The three main categories of approaches to Mission-Aligned Investing include:

- Integration

- Values-Based Screening

- Impact (which can include shareholder engagement and proxy voting)

Integration

ESG integration is the inclusion of non-financial factors into the investment decision process. ESG integration is generally incorporated during a manager’s fundamental research process and reflects the manager’s view of the value or risks associated with a certain investment.

ESG integration can be difficult to define and assess, as it is easy to claim without requiring material changes to assess the investment process to back it up. With investor interest in the ESG space growing significantly, asset managers have an economic incentive to characterize themselves as ESG investors in hopes of attracting new capital. In assessing ESG integration practices, we generally ask ourselves these three primary questions.

- Is it observable in the investment process?

- Is it material to the investment process?

- Is it additive to the investment process?

Historically, in order to align their portfolio with ESG principles, investors may have needed to make significant changes to their holdings, vehicle types and/or asset allocation. With ESG integration becoming increasingly more common, an overhaul of one’s portfolio may no longer be necessary in this way. Investors with ESG interests may be pleasantly surprised to find “non-ESG” strategies in their portfolios have already incorporated some of these ESG factors.

However, a greenwashing effect is likely to persist for some time as the industry comes to terms with common integration definitions and better sources of data. Therefore, in our opinion it is extremely important to conduct an extensive review of strategies that claim to incorporate ESG criteria to assess whether integration is meaningful and authentic.

Values-Based Screening

Values-based screening applies the core values of an individual or organization to the decision-making process. It can be incorporated into an investor’s portfolio construction process in three primary ways:

- Negative screening – The process of screening out companies or industries that do not align with an investor’s values.

- Positive screening – The process of tilting an investor’s portfolio to the best-in-class companies as defined by the investor’s values.

- Thematic investing – A top-down investment approach that incorporates broad themes in conjunction with a values-based focus in selecting a portfolio of companies. Common themes within the industry include sustainability and clean energy.

As it pertains to negative and positive screening, the larger the list of values to incorporate, the greater the impact on an active manager’s ability to select securities of interest and the more difficult it will be for a passive mandate to track a benchmark. Investors may use one of the above methods, or a combination of some or all of these methods, to strive to achieve their goals.

Impact

Shareholder Engagement and Proxy Voting

Shareholder engagement and proxy voting are ways to use the benefits afforded to owners of a security to pursue positive change. Proxy voting is an investor’s primary method of voicing opinions and affecting company decisions. Proxy voting is a form of shareholder engagement wherein voting power is delegated to a representative. It enables investors to establish a bloc of likeminded voters by selecting a single representative to vote on their behalf. Since voter influence is determined by the size of their stake in a company, a unified voting segment established through proxy voting exercises greater influence. Investment funds that invest in accordance with certain values can help facilitate this collaboration and cohesion of likeminded smaller investors because the fund acts as the representative responsible for voting on behalf of fund shareholders.

Another impact-focused approach is company engagement, which is the establishment of a direct dialogue with companies to encourage them to change or improve their environmental, social and governance practices. Frequently, the shareholder engagement process simply entails large stakeholders (such as mutual funds) interacting with company management to share their concerns and suggest ways to improve. The implication is if company management does not make improvement and progress in the areas of concern, large investors may withdraw their funds. Company engagement allows investors to use their assets – their “seat at the table” – to enact change.

Impact Investing (Private Markets)

While much of the implementation around Mission-Aligned Investing has been focused in public markets, there is growing adoption within private markets as well. Impact investing entails making investments in companies with the explicit intention of generating both positive change and strong financial returns. This is a natural extension within private markets as the general partner often has majority control of a business allowing for greater alignment with, and influence over, the organization’s priorities and growth plans. Impact investing often targets specific outcomes – a greener environment, more diverse workforce, access to education, veteran support, etc. – and investors’ funds can be dedicated to one or more impact initiatives.

