If markets have taught us anything, it is that cyclicality is often a prime feature of investing in the long run.

Two Ps in a Pod: Patience & Pragmatism

In our May market review, we highlighted the latest update to our recurring paper on Active versus Passive investing. To ‘revisit the basics’ of that debate, we reminded and stressed to readers one of the paper’s key components: “the importance of patience. Without it, we risk falling prey to the trap of selling low and buying high—a true capital-destroying quagmire.” Markets testing investors’ patience is nothing new. It takes resolve and a long-term mindset to keep investors from making poor, short-sighted decisions. Beyond simply staying patient, investors would also do well to act pragmatically and to recognize both the existence and power of cycles in investing.

Like other areas of the investment universe, ESG investing remains prone to cyclicality. ESG-oriented investment strategies, previously in a period of robust growth, seem to have fallen slightly out of favor in recent times (and in certain circles). The question is likely not a matter of if ESG investing will resume its prior trajectory, but rather when and how. What might that next cycle look like? We examine the factors driving this trend reversal and what may affect its possible resurgence.

Not So Fast

Monopoly players are accustomed to moving smoothly around the gameboard until the dreaded ‘Do Not Pass Go’ card is drawn which temporarily halts further progress. For much of the last decade, ESG investing had been enjoying advancing on the theoretical investment gameboard. However, it appears to have drawn a ‘Do Not Pass Go’ card as it deals with questions related to the motivations and political backlash connected with this theme of investing.

We have discussed the evolution of ESG investing as it matured and became more popular among investors, markets and managers. However, that popularity allowed some bad actors to enter (see countless articles about “greenwashing”) and raised a slew of questions concerning ESG’s quantifiable metrics and evaluation methods. This has generated meaningful debate on what constitutes “ESG” investing. Complicating the issue further is the unanswered question of whether “ESG” can or should be expected to outperform traditional market benchmarks.

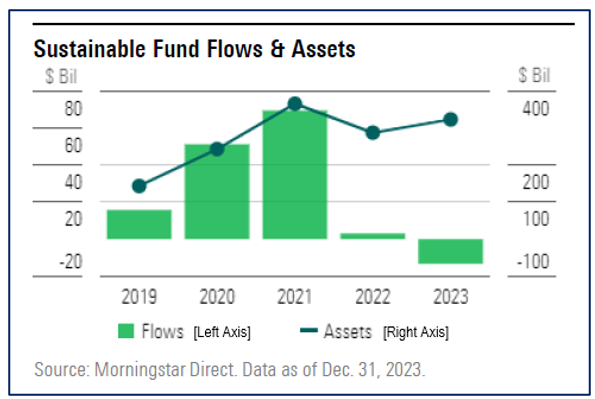

A recent report published by Morningstar estimates that while total ‘sustainable fund’ assets surpassed $300B in 2023, over $13B was withdrawn in the year.1 The main factors credited with the outflows include heightened “political scrutiny” and a lack of “industry consensus or U.S. regulatory guidance, (as) confusion endured regarding terms often used interchangeably, for example, “ESG,” “sustainable,” and “impact.”2 These issues are not necessarily new or easily resolved. It will take time for investors and markets to adjust and make progress.

