interesting decision. For the first time ever, they abandoned their rebalancing rules. The breaking of the rules was not uniform across providers. ICE, for example, decided to postpone the removal of the downgraded corporate issues, while Bloomberg Barclays did remove the downgraded issues but determined they would keep securities with maturities of one year or less in the investment-grade universe due to market liquidity concerns.

What was the consequence of this decision? Overall, such a decision has had – and will continue to have – a major impact on the market. For instance, benchmark providers have now set a precedent that changes risks surrounding fallen angels. We’ve cited that more than $2 trillion in BBB-rated securities are at risk of downgrades due to leverage levels and the cyclicality of the issuer’s industry. Should a wave of downgrades occur, those bonds would effectively swamp the $1.1 trillion high-yield universe. However, the influence of passive investment managers may play a critical role as will the Federal Reserve’s (“the Fed”) announcement and willingness to buy corporate debt, including fallen angels. Passive managers are key stakeholders of benchmark providers as the data licensed by the provider is required for the manager to effectively track those indexes. It is possible that the influence of passive managers caused benchmark providers to delay the rebalance until the market rationalized in order to minimize any tracking errors in those benchmarks.

This conflicts with the interests of active managers whose mandate is to outperform those benchmarks through active portfolio allocation and security selection. As a result of index providers disrupting rebalancing rules, benchmarks no longer accurately reflected their representative markets. While the market environment experienced in March was unprecedented, the reaction from those who provide a structural reference point was equally unexpected. Keen investors would be wise to monitor how benchmark construction decisions influence technical risk factors across fixed income markets.

While the issue of benchmark providers choosing to ignore their index construction and rebalancing rules is hopefully a one-time occurrence, there is another aspect of index construction that warrants attention. Index provider Bloomberg Barclays adjusts for the Treasury float in the market for some of its U.S. Treasury indices. This effectively removes new issue Treasuries that the Fed purchases for their System Open Market Account (“SOMA”) from the benchmarks, including the widely used Bloomberg Barclays U.S. Aggregate Index.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.