“The name of the investment game is not to get rich, but rather to not get poor.” – William J. Bernstein1

The concept of a spending policy is to provide guidance and guardrails when it comes to thoughtfully using and protecting investment resources. It has application among all investor types – both institutional and individuals – though, in practice, a spending policy often takes on more formality and nuance for institutions.

For individuals approaching retirement, this typically means establishing a reasonable and realistic dollar figure to draw from retirement assets/savings to cover one’s regular annual expenses. If expenses and investments are managed responsibly (and markets behave), it is expected that the retiree will be able to draw this same amount plus adjustments for inflation over the entirety of their retirement years. With any luck, some amount will be left over for heirs and/or philanthropy.

For perpetual institutions like nonprofit organizations with endowed assets, the spending policy process can become more complicated given the infinite time horizon. Most endowment investors are not expecting to completely spend down their assets over time but rather draw from and extend the value in perpetuity. Managing the regular spending amount is critical as it can cover both financial support to the organization’s operations (e.g., salaries) as well as direct grantmaking or other charitable programs. Thus, prudently evaluating long-term spending needs relative to projected resources (both revenue and investments) is crucial. Moreover, the methods for calculating the appropriate spending can take various forms and present various risks.

What follows outlines popular methods, challenges and recent trends for spending policy considerations geared toward nonprofit investors operating with an infinite time horizon.

“Guardians of the Future”

Most nonprofit institutions like schools/universities, cultural institutions and foundations operate with the intent and expectation of being able to serve future constituents (students/faculty/patrons) in the same way they serve these groups today. This is the concept of “intergenerational equity.”

The fiduciaries chosen to serve such institutions must act in the best interests of the organization. The tension that builds from this duty is most often associated with fiscal matters – especially those related to endowed assets. In order to preserve the long-term purchasing power of endowed assets (i.e., inflation-adjusted dollars) and achieve intergenerational equity, both generally considered to be the most important objectives of an endowment pool, trustees/fiduciaries representing the charitable organization must follow responsible spending practices.

That begins with a thorough understanding of the organization’s financial position, which largely depends on the sustainability of both current and future inflows/outflows. For brevity, we’ll refrain from commenting on the broader topics of fiscal management and portfolio asset allocation. However, these are essential elements that should be addressed by fiduciaries with their advisor(s) before developing or choosing a spending policy. For the purposes of this paper, we assume the organization’s assets can be drawn from in a regular/recurring fashion.

Types of Spending Calculations

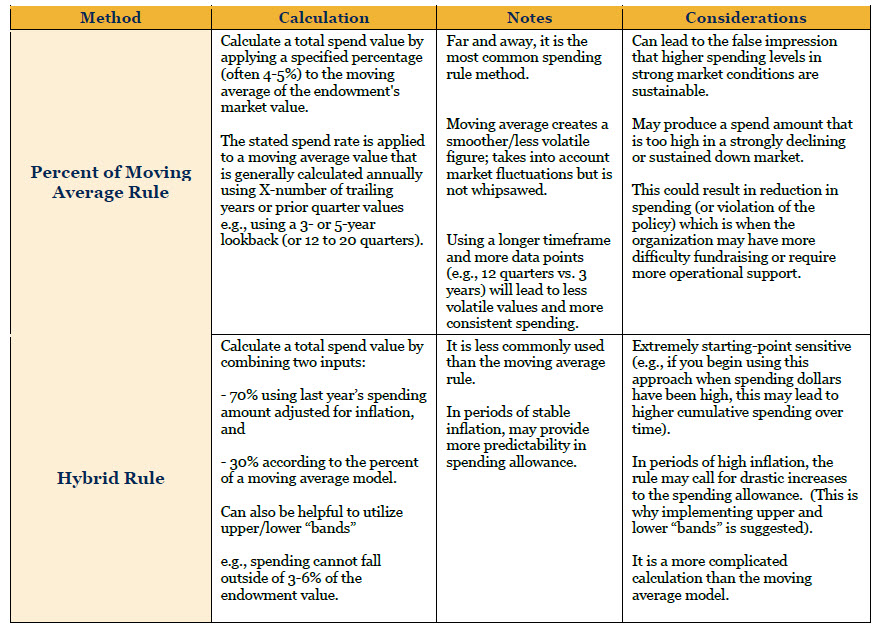

Nonprofit institutions use various spending policy methods, the most common of which is the ‘percent of a moving average’ calculation. Below, we expand on this approach and the “Hybrid” method.

Tracking Spending: Too Much? Too Little? Or Just Right?

