Key Observations

• Hedge funds shined in 2022 when both equities and fixed income markets experienced sharp declines.

• Diversification across various hedge fund managers and strategy types continues to be a key characteristic of successful all-weather marketable alternatives programs.

• Strong performance in recent years from multimanager hedge funds resulted in an influx of capital into that space.

• Amidst the backdrop of a higher cost of capital, tightening credit and overall market uncertainty, convertible bonds remain a compelling instrument for companies and investors alike.

A Bright Spot in a Dark Year

Many allocators are happy to see 2022 fade into the distance as they look through the rearview mirror. While 2022 was a challenging year for many investors, hedge funds in general proved to be a bright spot in client portfolios, with the HFRI Asset-Weighted Composite generating a positive return of 0.7%.1 This is in stark contrast to the declines experienced by both equity and fixed income markets, down 18.1% and 16.2% for the MSCI World and Bloomberg Aggregate, respectively.1

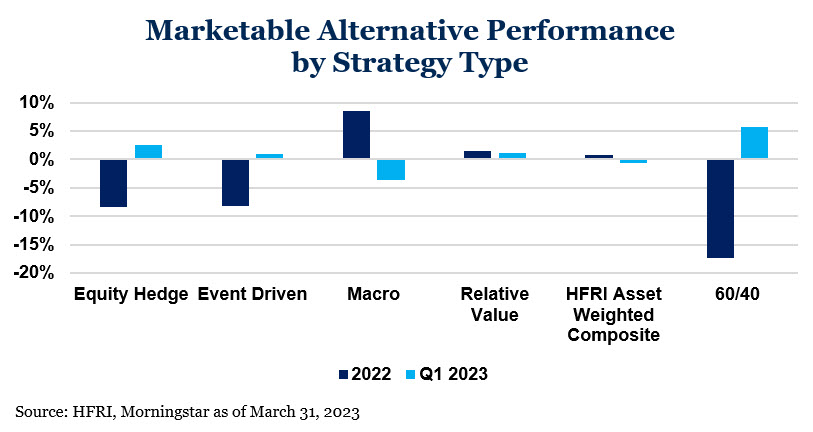

Despite the positive relative performance across the hedge fund industry relative to other asset classes, performance was hardly uniform across all strategy types. Strategies typically associated with higher equity beta profiles such as HFRI Equity Hedge and HFRI Event Driven struggled in 2022 and were down 8.5% and 8.2% respectively. On the other hand, historically less correlated strategies such as Global Macro excelled in large part due to being positioned to benefit from higher interest rates.

Through the start of 2023, the script has once again flipped with equity hedge and event driven strategies contributing with positive performance while macro has been a negative contributor.2 Market history and recent volatility continue to highlight the importance of manager and strategy diversification within a marketable alternatives program seeking all-weather characteristics.

Multimanager Funds – The Elephant(s) in the Room

A core value proposition of hedge funds is the ability to generate uncorrelated alpha and preserve capital during times of market downturn. In this regard, multimanager funds have proven themselves particularly adept at taking full advantage of a key component in risk management: diversification. With the ability to allocate capital to multiple managers, strategies and asset classes, multimanager funds have grown popular with many allocators, often making up a large percentages of hedge fund portfolios. This trend is reflected in the growth of multimanager funds in recent years. According to a Goldman Sachs hedge fund report, multimanager funds have seen their assets grow by around 150% in the last five years, while the rest of the industry grew by just 13%, highlighting the large appetite for the model by allocators.3

1Morningstar as of March 31, 2023

2Morningstar as of March 31, 2023

3Goldman Sachs – “The Multiplier Effect: The landscape and evolution of the multi-manager hedge fund model” as of December 2022

Disclosures and Definitions

Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that actual returns or volatility will be similar to the indices. Indices cannot be invested in directly. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect our fees or expenses.

- MSCI World captures large and mid-cap representation across 23 Developed Markets countries. With 1,645 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

- Bloomberg U.S. Aggregate Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

- Bloomberg Global High Yield TR USD is a multi-currency flagship measure of the global high yield debt market. The index represents the union of the US High Yield, the Pan-European High Yield, and Emerging Markets (EM) Hard Currency High Yield Indices.

- Refinitive Global Convertible Bond TR USD is designed to provide a broad measure of the performance of the investable, global convertible bond market.

