During the last few years, the hedge fund industry has seen its share of undesirable headlines, and yet investors continue to allocate to the space, with portfolio managers adapting to this ever-evolving industry. Here, we highlight some key trends, including the expanded definition of the term “hedge fund”, increased competition for assets and corresponding fee pressure, the rise of quant shops, demand for exposure in Asia and the launch of impact funds as well as the incorporation of ESG factors. As Heraclitus the Greek philosopher once said, “change is the only constant in life.”

New Structures to Meet Investor Interests

“Hedge funds” are not an asset class, as cited in previous research papers, but rather a legal structure facilitating an amalgam of strategies invested across asset classes. While this statement holds true, some managers have expanded the definition to include investment vehicles that are not typical hedge-fund structures.

The term “hedge fund” might include structures such as co-investment vehicles, separately managed accounts, drawdown vehicles and ’40 Act mutual funds. Hedge fund managers introduced funds to meet the demands of various types of investors. When the market demanded better liquidity and lower fees, ’40 Act funds were in vogue. More recently, investors’ increased willingness to lock up capital has resulted in the launch of drawdown vehicles. As a result, reported assets under management can include a more expansive universe of strategies and funds.

Fee Pressure

With regards to co-investments, we have seen managers continue to invest and upsize specific investment opportunities outside of their main strategies. This could be due to a compelling opportunity that may breach certain position-size and/or liquidity limits in the fund, or it could simply be because the hedge fund might lack the necessary cash to take advantage of the opportunity.

Typically, only a performance fee is charged on these assets, so the investor earns a lower management fee across their respective asset base since it includes the co-investment. Investors have sought co-investment opportunities that allow them to capitalize on “best ideas” and lower fees.

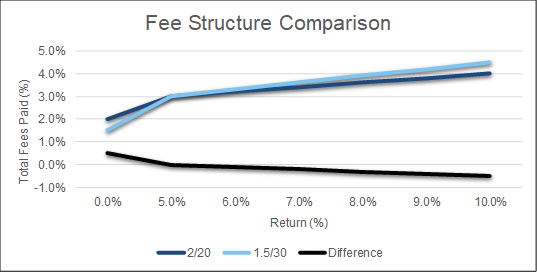

Co-investment vehicles are an example of the solutions created to address increased fee pressure. The new-launch environment has been challenging in recent years and most hedge fund managers cannot charge a two percent management fee and a 20 percent performance fee out of the gate. Therefore, hedge funds have introduced lower management fees, even as low as zero, in exchange for higher performance fees.

However, this example shows that a client might pay more in fees under this structure despite lower management fees.

Source: Fiducient Advisors

Alternatively, managers offer longer lock-up vehicles in exchange for lower management and performance fees. We have even witnessed managers introduce hurdle rates, which are a minimum required return on investment prior to earning a performance fee. We expect this trend to continue as hedge funds are faced with steep competition for assets and investors push for lower fees and stronger alignment.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.