Earlier this year, the largest retirement plan provider in the United States announced that clients using their platform would have the ability to invest in digital assets within their core 401(k) investment lineup on an elective basis. The announcement touted a first-of-its-kind investment opportunity, catching the eye of Plan Sponsors, participants and even the Department of Labor (DOL). The timing of this announcement was particularly surprising considering the DOL had recently issued its own Compliance Assistance Release, reflecting its serious concerns with plan participants investing in crypto and warning Plan Sponsors that the DOL would question the “prudence of a fiduciary’s decision to expose 401(k) plan participants to direct investments in cryptocurrencies”.1

According to the DOL, investments in digital assets pose a significant risk and are too volatile for a retirement account. In seeming support of this concern, the legal disclaimer on the plan provider’s website states that “digital assets are speculative and highly volatile, can become illiquid at any time and are for investors with a high-risk tolerance. Investors in digital assets could lose the entire value of their investment”.2 This statement alone should give Plan Sponsors pause.

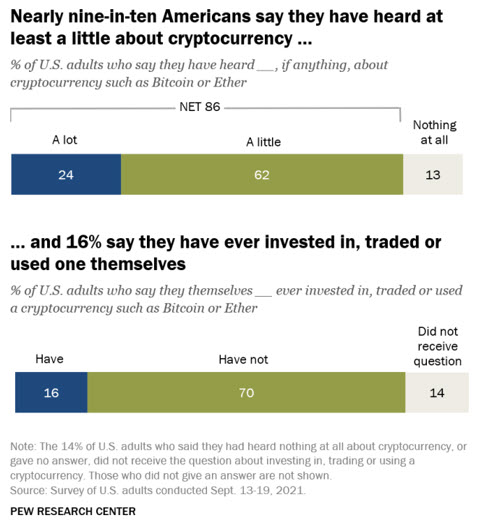

However, A Pew Research Center survey conducted in 2021 determined almost nine in ten Americans have at least heard of cryptocurrencies. Furthermore, more than 27 million U.S. individuals have ownership stake in these vehicles with that number growing significantly.3 So, with the promise of additional DOL scrutiny and the increase in fiduciary liability for Plan Sponsors, will cryptocurrency ever be a viable option for your retirement plan? The answer to that question is actually quite complicated.

Cryptocurrency Makes Its Way to Retirement Accounts – How Will Plan Sponsors React?

Today, most individuals working in the private sector under the age of forty are likely unfamiliar with, and do not have access to, a traditional pension plan. However, generations of workers before them relied heavily on these Defined Benefit (DB) plans, which are funded and invested exclusively by their employers. This DB plan was generally based on salary and years of service, and when supplemented by Social Security, these plans provided many of our parents and their parents before them with a seemingly comfortable retirement. Our parents and grandparents relied on their employers and the government for their retirement security.

The retirement landscape has changed over time due to rising costs, increased risk, administrative challenges and both legislative and regulatory involvement. Due to these factors, traditional pensions have been declining for years and as such, the traditional approach, with employers exclusively funding employee retirement evolved into a partnership between employer and employee through Defined Contribution (DC) plans. DC plans enable both employee and employer contributions, participant control of investments and savings rates, as well as transparency and portability of account balances.

Currently DC plans, including 401(k) and 403(b) plans, dominate the retirement savings universe with $7.9 trillion in assets. With favorable tax treatment for both the employers and the employees, flexible plan features, portability and the opportunity for participants to choose investments, the popularity of DC plans is apparent. By June 2021, 65 percent of workers had access to a DC plan compared to 15 percent of workers with access to a DB plan.4

Based on the age, interest and investment sophistication of your workforce, Plan Sponsors may feel compelled to at least explore cryptocurrency as part of a diversified range of asset classes. This investment option may be an attractive incentive for today’s employees (and future employees) who have a longer time horizon and a higher risk profile. Conversely, it would not be appropriate for employees nearing, or in retirement and others averse to higher volatility and overall risk.