- The HFRI Asset Weighted Composite Index is a global, asset-weighted index comprised of single-manager funds that report to HFR Database. Constituent funds report monthly net of all fees performance in US Dollar and have a minimum of $50 Million under management or $10 Million under management and a twelve (12) month track record of active performance. The HFRI Asset Weighted Composite Index does not include Funds of Hedge Funds. The constituent funds of the HFRI Asset Weighted Composite Index are weighted according to the AUM reported by each fund for the prior month.

- HFRI Equity Hedge (Total) Index – Asset Weighted Index includes investment managers who maintain positions both long and short in primarily equity and equity derivative securities. A wide variety of investment processes can be employed to arrive at an investment decision, including both quantitative and fundamental techniques; strategies can be broadly diversified or narrowly focused on specific sectors and can range broadly in terms of levels of net exposure, leverage employed, holding period, concentrations of market capitalizations and valuation ranges of typical portfolios. EH managers would typically maintain at least 50% exposure to, and may in some cases be entirely invested in, equities, both long and short. The constituent funds of the HFRI Equity Hedge (Total) Index – Asset Weighted are weighted according to the AUM reported by each fund for prior month.

- HFRI Event-Driven (Total) Index – Asset Weighted Index includes Investment Managers who maintain positions in companies currently or prospectively involved in corporate transactions of a wide variety including but not limited to mergers, restructurings, financial distress, tender offers, shareholder buybacks, debt exchanges, security issuance or other capital structure adjustments. Security types can range from most senior in the capital structure to most junior or subordinated, and frequently involve additional derivative securities. Event Driven exposure includes a combination of sensitivities to equity markets, credit markets and idiosyncratic, company specific developments. Investment theses are typically predicated on fundamental characteristics (as opposed to quantitative), with the realization of the thesis predicated on a specific development exogenous to the existing capital structure. The constituent funds of the HFRI Event-Driven (Total) Index – Asset Weighted are weighted according to the AUM reported by each fund for prior month.

- HFRI Macro (Total) Index – Asset Weighted Index includes Investment Managers which trade a broad range of strategies in which the investment process is predicated on movements in underlying economic variables and the impact these have on equity, fixed income, hard currency and commodity markets. Managers employ a variety of techniques, both discretionary and systematic analysis, combinations of top down and bottom up theses, quantitative and fundamental approaches and long and short term holding periods. Although some strategies employ RV techniques, Macro strategies are distinct from RV strategies in that the primary investment thesis is predicated on predicted or future movements in the underlying instruments, rather than realization of a valuation discrepancy between securities. In a similar way, while both Macro and equity hedge managers may hold equity securities, the overriding investment thesis is predicated on the impact movements in underlying macroeconomic variables may have on security prices, as opposes to EH, in which the fundamental characteristics on the company are the most significant are integral to investment thesis. The constituent funds of the HFRI Macro (Total) Index – Asset Weighted are weighted according to the AUM reported by each fund for prior month.

- HFRI Relative Value (Total) Index – Asset Weighted Index includes Investment Managers who maintain positions in which the investment thesis is predicated on realization of a valuation discrepancy in the relationship between multiple securities. Managers employ a variety of fundamental and quantitative techniques to establish investment theses, and security types range broadly across equity, fixed income, derivative or other security types. Fixed income strategies are typically quantitatively driven to measure the existing relationship between instruments and, in some cases, identify attractive positions in which the risk adjusted spread between these instruments represents an attractive opportunity for the investment manager. RV position may be involved in corporate transactions also, but as opposed to ED exposures, the investment thesis is predicated on realization of a pricing discrepancy between related securities, as opposed to the outcome of the corporate transaction. The constituent funds of the HFRI Relative Value (Total) Index – Asset Weighted are weighted according to the AUM reported by each fund for prior month.

- ICE BofAML MOVE Index is a widely used measure of expectations for interest rate volatility, tracks the movement in U.S. Treasury yield volatility implied by current prices of 1-month OTC options.

Material Risks Disclosures

Marketable Alternatives involves higher risk and is suitable only for sophisticated investors. Along with traditional market risks, marketable alternatives are also subject to higher fees, lower liquidity and the potential for leverage that may amplify volatility or the potential for loss of capital. Additionally, short selling involved certain risks including, but not limited to additional costs, and the potential for unlimited loss on certain short sale positions.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.