Disruption from AI paves way for assets outside of U.S. large cap

Key Observations

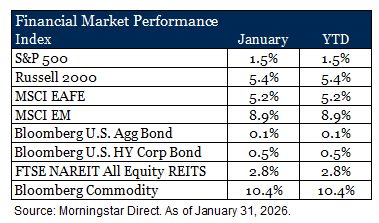

• Global markets started the year strong and were broadly positive across asset classes in January.

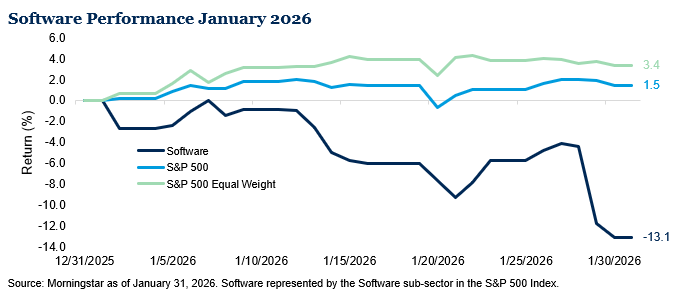

• Concerns of potential disruption from new AI tools wreaked havoc on select sub-sectors such as software. Areas such as U.S. small cap and emerging market equities benefited from a rotation away from U.S. large cap.

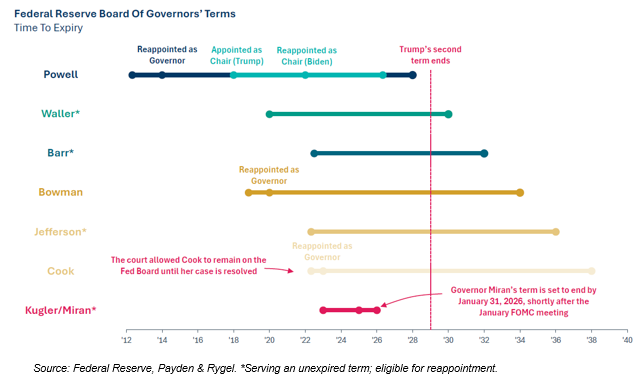

• President Trump nominated Kevin Warsh to be the 17th chair of the Federal Reserve. Markets initially viewed this as “hawkish” but his views on inflation and productivity could lay the groundwork for more rate cuts.

Market Recap

January opened the year with a more confident tone across global markets. Markets were focused on the path of monetary policy, early corporate earnings signals and geopolitical developments that shaped sentiment throughout the month. Equity markets generally advanced and commodity markets rallied sharply. The combination created a constructive backdrop that helped most major asset classes deliver positive returns to start the year.

Large-cap U.S. equities posted a modest opening month. The S&P 500 Index gained 1.5%, supported by pockets of strength in energy and communication services, along with steady demand for higher quality large cap companies within consumer staples. Small cap stocks performed even better as concerns grew about the impact generative AI might have on software-related companies and investors rotated into more attractively valued areas of the market. The Russell 2000 Index rose 5.4% in January. Softer inflation, improving business surveys and an overall economic backdrop that remains resilient helped fuel the asset class.

International developed equities outpaced U.S. large caps. The MSCI EAFE Index advanced 5.2%, helped by broad strength across Europe and Japan. European equities found support from central bank communication that pointed to stable policy in the near term, while inflation remains moderate. Japanese equities rose as well.

Investor concerns surrounding geopolitical tensions in the Middle East and Eastern Europe remained present but did not dampen the regional rally. A weakening U.S. dollar further helped the space. Emerging markets delivered the strongest equity performance in January. The MSCI EM Index climbed 8.9%, led by strong gains in South Korea, Mexico and Brazil. Technology shares in Asia rebounded sharply, supported by improving semiconductor demand and favorable trade expectations tied to early conversations about reopening supply channels between major economies. Latin America benefited from resurgent commodity demand and further currencies.

Fixed income markets generated modest gains as interest rate volatility remained. The Bloomberg U.S. Aggregate Bond Index returned 0.1% for the month. Treasury yields moved modestly higher during the period as the expectation for the number of rate cuts in 2026 diminished and the markets digested the announcement of Kevin Warsh as the next Fed Chair nominee. Credit markets extended the positive tone. High yield bonds, measured by the Bloomberg U.S. Corporate High Yield Index, rose 0.5%, supported by narrowing spreads, resilient corporate fundamentals and a favorable economic backdrop.

Diversifying areas of the markets such as REITs and commodities also opened the year in positive territory. U.S. Equity REITs gained 2.8% during January. The sector benefited from early signs of improving fundamentals in data centers, industrial properties and select residential markets. Concerns around office properties persisted, but strength in other areas outweighed the drag. Commodities delivered the most notable performance of the month. The Bloomberg Commodity Index surged 10.4%, driven by strength in energy and industrial metals. Energy prices, particularly crude oil and natural gas, moved higher as extremely cold temperatures swept across much of the country. Precious metals saw favorable returns as well, although gold prices sold off at the end of the month, limiting the gains.