Designing Your Retirement Plan to Attract and Retain a New Generation of Employees and Investors

While there are many important duties retirement Plan Sponsors need to follow, the primary responsibility is designing and administering a retirement plan for the exclusive benefit of its plan participants and beneficiaries. This obligation covers everything from deciding when new employees can join the plan to how their account is distributed when they retire, and everything in between. A DC plan can also be a powerful tool to help attract and retain talent, especially in a competitive job market. Legislative and regulatory changes over the last several years have allowed Plan Sponsors to:

- Adopt automatic enrollment

- Provide advice through managed accounts

- Increase deferral limits

- Add a catch-up contribution

- Complement core fund lineup with a brokerage window

These participant-friendly features have enhanced DC plans and helped Plan Sponsors build a flexible and more powerful retirement benefit for their employees. However, with the youngest Baby Boomers retiring over the next several years, most active participants will be representative of Generations X, Y and Z. Legislation under consideration now, known as The Secure Act 2.0, has bipartisan support and could provide Plan Sponsors with even more options to modernize, including the ability to annuitize a portion of their account balance and earn company contributions for paying down student debt, among other improvements.5

As the future of DC plans continues to evolve, we are reminded our retirement plan options are not like our parents’ and the next generation’s will be different too. The future may include access to cryptocurrency investments or something as bold, so Plan Sponsors will need to be very engaged with employees to discover what tools, products and services will help them best save for their retirement.

The Future of Cryptocurrency in Retirement Plans

Building a plan to attract and retain talent in the years ahead requires careful deliberation upon differentiators to modernize retirement benefits. Is the ability to invest in cryptocurrency the answer? We believe that cryptocurrency investing in retirement plans may be a logical consideration in the future, but certainly not at this time.

In that sense, Plan Sponsors can take a deep breath before making any crypto-related decisions regarding their DC Plans. With the DOL publicly at odds with recordkeepers who are exploring new digital asset investment opportunities and future participant lawsuits almost assured, we are in the initial stages of evaluating the future viability of cryptocurrency as an option.

Indeed, technology has changed every industry, including the retirement industry. Think of life before technological advances as it relates to your retirement plan: reliance on paper forms, calling customer service for all financial transactions, trying to decipher information regarding investments and managing all decisions on your own. Broader asset allocation options, greater participation and improved knowledge levels today reflect the changes that were made to assist participants in making good decisions, with the hope for a better outcome at retirement.

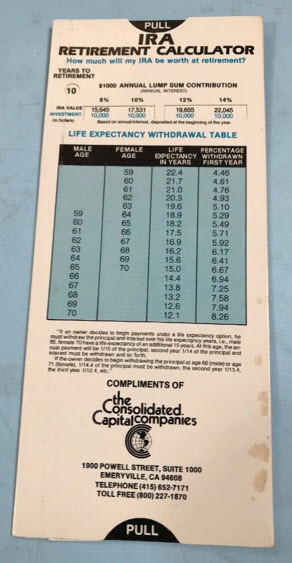

The image below may be familiar to my contemporaries and is an example of a slide calculator that was widely utilized with plan participants up until the late 1990s. Basically, the card is moved to select salary range, deferral percentage and number of years to retirement and it would give you an estimate of your account balance based on a set market return. When considering the tools and the institutional quality of information available instantaneously today, compared to just a couple decades ago, it is hard to believe the technological advances in the retirement industry in a relatively short period of time.

Currently, we believe offering cryptocurrency in a retirement plan is too aggressive and not worth the extra scrutiny Plan Sponsors will likely attract. However, we will keep an eye on this dynamic topic and report on any significant changes in the future.

For a more thorough discussion on cryptocurrency, or if you are ready to review your plan design or explore new services or products with your existing Recordkeeper, please contact the professionals at Fiducient Advisors. We can assist you with helping your plan participants become successful retirees.

1Department of Labor, Employee Benefits Security Administration, Compliance Assistance Release 2022 – 01, March 2022

2Fidelity Investments, Press Release, Fidelity Advances Leading Position as Digital Assets Provider, April 2022

3Pew Research Center, Cryptocurrency Survey, November 2021

4Investment Company Institute (ICI), 401k Research, October 2021

5American Society of Pension Professionals (ASPPA), What’s In the New Secure Act 2.0, May 2021

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.