Strong Equity Markets in Second Half Drive Solid Results, Redemption Queues

Building for Open End Private Real Estate

Public Defined Benefit (DB) and Other Post Employee Benefit (OPEB) plans often assess their financial progress on a fiscal year (FY) ending June 30. In the most recent fiscal year ending June 30, 2023, the Bloomberg Aggregate Bond Index showed minimal changes. However, domestic equities, represented by the Russell 3000 Index, performed exceptionally well, posting a 19% return.1 This marked a significant turnaround from the investment numbers reported in the previous fiscal year.

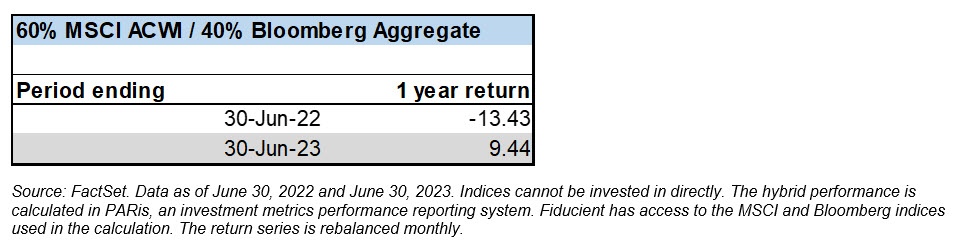

Using the MSCI ACWI and the Bloomberg Aggregate indices as a proxy for investment performance, the difference in returns for a 60/40 portfolio (60% global equities/40% domestic fixed income) over the past two fiscal years is striking.

This surge in investment returns during fiscal year 2023 led to an increase in the aggregate funding ratio of U.S. state and municipal retirement systems, as reported in the Public Pension Fund Indexing Report by Milliman, a global actuarial firm. The estimated funded status of the 100 largest public pension plans rose to 75.8% by the end of June 30, 2023, compared to 74% as of June 30, 2022.2

Higher Interest Rates and Fixed Income Allocations

In our November 2022 edition of the Public Fiduciary Newsletter, we highlighted the potential benefits of rising interest rates for public pension portfolios. For nearly four decades, the bond market experienced one of the longest bull markets, resulting in increased bond prices due to declining yields. To meet their assumed investment returns, many public pensions shifted assets away from fixed income to global equities and alternative investments. They also took on more credit risk by investing in non-investment grade issuers.

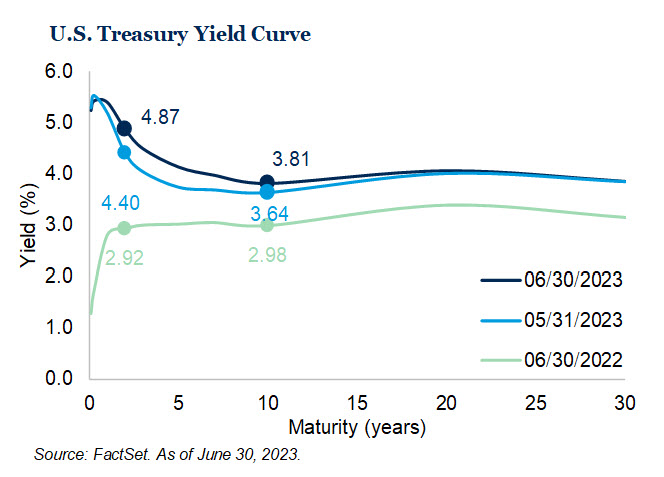

The upward trend in yields continued, with the 10-year U.S. Treasury yield rising from 2.98% at the end of fiscal year 2022 to 3.81% at the end of fiscal year 2023. This rise was not limited to U.S. Treasuries; it also affected the broader bond market.

The yield on the bellwether Bloomberg U.S. Aggregate Bond Index, a proxy for the U.S. bond market, stood at 4.8% at the end of June 30, 2023, while the yield on the Bloomberg Corporate High Yield index stood at 8.5%.3

Public pension plans often rely on fixed income to provide stability within their portfolios. The resurgence of higher yields is expected to boost incremental income and align portfolios with their investment return goals and risk tolerance. However, the rise in yields may introduce volatility, prompting Plan Sponsors to reassess their fixed income allocations with regard to duration, credit quality and active vs. passive strategies.

Alternative Investments: Illiquidity & Investment Policy Statements

“Alternatives” is a broad term encompassing various investment strategies such as private equity, hedge funds and private real estate. These strategies can enhance a portfolio’s risk-adjusted returns because they are not closely correlated with traditional stocks and bonds. However, Plan Sponsors should carefully evaluate the alternatives based on risk tolerance, liquidity needs and time horizon.

For public plans that depend on asset liquidation to cover ongoing pension obligations, the illiquidity of alternatives and the differences in public and private market valuations can result in an over allocation to alternatives compared to target allocations. Investment policy statements should include language to address this issue, acknowledging that allocations may deviate from the target due to market conditions and illiquidity.

An example is open-ended private real estate funds with quarterly redemption features. Plan Sponsors may find themselves in a queue for redemptions, and a lack of liquidity can lead to partial redemptions. This scenario can persist until market conditions change. As a result, Plan Sponsors should be aware that certain alternative positions, like private real estate, may remain overweight compared to policy targets for an extended period, potentially leading to performance disparities against stated policy benchmarks.

For additional information on any of the topics discussed in this article, please reach out to the professionals at Fiducient Advisors.

1FactSet Data as of June 30, 2023.

2Public Pension Funding Index July 2023 – Milliman, Rebecca A. Sielman and Richard L. Gordon

3FactSet Data as of June 30, 2023

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.