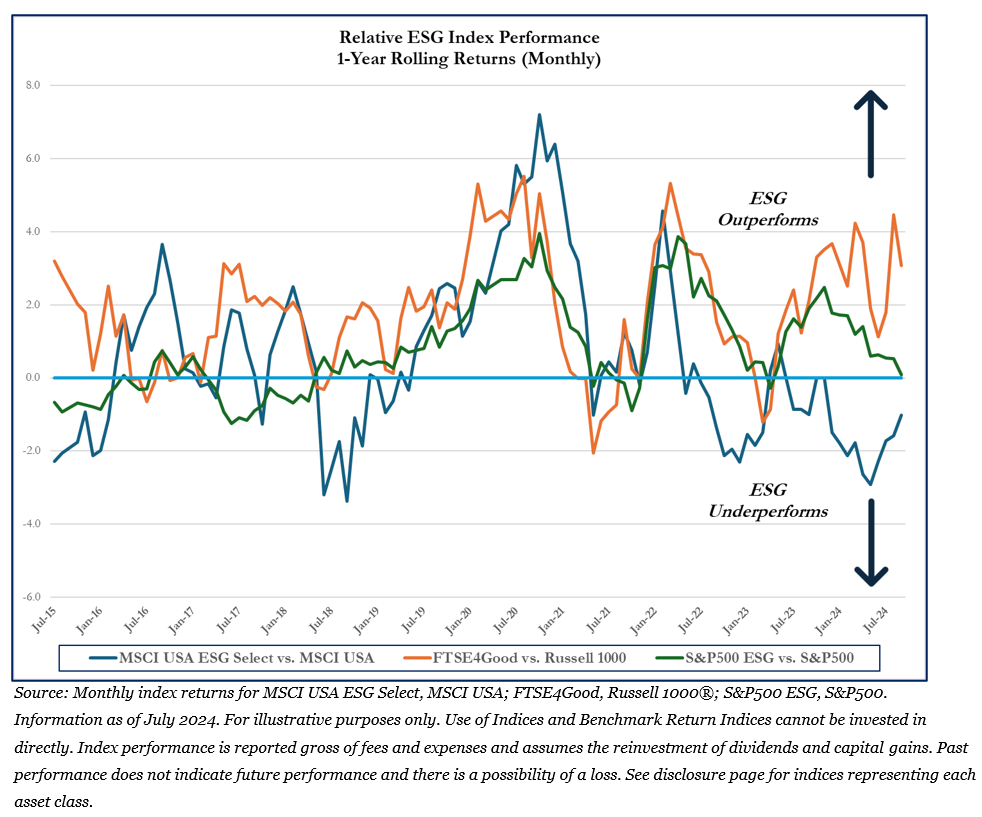

Examining the performance of ESG index funds relative to traditional counterparts reveals that comparative results are also less conclusive. Furthermore, like style-based indices (e.g., growth v. value), returns are prone to similar periods of outperformance and underperformance.

We plotted the rolling 1-year relative performance of three US large-cap equity ESG indices3 versus their passive, non-ESG counterparts from July 2015 through July of this year. Each of the three ESG indices appears to stay mostly ‘above the line’ in the “Outperforms” half of the chart; however, each also spends some time ‘below the line’ showing periods of underperformance.

Notwithstanding the scrutiny associated with ESG index construction, we would simply point out that factor performance, whether it be derived from size, style, sector, or, in this case, ESG criteria, is prone to cyclicality in relative returns. To that end, we would strongly advise investors against attempting to market-time their investments in this area – or any other portfolio area, for that matter.

The CFA Institute states that ESG factors may have the potential to affect a company’s value and encourages investors to incorporate consideration for such material factors in their overall investment analysis.4 In theory and the long run, companies that run their businesses well, including managing environmental, social, and governance risks, should see that reflected positively in their valuations. However, that is not to say they will always be in sync.

Looking Beyond the Label(s)

Marking the next phase in the cycle of ESG investing will still require classifying or rating individual companies on environmental, social, and governance metrics. However, fund strategies may see a move beyond and away from current categories and labels. Alyssa Stankiewicz of Morningstar suggests: “The consideration of those [ESG] factors has become so ubiquitous that investors don’t necessarily see the need to select [ESG] funds that are instituting binding criteria around environmental and social factors…because they have good alternatives in funds that are managing for financial materiality [not ESG explicitly].”5 We agree many of today’s fund managers appropriately consider the risks associated with a company’s approach to managing ESG factors without actually connecting the manager’s fund strategy directly with ESG investing. As the quote above suggests, there are “good” options available – meaning ESG-aware funds that are not openly labeled as ESG. To that end, additional analysis is required to understand the link (if any) between a fund manager and ESG criteria.

