Inflation matters in many ways, but most importantly for markets today is the force behind the Federal Reserve’s actions. It’s primary tool to cool inflation is higher interest rates. Higher rates potentially pass through to slower economic growth and may apply additional pressure on fixed income and equity prices. So, in some ways today, the sun rises and sets on inflation as a matter of importance.

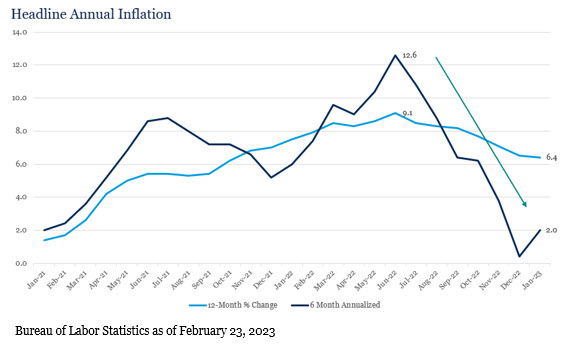

Fiducient’s 2023 Outlook details our belief that Moderating Inflation is a key theme. Moderating is an intentional word. We believe inflation will slow, but it is likely to be a bumpy road. To that end, the January Consumer Price Index (CPI) gave us our first taste of this, with headline CPI accelerating to 0.5% month-over-month in January versus 0.1% in December1. Annual CPI fell from 6.5% in December to 6.4% in January, but only because January 2022 data was dropped from the calculation which was higher than January 2023 that was added to the calculation (more on that below)1. Our view remains that inflation is on the right path, but it may not be a straight path.

The Math Matters

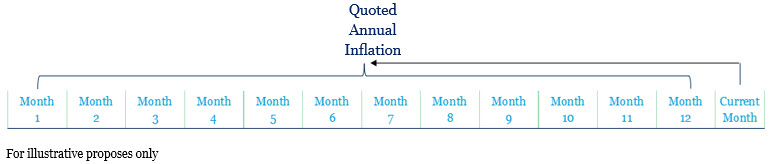

Inflation like many other economic figures, is reported monthly and on a lag, i.e., December CPI is reported in

January. As a result, when we read about annual inflation, we are looking at 12 data points, the oldest of which is measuring data 13 months old, the youngest of which is one month old. So mathematically annual figures are referencing the inflation six months ago. When inflation is benign and range bound, monthly versus annual figures do not matter all that much. Today that is not the case. Over the last year we experienced very high measures of inflation and moderating inflation. Therefore, annual (12 month) inflation may be overstating the recent trend and level of inflation. That in turn may have a meaningful impact on how markets and the Fed react.

The Recent, Recent Trend

To combat looking too far into the past to judge the present we can utilize more recent data points to compare to longer-term figures. However, we should be mindful of extrapolating short-term trends and inferring they are meaningful to the future. In periods of change it is wise to consider both short and long-term trends.

As you can see, six-month annualized data tells a different story on the inflation front. Even including the acceleration, we saw in January inflation over the last six months has grown at a modest 2% annualized compared to 6.4% over the last year1. Moreover, shelter, as calculated by the Bureau of Labor Statistics, is controversial and some would argue (including us) a lagged indicator of actual rental and ownership prices. If we evaluate Headline CPI less shelter in a similar six-month manner, we actually see an inflation fall by an annualized rate of -0.29%1.

The Fed’s Inflation Target is Not Yours

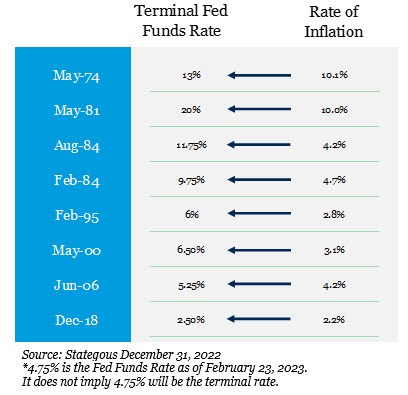

Now that we have shattered the idea that inflation is a single number, what number are we actually looking for? The Fed’s long-term inflation target is 2%. For investors, that is not our target, at least for now.

Our target should be a rate and trend of inflation that allows the Fed to stop or at least pause hiking rates. In fact, in all eight past rate hiking cycles since 1974, the Fed has stopped raising rates when inflation was above 2%2. Moreover, if more recent inflation trends persist the inflation rate will quickly fall below the Fed Funds rate, historically common signal to stop hiking. This bumpy, but directionally correct path of moderation aligns with our 2023 Outlook and portfolio positioning. Investors caught in the fits and starts of inflation that choose to wait for the “all-clear horn” may miss opportunities.

1U.S. Bureau of Labor Statistics as of February 28, 2023

2 Strategous as of December 31, 2022

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.