While elections are important to any functioning democracy, to investment professionals, elections are primarily significant due to their effect on portfolios. In particular, investors must understand – and anticipate – the correlation between the outcomes of the election and the markets, if any.

Red, Blue or Purple – Does It Matter Who Wins?

It is true that politics can be deeply personal, especially because the issues addressed by both parties extend well beyond capital markets. Additionally, elected officials can enact policies that, for the long term, may impact markets and market returns. However, despite these facts, it seems investors place far too much onus on market returns and their connections with presidential election results. And yet to ask, “Does it matter?”, with regards to the scope of the election results and their impact on the markets, is to take a narrow view of generated returns under different political party leadership for both the White House and Capitol Hill.

First, consider the presidency in terms of the markets and the importance of the executive branch. While it is the highest office in the land, the president is not a solo act. The U.S. and global economies act outside of the U.S. president’s control and the president by design is often forced to work with the legislative branch to enact substantive polices that may have long-term economic impact.

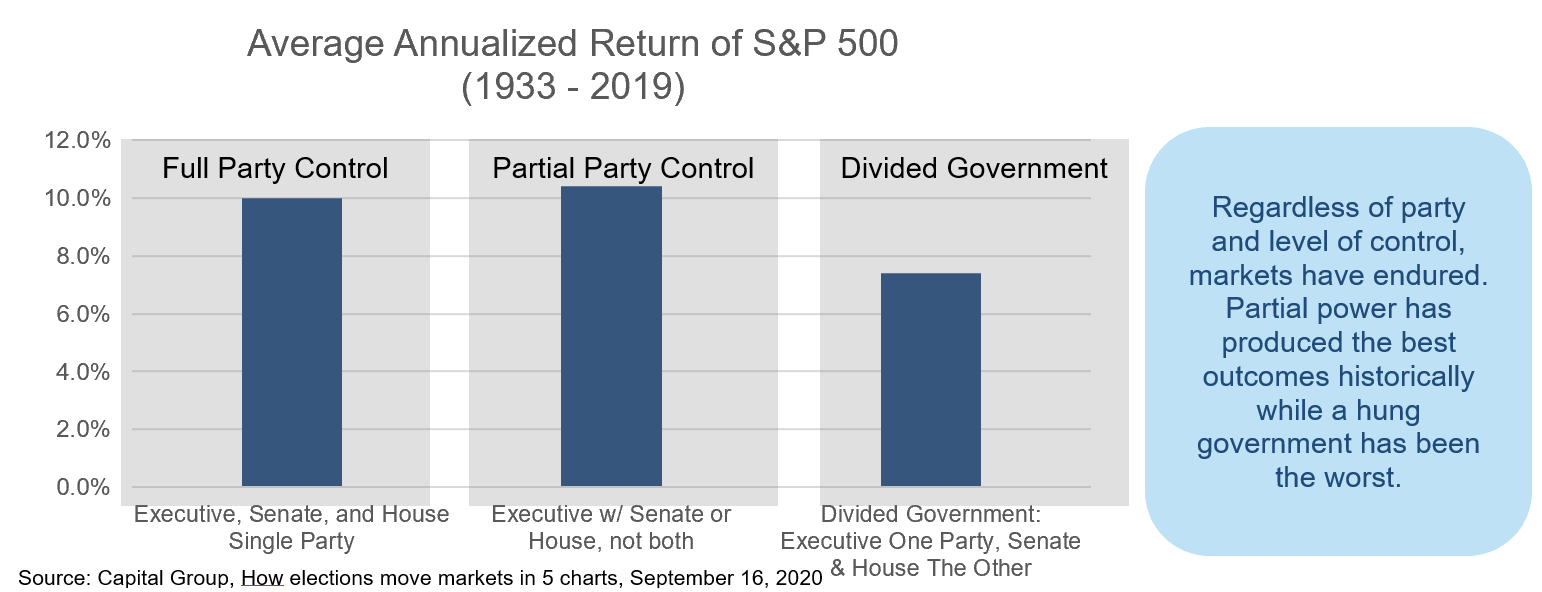

Therefore, keeping this in mind, simply looking at political party based on presidency is too narrow as a frame of reference. Below are historical outcomes and party control noting that markets tend to persevere regardless of party.

So Why Do Markets Seemingly React During Election Season?

With the above data to support the hypothesis that the markets are resilient to which party takes power, succeeding regardless of the party that is in control, why does it feel like such a critical event to investors every four years during the presidential election?

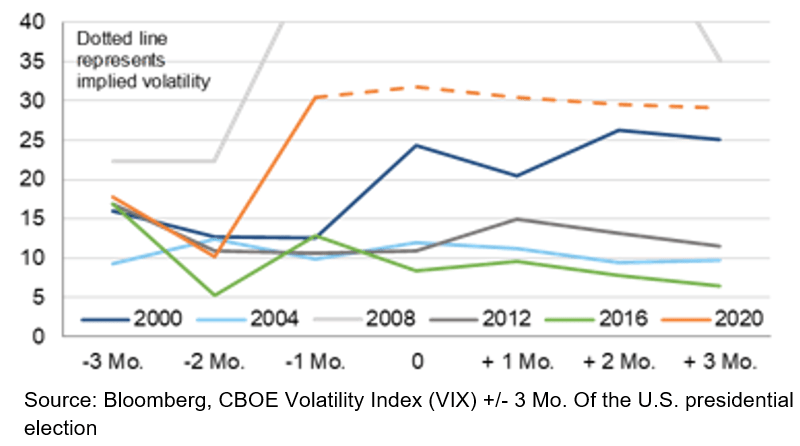

In short, investors are predisposed to feel like it is. During presidential election years, market volatility tends to increase in the months leading up to the election date as shown on the left. As previously shown, this volatility is not based on definitive evidence affirming that one party is better than the other for market returns. Rather, this heightened volatility is based more on uncertainty.

With investing, just like many other things in life, individuals do not like uncertainty. In actuality, markets often even tend to dislike uncertainty more than they dislike bad news. With bad news, investors can analyze the results and move forward. Uncertainty, in contrast, can leave investors paralyzed or even selling first and asking questions later. While it can be explained, this phenomenon does not require the attention and immediate reaction of investors. Harnessing the knowledge of greater market volatility in an election year is not only helpful to avoid classic behavioral mistakes that can lead to worse portfolio outcomes, but it also reinforces the notion that investors are more likely to be successful if they maintain a long-term point of view.

But 2020 is Different, Isn’t It?

As the economy – and, indeed, daily life – have seen a tremendous shakeup over the last several months due to COVID-19, you might be thinking 2020 will be different. Actually, with regards to the impact the executive branch will have on long-term market outcomes, 2020 is no different.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.