There are numerous reasons why private markets are conducive to investors seeking material change, including:

• The focus on impact is made perfectly clear from the outset and companies are purchased with a particular goal in mind.

• Private companies compared to larger public peers often have a more targeted business line, making their alignment with certain values clearer. Often, public companies may have a mix of business lines, some of which investors may find less attractive, but they have no opportunity to segregate those lines of business.

• Impact investors can act as patient and long-term providers of capital, supporting businesses as they scale over time. They can have direct influence, working alongside management teams as well as contributing their own operational expertise.

• There is also greater transparency into how a specific outcome will be achieved through a general partner’s value-add playbook and historical deal experience.

• Ultimately, there is intentionality to bring about positive change and foresight into how that will be accomplished.

Building an impact-oriented private markets portfolio is an interactive, collaborative and dynamic process. The interpretation of an investor’s mission may change over time as new investment strategies and measurement data become available. This information may lead to greater understanding of the mission and the necessary modification of that mission over time.

Choosing an Optimal Approach

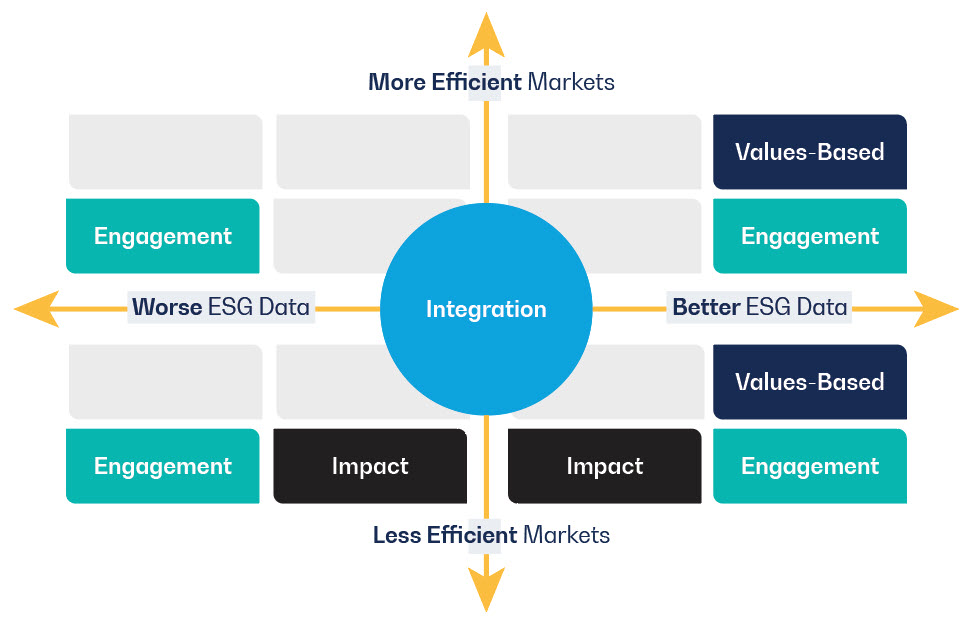

Given the current environment around ESG reporting standards and disclosures, we recommend different implementation approaches depending on market efficiency and data quality, as shown above.

- For large capitalization markets where data quality and availability is greater, values-based investing, particularly a negative and/or positive screening approach, may be utilized most effectively.

- Conversely, for less efficient markets where data quality is poor and availability is scarce, an impact and/or engagement-focused approach may be most effective. In those cases, investment managers can engage corporate leadership and executives on ESG-related issues and provide a path for improved ESG policies and better ESG disclosures, thus increasing visibility and influencing key issues material to the company’s business operations.

- Lastly, an ESG integration approach involves employing investment managers who integrate ESG factors into the investment thesis. This approach can be employed throughout the investable universe, in essentially all areas of the market.

Notably, unique or specific investor situations have the potential to dictate a specific approach. For example, if an organization is facing public pressure to divest from fossil fuels, this would directly lead to a values-based approach, specifically negative screening, as the availability and quality of data allows.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.