We believe most people do not actually need permanent life insurance; in fact, they would probably be better off using those funds in a million other ways instead of putting it toward a premium payment. For wealthy families, however, there are opportunities to get creative with permanent life insurance to help their heirs remain wealthy for generations. The following is just one of those creative solutions.

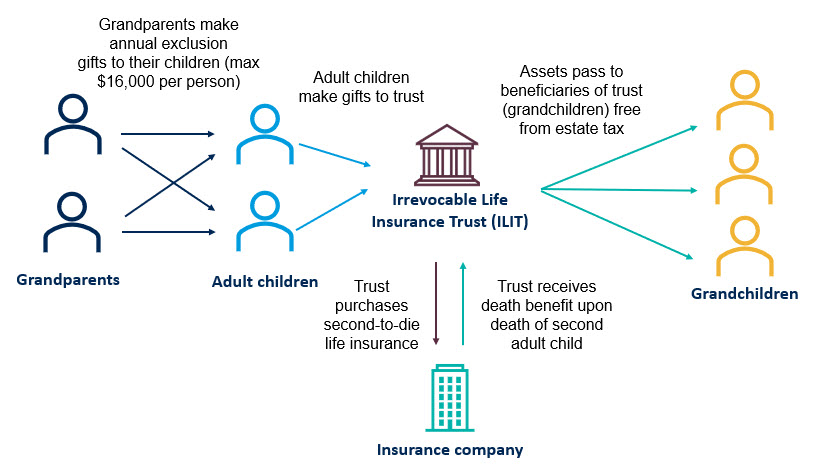

Summary: Annual exclusion gifts come from the grandparents. Their adult children turn around and use the funds to purchase a second-to-die life insurance policy on their own lives, with their children, the donor’s grandchildren, named as beneficiaries.

Who would opt for a strategy like this?

Families with assets above the federal estate tax exemption. The exemption is the amount the IRS says you can transfer to your heirs (either while living or after death) before you are subject to the estate tax. For 2022, this is $24.12 million for a married couple ($12.06 million for individuals).

In addition to the lifetime $12.06 million exemption, individuals can gift up to $16,000 per year ($32,000 for a married couple) to as many people as they want. That is $16,000 to their children, their children’s spouses, their grandchildren, their neighbor, mail carrier or anyone else. The limit is $16,000 per recipient. For instance, a married couple with three adult children, all married, would be able to give $192,000 annually with no gift or estate tax considerations.

For example, an adult child and her husband are receiving $62,000 annually from her parents in annual exclusion gifts. Assuming they do not need the cash for their own living expenses, they could instead choose to purchase a permanent life insurance policy with their children as beneficiaries. To optimize these benefits, they fund a second-to-die insurance policy, one that does not pay out a death benefit until the surviving spouse passes away. The insurance company is underwriting two lives rather than one, allowing them to purchase a larger death benefit. Even a generic example suggests that a couple in their 40s with good health could purchase something close to $6 million of death benefit by paying a $62,000 premium on a second-to-die policy for 10 years.

There are costs and nuances associated with this strategy. We already know that the grandparents are subject to the estate tax, so it is probable that the adult children will have taxable estates as well. In order for the adult children to remove the insurance policy from their estate, they set up an irrevocable trust to own the policy. The estate planning term for this type of trust is an irrevocable life insurance trust (ILIT). The adult children will not have access to the funds once they are placed in the ILIT.

If this strategy is done correctly, the permanent life insurance policy will pay out a tax-free death benefit to the original donor’s grandchildren and outside of both the grandparents’ and parents’ estates, avoiding estate tax as well. In this way, no matter what happens in the life of the middle generation – bankruptcy, divorce, poor investments, expensive long-term care – a minimum inheritance is solidified for their children.

If you are interested in this strategy or any other estate-planning strategies to help reduce or eliminate your estate tax, please reach out to any of the professionals from The Wealth Office® of Fiducient Advisors.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.