Regular reviews of investment performance are a valuable exercise but only when done properly.

In 1983, a group of elderly women met in a church basement in Beardstown, Illinois and decided they would take on Wall Street. They pooled together $1,200 and started an investment club focused on picking stocks. Turns out, they were pretty good at it – really good, in fact. Their portfolio’s performance regularly trounced the return of the S&P 500 even amidst a roaring bull market. Word eventually got out and these “little old ladies” from America’s heartland were suddenly the authors of three books on investing and regulars on the talk show circuit. Dubbed the “Beardstown Ladies”, they became another bull market story that felt almost too good to be true.

Unfortunately, it was.

Doubts were raised in the press and an independent audit ultimately confirmed their performance was nowhere near what they had been reporting. In fact, they had actually significantly underperformed the very market indices they claimed to be beating so handily. Rather than intentional deception, it turned out to be an honest mistake of calculation; simply put, their math was wrong. But the damage was done – the talk shows stopped calling and even their publisher was sued.

I am reminded of this cautionary tale every time I come across an organization whose performance reporting on their investment portfolio is lacking. Often, this is because they do not have an investment advisor. Or if they do, their advisor is not providing performance reports or the reporting is simply inadequate. Occasionally it is because they have investment assets at multiple places through multiple advisors, with no one preparing a coordinated performance analysis beyond a finance team member armed with an Excel spreadsheet.

Clearly, this presents a fiduciary risk but, just as important, it is a business risk. Organizations with investment portfolios have made a business decision to take on some level of investment risk to earn a return above what’s being offered in the “risk free” markets (such as FDIC insured cash investments and U.S. Treasury securities). In order to gauge the effectiveness of this business decision, performance needs to be accurately measured. The key elements of this business decision (how much to invest, how to invest and for how long) need to be continually reviewed, a task complicated by improper performance measurement.

What are the important components that need to be factored into a portfolio performance report?

Here are just a few of them:

• Fees. There are numerous costs associated with an investment program:

– Investment advisory fees

– Investment manager fees

– Mutual fund fees

– Transactions

– Custody

How do they impact performance? All performance figures should be reported net of fees and expenses.

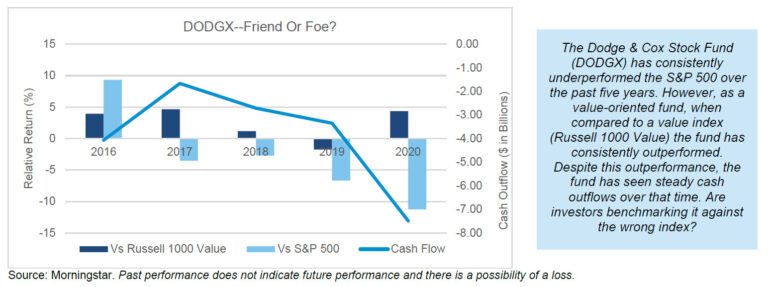

• Benchmarking. Are you meeting the goals set forth in your investment policy? This should be a primary determinant of success or failure. Comparisons to broad market results should be relevant to your portfolio. For example, if your portfolio is 50 percent stocks and 50 percent bonds, comparing overall performance to an index like the S&P 500 is not relevant. A custom benchmark should be used that reflects your specific asset allocation and adjusts along with your allocation strategy. Benchmarks should be set for individual investments (e.g., mutual funds, managers) in your portfolio at the outset. They should be appropriate given the manager’s investment style and should not change without a justifiable reason.

While benchmarking against your peers can also be valuable (note: associations can turn to our annual collaboration with the ASAE Research Foundation, Association Investment Policies, Practices and Performance as a resource), it’s important to remember that each organization is unique and even similarly sized organizations can have different investment preferences than yours.

• Cash Flows. Transfers of funds in and out of your investment portfolio are finance decisions, not investment ones. They should not influence your performance assessment. Time weighted investment returns seek to minimize the impact of cash flows on a portfolio’s performance and should be the basis of your portfolio returns.

• Policy Compliance. Your specific mix of investments will change day to day along with the markets. How close are you to the targets in your policy? Left unmonitored, a portfolio can move out of compliance quickly.

• Risk. When reviewing performance, prudent fiduciaries understand that performance is just one side of the coin. Risk is important too. Are you taking too much risk to earn your investment returns? Have you underperformed, but at a significantly lower level of risk? These metrics should be a part of the reporting process.

• Market Context. If your performance review consists of a simple glance at a set of data points, you may be wasting a valuable opportunity. Markets are complex and everchanging. Evaluating performance without an understanding of general market trends can lead to poor decisions.

As you enter your next quarterly investment review cycle, keeping these items in mind will hopefully lead you towards a more productive meeting. While it might not result in any talk show appearances or best sellers, it should make you a better fiduciary and steward of your organization’s assets.

For more information, please contact any of the professionals at Fiducient Advisors.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.