In December 2020, Fiducient Advisors, hosted a roundtable webcast titled “Diversity, Equity & Inclusion in Investment Management,” moderated by Managing Partner Mike Goss. Mike was joined by Roy Swan, Director of Mission Investments of the Ford Foundation, and JoAnn Price, Co-Founder and Managing Partner and Alan Mattamana, Partner, both of Fairview Capital. During this informative and intriguing discussion, the panel considered the fact that the investment management industry is led almost exclusively by white men – the representation of women and people of color, particularly in positions of power, is appallingly low. Roy posed these thoughtful and deliberative questions to the audience:

Furthermore, the three panelists discussed how cultivating portfolios that focus on diversity has, in their experience, led to strong performance. While outperformance of diverse managers is not necessarily demonstrable, the Knight Foundation’s study1 focusing on ownership diversity and performance in the investment management industry suggests investing in diverse management does not undercut performance:

“Within conventional statistical confidence levels, funds managed by diverse-owned firms typically perform as well as non-diverse funds after controlling for relevant characteristics (such as firm size, fund size, geography and investment focus).”

As such, a reasonable conclusion could be that achieving strong performance results and employing a diverse set of investment managers are not mutually exclusive goals.

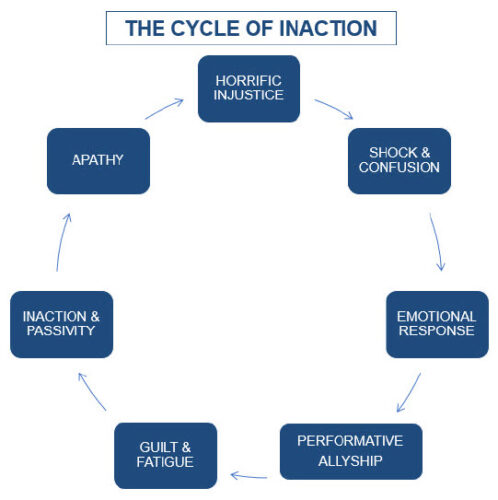

So often, people are moved by what is known across social media platforms as the Cycle of Inaction. They become aware of a tragedy or an injustice; they are shocked and angered; and they intend to do their best to make things right. However, as time passes, that initial emotional response and outrage fades away into the periphery as they get discouraged by the amount of work that needs to be done in order to set things right. Eventually, and unfortunately, the preliminary rush of obligation gives way to apathy. Before long, despite all that initial emotional outpouring and good-willed vow to take action, they eventually do nothing. See schematic below2.

During the aforementioned December webcast, when asked how we can improve diversity in the field of investment management, Alan Mattamana said, “It’s about continuing to ask the questions. Making sure the data is being collected and progress is being measured.”

However, according to the Diverse Asset Managers Initiative website,3 “Too much of the conversation in this area is spent around anecdote, not data. If the maxim ‘that which is measured matters’ has truth, then it’s hard to make the case that institutions care much about the demography of who manages their money, if they can’t or won’t track and report that fact.”

We at Fiducient Advisors are determined to break the Cycle of Inaction. We believe Diversity, Equity and Inclusion (DEI) matters, so we’re starting off by measuring the data. Our initial step is to collect and synthesize the diversity metrics of the managers that we are using on behalf of our clients. This endeavor began many months prior to our DEI webcast, during the second quarter of 2020. We sent out a survey to all our “preferred” managers, asking for the following information regarding their diversity metrics:

• Representation of women and minorities according to the following classifications:

o Total Employees

o Firm Executive Leadership

o Investment Team

o Portfolio Manager(s)

o Firm Ownership/Board Composition

We intend to expand the DEI data collection to managers that we use on our clients’ behalf outside of our preferred list. The questions we are asking are vitally important. If you were in a job interview and the interviewer asked you, “How would you evaluate your critical thinking skills?” you would rightly assume that critical thinking skills are important to the job. Accordingly, the fact that we are asking these questions of our preferred managers signals to them that we care about these diversity metrics.

Overall, investment managers are not blind to what is happening in the world today in terms of a spotlight being shined on racial injustice and inequity, and we are confident that Fiducient Advisors is not alone in asking these questions. We expect that, from societal pressure alone, these investment management firms will make a concerted effort to report on and improve their diversity metrics.

We are in the process of organizing the data that we have collected in an easily digestible and available manner, so consultants and individuals outside of the research team have ready access to this important information. This is crucial to the establishment of a clear framework delineating where we currently stand and giving us a benchmark by which we can measure progress.

Once we get a sense for what our current metrics are, we can draw a line in the sand and state measurable goals. In any event, it is fair to say that what we are ultimately looking for is improvement in these diversity metrics over time. According to the Knight Foundation’s study, only 1.3 percent of the $69.1 trillion in assets under management across mutual funds, hedge funds, private equity and real estate are managed by “substantially and majority diverse-owned firms.” (Substantially means that 25-49 percent of the firm is owned by diverse individuals, and majority means that 50 percent or higher is owned by diverse individuals.) With the bar set so incredibly low, improvements will not go unnoticed.

In addition to our own efforts in gathering diversity data from the managers we employ on behalf of our clients, we have also joined the newly formed Institutional Investing Diversity Cooperative (IIDC)4. The goal of this organization is to ensure greater diversity in the institutional asset management sector by advocating for access to data that captures all dimensions of diversity. We are hopeful that our participation in this cooperative alongside other well-respected consulting firms will help improve diversity in the asset management industry.

In our DEI webcast, Roy Swan said:

What I’ve observed and the conversations I’ve had when it comes to folks who are very wealthy themselves or who are in a position to control capital, it really boils down to whether they’re interested in finding diverse managers. I think that’s really the lynchpin… A lot of it just boils down to interest and intentionality.

We at Fiducient Advisors are interested and intentional in our efforts to not fall prey to the Cycle of Inaction. We will follow through with quantifying the data we have already gathered, continue to collect new data and measure our progress over time. We will do it because it is the fair thing to do, the right thing to do and the moral thing to do. Most importantly, we will persist in doing this because we think our clients will benefit from these efforts over the long term.

For more information, please contact any of the professionals at Fiducient Advisors.

1“Diversifying Investments: A Study of Ownership Diversity and Performance in the Asset Management Industry,” Executive Report, January 2019, Professor Josh Lerner, Harvard Business School, along with Bella Research Group:

https://kf-site-production.s3.amazonaws.com/media_elements/files/000/000/281/original/2019_KF_DIVERSITY_REPORT-FINAL.pdf

2Oh Happy Dani Facebook page: https://www.facebook.com/ohhappydani/

3Diverse Asset Managers Initiative: https://www.diverseassetmanagers.org/

4Institutional Investing Diversity Cooperative: https://www.iidcoop.org

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.