Moreover, how does one discern whether the manager is skilled in his or her area of expertise and whether the ESG process is additive? This is especially difficult given the cyclicality in relative performance and the expectation for periodic (sometimes sustained) underperformance. We would emphasize: “investors need to make a concerted effort before investing to understand a manager’s investment process, sub-style, and whether they possess competitive advantages over their peers that improve the odds of ranking in the top quartile. We continue to affirm this allows investors to develop the confidence, and more importantly, the patience required for long-term success.”6

As we wrote in our paper, it is important to avoid being dogmatic about one’s investment beliefs concerning active versus passive investing. Neither the active or passive approach is categorically better to the other – considering the appropriateness of both approaches in the context of the expectations for the forward market cycle is what should influence portfolio decisions. ESG remains as another lens from which to consider effectiveness.

The Ongoing Cycle for ESG:

ESG investing may not be experiencing the same rising popularity it has over recent years, BUT interest in this area is not dead. Investors should let their own values and priorities drive their decisions – not recent performance, and not headlines.

Fiducient Advisors has decades of experience working with clients to advise on ESG strategies as part of our approach to Mission-Aligned Investing (MAI). This also encompasses the realms of Socially Responsible Investing (SRI), impact investing, sustainability-based investing and Diversity, Equity and Inclusion (DEI) criteria. Our ESG and MAI process is structured to be client-centric and is therefore driven by the specific values prioritized by the institutions they represent and the investment goals they aspire to achieve. If you would like to learn more about our approach or our due diligence process, please reach out to any one of the professionals at Fiducient Advisors.

1U.S. Sustainable Funds Landscape 2023 in Review: U.S. Sustainable Funds Face Outflows in 2023 | Morningstar

2U.S. Sustainable Funds Landscape 2023 in Review: U.S. Sustainable Funds Face Outflows in 2023 | Morningstar

3Source: Monthly index returns for MSCI USA ESG Select, MSCI USA; FTSE4Good, Russell 1000®; S&P500 ESG, S&P500

4CFA Institute Positions on Environmental, Social and Governance Integration, January 2021

5ESG funds faced their worst year on record in 2023 (yahoo.com)

6The Next Chapter in the Active vs Passive Debate 2024 (Fiducient Advisors)

Disclosures and Definitions

Environmental, Social, and Governance (ESG) Investing Risk. ESG investing risk is the risk stemming from the environmental, social, and governance factors that are analyzed when selecting securities. This may affect the exposure to certain companies or industries and cause ESG related investments to forego certain investment opportunities. ESG investing returns may differ than other strategies that do not seek to invest in companies based on ESG screens.

Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that actual returns or volatility will be similar to the indices. Indices cannot be invested in directly. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect our fees or expenses.

- MSCI USA ESG Select: The MSCI USA ESG Select Index is designed to target companies with positive environmental, social and governance (ESG) factors while exhibiting risk and return characteristics similar to those of the MSCI USA Index. Tobacco and Controversial Weapons companies, as well as major producers of Alcohol, Gambling, Firearms, Military Weapons and Nuclear Power, are not eligible for inclusion.

- MSCI USA: The MSCI USA Index is designed to measure the performance of the large and mid cap segments of the US market. With 601 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in the US.

- FTSE4Good: The FTSE4Good Index Series is a tool for investors seeking to invest in companies that demonstrate good sustainability practices. It also supports investors that wish to encourage positive change in corporate behavior and align their portfolios with their values. To create the FTSE4Good US Index, the standard FTSE4Good Index Series selection criteria have been applied to the FTSE USA Index

- Russell 1000: The index measures the performance of the large-cap segment of the US equity securities. It is a subset of the Russell 3000 index and includes approximately 1000 of the largest securities based on a combination of their market cap and current index membership.

- SP500 ESG: The S&P 500 ESG Index is a broad-based, market-cap-weighted index that is designed to measure the performance of securities meeting sustainability criteria, while maintaining similar overall industry group weights as the S&P 500.

- SP500: The index measures the performance of 500 widely held stocks in US equity market. Standard and Poor’s chooses member companies for the index based on market size, liquidity and industry group representation. Included are the stocks of industrial, financial, utility, and transportation companies. Since mid 1989, this composition has been more flexible and the number of issues in each sector has varied. It is market capitalization-weighted.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.