Key Observations

• Many broad market indexes posted positive returns for the month of July with some U.S. indexes hitting all-time highs.

• However, recent trends favoring the ‘vaccine trade’ areas of the market have reversed for the month with energy taking a step back, large cap catching up and growth outperforming its value counterpart.

• These shifts in investor sentiment may be due to greater attention being paid to recent changes in COVID case counts as the delta variant takes hold. While investors should remain alert to these trends, we do not think these alone should call to action changes in portfolios.

Market Recap

July was, on balance, a good month for investors as many broad market indexes across equity and fixed income posted positive returns. The S&P 500, the Dow Jones Industrial Average and the NASDAQ Composite each hit an all-time high during July reflecting general optimism around the path toward ‘normalcy’. However, underneath the surface investor hesitations were present. Winners since November 2020, following the creation of the COVID-19 vaccine, have generally been concentrated in areas left in the wake at the onset of the pandemic. This trend largely reversed in the month of July showing new, albeit short-term, leadership. Growth outperformed value (2.5 percent)1, large cap outperformed small cap (5.7 percent)2, the Energy sector (which has been leading all other U.S. sectors in 2021) was one of two sectors down in July (-8.27 percent)3 and long-term U.S. Treasuries (historically a safe-haven asset) rallied (2.8 percent)4. If these recent shifts in investor interest indicate a broader cause for concern, there are likely a few circumstances worth highlighting. Elevated valuations, rising concerns around inflation and the escalating trend in COVID-19 cases caused by the delta variant are commonly cited. We recently released our Mid-Year Outlook, which outlines our standing views on valuations and inflation. We will now turn our attention toward recent trends relating to the COVID-19 delta variant and our thoughts regarding its potential impact on the investing landscape.

Delta Deluge

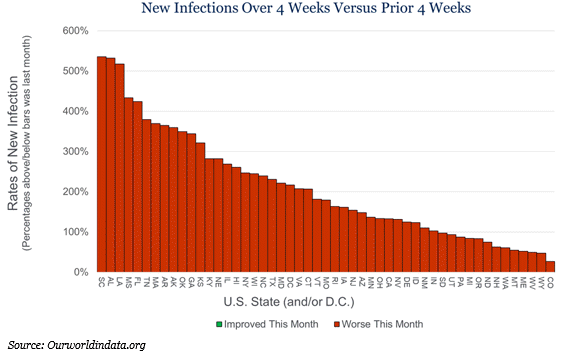

The delta variant, which was first discovered late last year in India, has become the most common source of new COVID-19 cases globally and in the U.S. accounts for 82 percent of new cases as of July 17, 20215. According to Yale Medicine, the delta variant is 50 percent more contagious than the original alpha variant which previously swept across the world6. The data suggests that in an unvaccinated and unencumbered environment, a person infected with the alpha strain would infect, on average, 2.5 people. The delta strain’s infection potency increases to an average of 3.5 to 4 people. These greater transmission rates have stoked investor fears of a slower pace to which society returns to ‘normalcy’. As seen below, from June to July infection rates increased across all 50 states month-over-month, albeit from recently moderated levels.

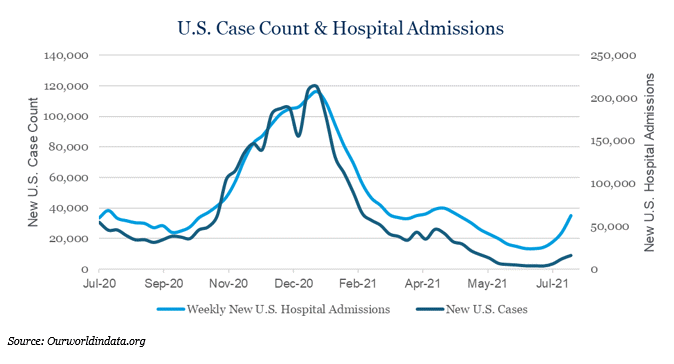

Case count and hospitalizations also rose, prompting many local governments to take additional actions to slow the spread and reduce the potential need for more drastic measures. In the short-term, markets may be particularly sensitive to this news given the challenges first encountered in March of 2020 (fresh in investors’ minds) and the high expectations for business and the economy in a post-COVID world.

Market Outlook

While investors should certainly remain attentive to recent trends in COVID-19, we note that the intersection of epidemiology and market prognostication should be an exercise filled with humility. As is the case with most manners of forecasting, the variables at play make short-term predictions very difficult. Investors are right to take pause in a rising case count and the potentially elevated impact that the delta variant (or any future variant) may have on markets and the economy. However, investors also need to consider other factors prior to taking action, such as the likelihood of an intensified response from governments to support markets should restrictions again be required, how a new COVID-19 vaccine or booster could change the dynamics of new case count, or the myriad of other related inputs that could swing investor sentiment. We suspect that investors may need to fully acknowledge and come to terms with the notion that COVID-19 (and its future variants) may not be a transitory issue.

In response, portfolios should be constructed with resiliency to accept and withstand such disruptions in the future. With markets hitting recent highs, investors that have not revaluated their risk tolerance and objectives since the downturn in March 2020 may find it to be an opportune time to do so. The more recent dynamics associated with the COVID-19 situation do not alter our central investing thesis as the second half of the year takes hold. We still believe the current economic and market circumstances will render thoughtful and disciplined investing with a constructive undertaking through the balance of the year.

For more information, please reach out to any of the professionals at Fiducient Advisors.

1. Russel 1000 Growth Total Return vs Russell 1000 Value Total Return

2. Russell 1000 Total Return vs Russell 2000 Total Return

3. S&P 500 Energy Total Return

4. Bloomberg Barclays U.S. Long Gov/Credit

5. https://ourworldindata.org/covid-hospitalizations

6. https://www.yalemedicine.org/news/5-things-to-know-delta-variant-covid

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.