What is Mission-Aligned Investing?

Mission-Aligned Investing is the concept of aligning an investor’s investment capital with their mission or values. These values can vary widely, drawn from a variety of principles including religious beliefs, environmental interests and social justice. Over the last decade, interest in Mission-Aligned Investing has increased within our client base, along with associated investment opportunities.

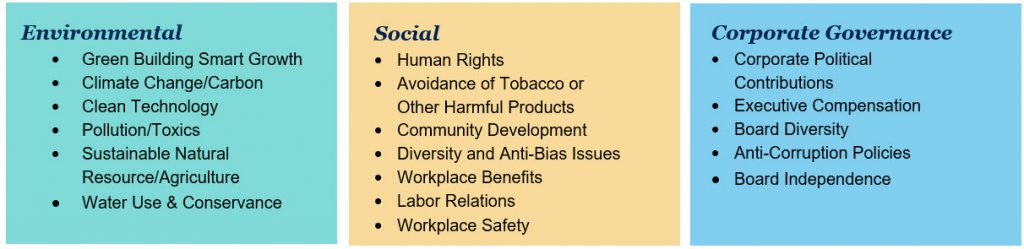

There are many different types of Mission-Aligned Investing values that investors may consider incorporating into their portfolio. One of the most common acronyms within this space is ESG, which stands for Environmental, Social and Governance.

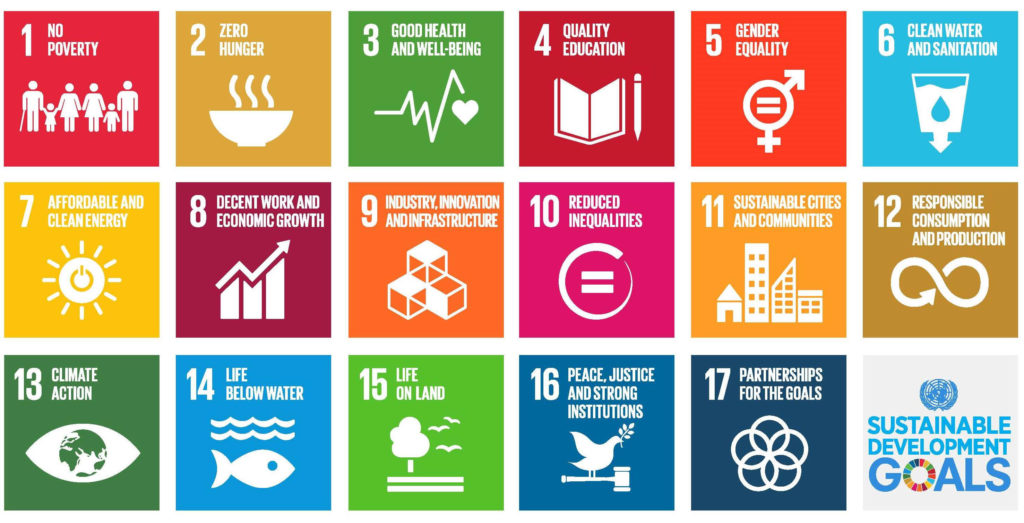

While these broad categories cover many of the well-known considerations, such as those outlined above, in-and-of themselves they do not necessarily align with an investor’s specific set of values. Some Mission-Aligned Investing investors seek to avoid negative externalities (pollution, worker exploitation, poor safety conditions, etc.) while others seek to support what they believe to be positive externalities (energy efficiency, pay equality, shareholder rights, etc.). Many clients want to invest according to their specific mission or set of values. To find investments that explicitly align with investor values, it is important to be specific. The United Nations’ Sustainable Development Goals (UN SDGs) is a framework by which to articulate specific values. Below is the full list of UN SDGs. While not all the goals may be “investable,” investors often find them quite helpful, especially during this early stage of defining their particular preferred values.

Sustainable Development Goals

Values—Faith-Based Mandates

A cornerstone of Mission-Aligned Investing for many is faith-based investing. Faith-based investing is also referred to as Socially Responsible Investing (SRI), Biblically Responsible Investing (BRI) or even Morally Responsible Investing (MRI). At its core, faith-based investing is a values-based screening strategy that aligns investment dollars with the investor’s religious faith. Screening approaches may be negative (exclusionary) or positive (inclusionary), and faith-based investment strategies can be found in both public and private markets as well as in a wide variety of diverse investment vehicles, from mutual funds, commingled funds, exchange-traded funds (ETFs) and separately managed accounts through private investments.

Faith-based investing originated as an avoidance strategy whereby “sin stocks” (alcohol, tobacco, gambling, etc.) considered at odds with religious beliefs were excluded from a portfolio. As faith-based investing has expanded, so have the methods to implement it. While much of faith-based investing still focuses on excluding industries and sources of revenue, strategies can also incorporate positive screening, in addition to integration and impact approaches.

Diversity, Equity, Inclusion and Belonging / Diverse and Emerging Managers

Organizations of all types are placing a greater focus on Diversity, Equity, Inclusion and Belonging (DEIB), either in their own practices to advance their mission. It should come as no surprise that many of these organizations also want to do business with companies that share similar values. In fact, many organizations have policies that require reviewing the DEIB policies and metrics of their vendors, including their investment managers. Whether it is a formal policy or not, many investors care about building wealth in alignment with DEIB values.

A common approach to expressing DEIB values in an investment portfolio involves intentionally investing with managers who have demonstrated a strong commitment to organizational diversity across the employee population, portfolio management teams, executive leadership, board composition and/or ownership structure. Data on representation of women and minorities across these metrics can be collected, synthesized and tracked, with the objective of steering capital to managers who demonstrate strong DEIB values, a commitment to transparency and improving their diversity metrics over time.

However, some organizations desire to further their mission by increasing opportunities for investment firms owned or led by underrepresented groups – women and people of color. While there is abundant research across many industries identifying the economic benefits of diversity, the investment management industry has historically struggled with a lack of diverse managers. A major obstacle for diverse managers lies in the traditional asset manager due diligence framework, which is inadequate for assessing diversity outcomes, thus making it more difficult for diverse and emerging managers to be considered.

For this reason, Fiducient Advisors is committed to taking a forward-thinking and more inclusive approach to investment research. We can assist organizations in framing their specific objectives, while developing thoughtful approaches and manager rosters to meaningfully integrate a DEIB lens into their investment practices.

To learn more about how Fiducient Advisors is elevating our intentionality around DEIB initiatives, please read our blog post Advancing our Commitment to Diversity and More.

For additional information or perspective on Mission-Aligned Investing, please contact any of the professionals at Fiducient Advisors.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.