Mixed Impact from AI

January brought mixed impact from AI during the month. We discussed the potential for disruption and displacement from AI as part of our “AI Playbook” theme in our 2026 Outlook. Investor concerns took hold about the potential disruption generative AI would have on software companies during the month following a new tool for Anthropic’s Claude large language model that can help with tasks for legal, marketing and data analysis. Shares of Oracle and Salesforce fell over 15% and 19%, respectively, for the month and resulted in the software sector being down 13.1%, wiping out nearly $800 billion in market value.1 On the other hand, semiconductor companies, particularly abroad, continue to benefit from the demand for chips and flash memory. Emerging markets were a standout in the month. Among the top contributors were Taiwan Semiconductor, up 14.3% in January, and SK Hynix, up almost 40%. We highlighted in our Outlook that having thoughtful diversification to areas of the market such as non-U.S. equity and small and mid-cap U.S. stocks may help balance portfolios and capture the benefits from a broadening of AI, and we are seeing this take shape so far in 2026.

A New Fed Chair Nominated

After weeks of the markets speculating, President Trump announced the nomination of Kevin Warsh to be the 17th chair of the Federal Reserve. If confirmed by the Senate, Warsh would take the lead seat in mid-May when Powell’s term as chair ends. It is important to note that Powell’s term on the board of governors does not end until 2028, unless he voluntarily steps down, and that Warsh would be replacing Stephen Miran. The market initially reacted viewing Warsh as a “hawk” based on his past Fed governor experience and his comments on balance sheet reduction. Interest rates ended the month modestly higher from where they began at the end of last year and the price of gold fell over 7% on the day of the nomination.2 But Warsh’s views on current productivity could help lay the groundwork for future rate cuts.

The nomination brought the topic of Federal Reserve independence once again to the forefront of investor concerns, something that has been ongoing over the past 18 months. It is important to note this is not the first time in history that the subject has been discussed. In fact, Warsh, who served as a Fed Governor from 2006 to 2011, addressed the issue in a 2010 speech in New York: “Independence in the conduct of monetary policy is at the core of advanced modern economies. And it can be too easily forgotten by those who have only known its benefits.

If the Federal Reserve lost its independence, its hard-earned credibility would quickly dissipate. The costs to the economy would be incalculable: Higher inflation, lower standards of living, and a currency that risks losing its reserve status.”3 We discussed the FOMC structure in depth in our May Market Review last year, Imperfect Independence. Our stance remains the same, that the institutional design should minimize short-term political influence and based on the current terms (depicted on the previous page), the current administration has limited ability to appoint new governors assuming terms are served in full.

Outlook

Overall, January provided a constructive start to the year across global markets. Many of our themes from our 2026 Outlook are taking shape. Diversifying positions away from U.S. large cap have been beneficial to start the year (small-cap U.S. equities and non-U.S. equities in particular). A resilient economy and strong corporate fundamentals are supportive for markets, but we remain mindful of current valuations, market concentration and the uncertainty created by geopolitical events.

1FactSet. As of January 31, 2026. Market value based on the software sub-sector of the S&P 500 Index.

2FactSet. As of January 30, 2026.

3Federal Reserve. Speech by Kevin Warsh March 26, 2010. https://www.federalreserve.gov/newsevents/speech/warsh20100326a.htm

Disclosures & Definitions

Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that actual returns or volatility will be similar to the indices. Indices cannot be invested in directly. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect our fees or expenses. Market returns shown in text are as of the publish date and source from Morningstar or FactSet unless otherwise listed.

- The S&P 500 is a capitalization-weighted index designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

- Russell 2000 consists of the 2,000 smallest U.S. companies in the Russell 3000 index.

- MSCI EAFE is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the U.S. and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

- MSCI Emerging Markets captures large and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country.

- Bloomberg U.S. Aggregate Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

- Bloomberg U.S. Corporate High Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included.

- FTSE NAREIT Equity REITs Index contains all Equity REITs not designed as Timber REITs or Infrastructure REITs.

- Bloomberg Commodity Index is calculated on an excess return basis and reflects commodity futures price movements. The index rebalances annually weighted 2/3 by trading volume and 1/3 by world production and weight-caps are applied at the commodity, sector and group level for diversification.

Material Risks

Fixed Income securities are subject to interest rate risks, the risk of default and liquidity risk. U.S. investors exposed to non-U.S. fixed income may also be subject to currency risk and fluctuations.

Cash may be subject to the loss of principal and over longer periods of time may lose purchasing power due to inflation.

Domestic Equity can be volatile. The rise or fall in prices take place for a number of reasons including, but not limited to changes to underlying company conditions, sector or industry factors, or other macro events. These may happen quickly and unpredictably.

International Equity can be volatile. The rise or fall in prices take place for a number of reasons including, but not limited to changes to underlying company conditions, sector or industry impacts, or other macro events. These may happen quickly and unpredictably. International equity allocations may also be impacted by currency and/or country specific risks which may result in lower liquidity in some markets.

Real Assets can be volatile and may include asset segments that may have greater volatility than investment in traditional equity securities. Such volatility could be influenced by a myriad of factors including, but not limited to overall market volatility, changes in interest rates, political and regulatory developments, or other exogenous events like weather or natural disaster.

Private Real Estate involves higher risk and is suitable only for sophisticated investors. Real estate assets can be volatile and may include unique risks to the asset class like leverage and/or industry, sector or geographical concentration. Declines in real estate value may take place for a number of reasons including, but are not limited to economic conditions, change in condition of the underlying property or defaults by the borrower.

All investing involves risk including the potential loss of principal. Market volatility may significantly impact the value of your investments. Recent tariff announcements may add to this volatility, creating additional economic uncertainty and potentially affecting the value of certain investments. Tariffs can impact various sectors differently, leading to changes in market dynamics and investment performance. You should consider these factors when making investment decisions. We recommend consulting with a qualified financial adviser to understand how these risks may affect your portfolio and to develop a strategy that aligns with your financial goals and risk tolerance.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.