Global pandemic, unprecedented government stimulus, record low GDP report, booming technology stocks and a red-hot IPO market – 2020 has been quite the year – and it is not over! A closely contested U.S. presidential election with record turnout appears to be the final drama that will play out as we head into the holiday season. The anticipated blue wave did not materialize to the extent that pollsters predicted, and as of now, it appears that we may have a split Congress with Republicans keeping the Senate and Democrats controlling the House. That balance of power suggests a lower probability of sweeping legislation, which could be beneficial for financial assets, at least in the short-term. Markets like certainty, and with the potential for legislative gridlock, the status quo is oftentimes the base case scenario.

Election Results

Ballots are still being counted and possibly recounted in several races, and the official results will certainly have implications for future policymaking. Over the weekend, the major news outlets called the presidential race for Joe Biden and Kamala Harris, and investors are now evaluating what that might mean for markets going forward.

Instead of speculating on outcomes, we would like to highlight a couple notable ballot initiatives that have been decided, but perhaps are not receiving as much attention. There were 120 total measures nationwide on the ballots this week, and the top ten represented around 75 percent of all campaign spending for all 120 initiatives. Two of the major ones included:

• California: Proposition 22 ($220 million spent) – voters approved allowing app-based driving companies (e.g. Uber, Lyft) to continue classifying drivers as independent contractors meaning the employers are not required to pay benefits that full-time employees typically receive.

• Illinois: Fair Tax ($120 million spent) – voters rejected moving from a flat to a graduated state income tax.

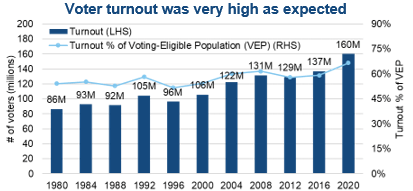

VEP is calculated by removing non-citizens and ineligible felons from the voting age population.

Source: McDonald, Michael P. “Presidential Voter Turnout Rates, 1948-2016” United States Elections Project. www.electproject.org. As of 11/5/20.

Another noteworthy story from this week was the incredible voter turnout. Despite the pandemic and other challenges that Americans faced, over 160 million people either mailed in ballots or voted in person on November 3. Compared to recent history, this was a record in terms of both the number of people voting as well as the percentage of the population that voted.

Market Reaction

As is typical leading up to elections and other major events, volatility picked up in late October and remained elevated through election day. On Tuesday evening, investors realized the election was significantly closer than most polls indicated just days before. As results came in, it became increasingly more likely that Republicans would retain control of the Senate, and Congress would remain split. Markets rallied on the news, recognizing that it is significantly more challenging to enact meaningful policy change without party control of both the executive and legislative branches. U.S. equity volatility gradually fell over the ensuing days, and U.S. equities generated very strong returns. U.S. Treasury yields fell, most notably further out the curve, amid lower inflation expectations.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.