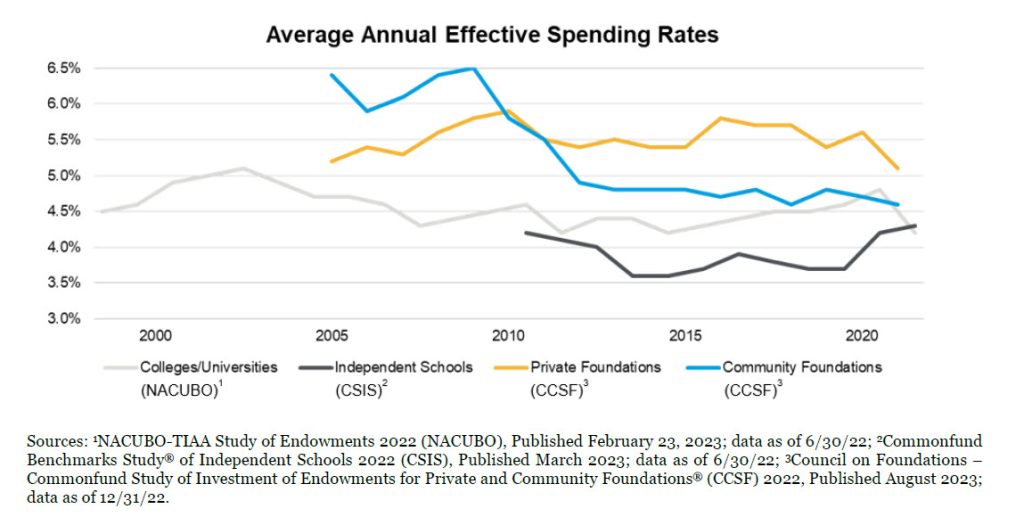

There are several benchmarking surveys that attempt to collect financial information each year to illustrate current trends and practices. The surveys are often completed annually (looking backward) and are typically sector-specific, i.e., geared to certain nonprofit types.

Below is a chart plotting the effective spending rates over time as determined by three major studies representing colleges/universities, independent schools, and private and community foundations.

There is a clear narrowing range of spending rates over time among these nonprofit types (4-6%), yet there is still some variation between them and volatility (up/down) from year to year. Digging deeper, there is often a correlation between size and spend rate, where larger asset pools have lower draw rates. The assumption is that larger institutions have more diverse and/or greater sources of revenue.

Interestingly, the most recent studies point to many of these institutions making “special appropriations,” i.e., spending above what their policy normally dictates. In extraordinary circumstances like the Covid-19 pandemic, it may be appropriate to spend more. However, that should not be the expectation year in and year out.

Four Steps to Protect Your Endowment

1 – Maintain a disciplined approach to spending:

• If you have a defined and functional spending policy, adhere to it.

• Approach spending policy from a long-term and disciplined perspective. Do not change your policy simply to take advantage of a larger spending allowance via a different calculation. Doing so will likely reduce your endowment corpus.

2 – Be slow to take a special appropriation from your endowment:

• Do not take that special appropriation if you do not have to! It will have long-lasting impact on your cumulative spending allowance and your endowment value.

• If you must draw down extraordinary amounts, be sure to examine and abide by any restrictions that may limit use of funds.

3 – Anticipate cash needs and plan accordingly:

• If you know you will need to spend from the endowment, inform your investment advisor in advance and provide as much detail as possible (e.g., amount of the draw(s), required timing, etc.). The advisor will work with you to develop a plan that considers market conditions, your target asset allocation profile and liquidity provisions of underlying assets.

4 – If you have flexibility to lower your stated spending rate, do so!

• It may be increasingly difficult for most charitable organizations to lower their spending rates, especially in this current troublesome environment, and very few likely have the ability to reduce spending. But if you can reduce the endowment draw, it can have a positive impact on the endowment over the long term.

Establishing and maintaining an effective spending policy is a crucial element of fiduciary duty. We encourage trustees and other fiduciaries of nonprofit institutions to adopt smart spending policies for long-term sustainability. The examples and data provided above are illustrative but based upon real-world experience. Don’t be overwhelmed; seek counsel from advisors offering practical expertise and perspective. More than anything, effective financial management can enhance the impact of nonprofit initiatives. For more information, please contact any of the professionals at Fiducient Advisors.

1Foreward, “The Little Book of Main Street Money” by Jonathon Clements

2“What is Permanent Endowment Income?” by James Tobin, The American Economic Review, May 1974, pages 427-432

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.