If your university relies on its endowment for scholarships, operations, or other support, the current environment may find you anxious about how a recession would impact your institution. So far we’ve avoided a recession, though many pundits still anticipate an economic pullback. Below we examine the probability of a recession, what to expect if recession becomes reality, and finally, considerations for positioning your endowment in advance of a recession.

Should you expect a recession?

Consider this the multi-billion-dollar question for university endowments. Truth of the matter is that no one knows with certainty. Some signs make the prospect of recession appear to be a foregone conclusion. Others point to the Fed possibly achieving a rare “soft landing” (soft landings occur when inflation can be tamed without significant job loss).

Let’s examine both sides of the coin and begin with positive metrics that suggest we might avoid a recession near-term. First, and most obvious, are the impressively low unemployment numbers. U.S. unemployment hovered around 3.5% as of this writing. The last time we saw a rate this low was May 1969 when it hit 3.4%.1 An obvious relationship exists between consumers feeling good about their jobs and strong economic activity.

Earnings for S&P 500 companies running ahead of expectations is another bright spot. Early Q2 reports show that about 80% of companies are beating earnings estimates, and the magnitude of these earnings surprises are above their 10-year average.2

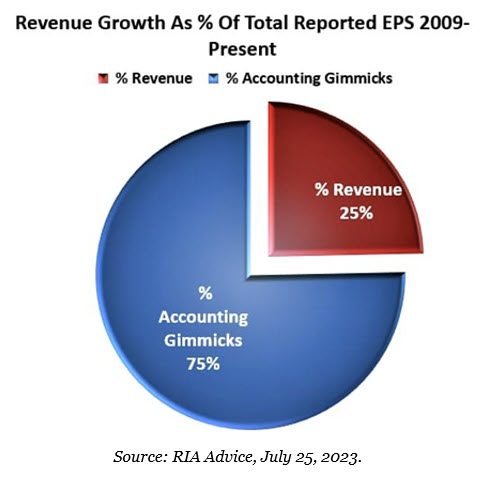

Before becoming jovial about earnings outperformance, recognize that “financial engineering” beneath the surface may be running higher than typical. Not illegal, but certainly impactful, companies have great latitude in important matters that can sway quarterly earnings including decisions on stock buybacks, the pace of depreciating assets, and more. Lance Roberts of RIA Advice captures it well: “The Problem with cost cutting, wage suppression, labor hoarding, and stock buybacks, along with a myriad of financial gimmicks, is that there is a finite limit to their effectiveness. By utilizing “cookie-jar” reserves, heavy use of accruals, and other accounting instruments, (companies) can either flatter or depress earnings.”3

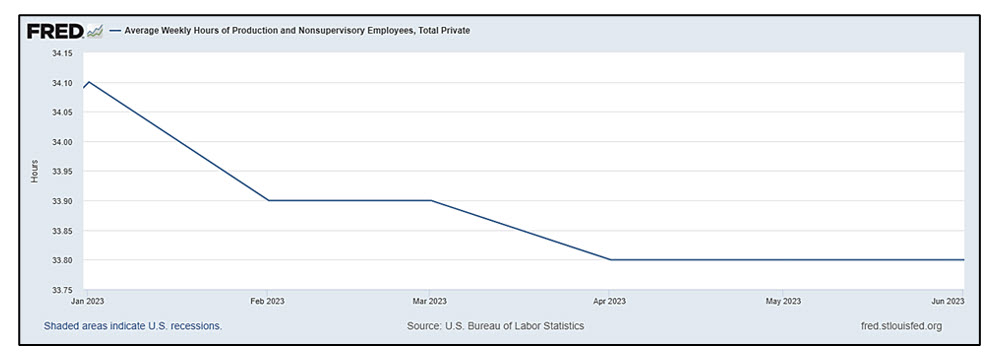

And concerning those extremely strong jobs numbers, low unemployment rates and higher wages are certainly welcomed, but turbulence may lie beneath the surface. Recent reports show that, despite adding jobs, businesses are cutting workers’ hours and that could be a warning sign for the economy. Businesses, having struggled so much to find workers, would rather reduce hours than lay off workers. But what follows?

How might a recession impact the markets and your endowment?

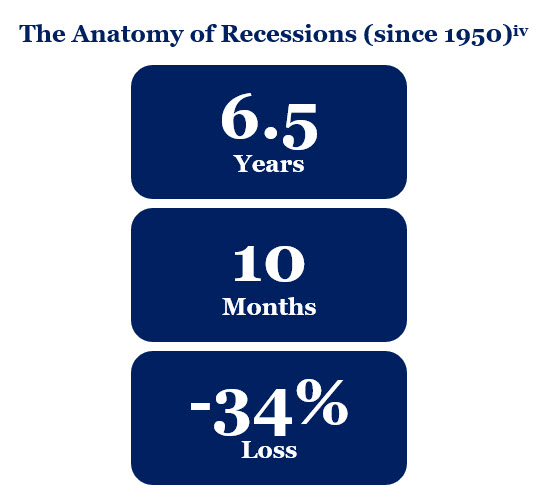

While no one possesses skill to precisely predict when a recession begins, it is important to remember that recessions (and bear markets) are part of typical economic cycles. There will be another recession. That said, if you oversee endowment investments, it is prudent to have historical perspective regarding recessions and how stocks have performed.

It is also notable that since 1950, markets, on average, have peaked seven months prior the onset of a recession and bottomed three months before the economy began growing again.

How to prepare for an inevitable recession.

It may be impossible for investors to forecast exactly when a recession or bear market may occur, but all good stewards can adopt these prudent principles to up their odds of long-term success.

Have a thoughtful plan and stick to it.

- Construct your endowment portfolio in tailored fashion specific to the objectives and circumstance of your university. Incorporate long-term risk, budget and capital considerations.

- Conceive your plan with realistic expectations on the risks your school and investment committee can tolerate… and returns you expect to achieve.

- Resist the urge to allow emotions to alter your plan. Have faith in the process and recognize the strategy was built knowing recessions and bear markets would occur.

Remain Diversified – Diversification is an admittance of not knowing what the future holds. It also helps investors avoid acting in absolutes, like “tech stocks will always outperform” or “fixed income is dead.” The discipline of diversification often leads to a more stable approach that can help a portfolio weather inevitable market storms.

Long-term is where the real money is made – Compounding investment returns are sometimes referred to as the 8th Wonder of the World. With most universities having an in-perpetuity time horizon, doesn’t it make sense to think long-term concerning your endowment? A short-term focus can lead to ‘flavor of the day” investing and decisions that run counter to your university’s long-term objectives. Try to eliminate daily noise and keep your eye on the prize.

Control what you can control – Markets fluctuate day to day and there is little you can do about that. But as a prudent steward there are many practices you can, and should, employ to improve your likelihood of success.

- Minimize fees of investment managers, custodians, etc.

- Tap into knowledgeable committee and board members.

- Use capable investment advisors that can help you create a plan and navigate challenging environments.

Conclusion and additional resources.

Leaders of higher education institutions face a gauntlet of challenges. But making reactive decisions regarding your endowment doesn’t have to be one of them. Use this information to assess whether your endowment is appropriately positioned. You can obtain many additional resources by listening to my podcast Nonprofit Investment Stewards, visiting Fiducient Advisors’ Insights, or contacting us.

1Newsweek, statista, Bureau of Labor, July 18, 2022.

2Factset: John Butters, July 14, 2023.

3Benzinga.com, July 25, 2023.

4Fiducient Advisors: Bear Market Field Guide, Bradford Long, July 2022.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.