On March 10, 2022, the Employee Benefits Security Administration (“EBSA”) issued Compliance Assistance Release #2022 titled “401(k) Plan Investments in Cryptocurrencies” which instructed Plan Sponsors to exercise “extreme care before they consider adding a cryptocurrency option to a 401(k) plan’s investment menu.” The release went on to report that “plan fiduciaries responsible for overseeing such investment options or allowing such investments through brokerage windows should expect to be questioned about how they can square their actions with their duties of prudence and loyalty.”1

The release brings renewed focus to the role played by brokerage windows, also known as self-directed brokerage accounts (“SDBAs”), in 401(k) plans for both participants who avail themselves of this plan choice and for fiduciary committees who have oversight responsibility for the selection and monitoring of the SDBA offering and its provider.

What Can an SDBA Offer to Plan Participants?

For plans that have the choice, SDBAs allow participants to select investments not available in the core investment line-up while remaining within the plan. The breadth of investments can include mutual funds, ETF’s, individual securities and options. The SDBA provider can structure offerings to include all these securities or limit the SDBA menu to mutual funds only. 2,3 SDBA menus for 403(b) plans can only consist of mutual funds.4

Prevalence of SDBAs in Plans

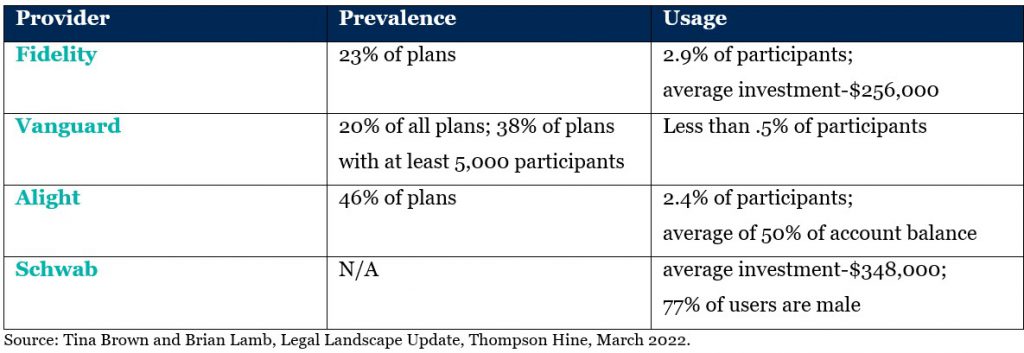

In testimony on SDBAs given by the Advisory Council on Employee Welfare and Pension Benefit Plans to the Secretary of Labor in 2021, recordkeepers disclosed the prevalence of SDBAs in plans for their recordkeeping clients. While overall participant usage is not large, SDBAs are popular with participants who have higher balances.2

Why an SDBA Might Be Offered

Often with the assistance of independent advisors, plan fiduciaries devote time and energy to creating and monitoring plan lineups populated with competitive, low-cost investment choices. These choices are known as Designated Investment Alternatives (“DIAs”) and should receive consistent, high levels of scrutiny from fiduciary committees. Over time, for a variety of reasons, the number of DIAs in plans has declined which provides one of the reasons for offering an SDBA. Other reasons for the growth of the SDBA option may include flexibility, customization and access to Environmental, Social and Governance (ESG) and mission-aligned investments.5

Plan Sponsor Considerations: Structure and Demographics

Understanding your plan’s structure and demographic profiles is essential to evaluating whether an SDBA makes sense.

How many fund options are there in the core lineup? Will adding an SDBA allow you to shrink an investment lineup with too many options and while keeping participants satisfied? A consequence of this decision might be a case where a popular fund is being removed from a lineup, but this issue could be resolved if the participant can purchase the fund again by utilizing the SDBA.

On the other hand, an SDBA may provide thousands of additional options besides those in the core investment menu.6 Do participants have sufficient investment knowledge, including an awareness of increased risks, to make wise choices amongst so many different alternatives?

Further structural considerations include the impact of having plan participants who are both non-union and union employees. Could the addition of SDBAs enter the collective bargaining process with a unionized workforce?

Demographics analysis encompasses a review of age buckets and industry peer usage. An SDBA is most popular with participants in the financial, investing, law and engineering fields.7

Plan Sponsor Considerations: Selecting the Provider

Typically, Plan Sponsors will first look to the SDBA provider owned by their recordkeeper. 7 Notwithstanding that reality, Plan Sponsors should be thoughtful about evaluating the services and capabilities of their prospective SDBA provider. At a minimum, topics to address include:

- Availability of investment options/SDBA investment menu choices.

- Operational requirements and simplicity of use for participants.

- Restriction on securities availability such as employer stock. Can the provider execute these?

- Trading costs and policies; rep-assisted vs. electronic.

- Limits on SDBA percent of participant accounts. Can the SDBA provider operationally support these restrictions?

- Account fees – either from the SDBA provider or mandated by the Plan Sponsor

- Participant education. Who provides this? How often? What is the message?

- Portability for participants who leave the plan.

- Use in managed account offerings.

For Plan Sponsors Using an SDBA, What Should be Top of Mind?

At a minimum, the EBSA Release has prompted concern about a committee’s fiduciary monitoring responsibilities, if any, for the investment choices in their plan’s SDBA offering. Heretofore, Plan Sponsors avoided “looking inside” the SDBA menu to evaluate investment offerings, driven by both the impractical nature of evaluating thousands of offerings and the lack of any case law that clarifies the fiduciary responsibilities of Plan Sponsors for monitoring investments available via SDB.7

For now, the EBSA communication has introduced uncertainty into the monitoring equation, with no fewer than 11 financial industry groups formally asking the EBSA to withdraw its release in favor of a formal rulemaking process that includes a robust public comment period.8

Until further clarification is received from the EBSA, Plan Sponsors with an SDBA may want to re-validate its role in their plan lineups and such Sponsors could take the following actions:9

- Engage ERISA counsel for clarity and direction regarding offering an SDBA in the current post-EBSA Release environment.

- Distribute additional educational materials and disclosures about the opportunities and risks of using an SDBA as a primary retirement savings vehicle.

- Assess if participants are investing in or asking for cryptocurrency within an SDBA option. If yes, should sponsors consider a limit to overall SDBA exposure or perhaps just limit the percentage in cryptocurrencies?

- Understand the potential risks of not making cryptocurrencies available in the SDBA.

Final Thoughts

Fiduciary committees should consider consulting with advisors who have experience in evaluating fiduciary oversight issues for their retirement plans, including an evaluation of both the advantages and risks related to the use of an SDBA as a plan choice.

For more information on an SDBA, please contact any of the professionals at Fiducient Advisors.

1U.S. Department of Labor; Employee Benefit Security Administration-Compliance Assistance Release No. 2022-01, 401(k) Plan Investments in Cryptocurrencies, March 2022.

2Advisory Council on Employee Welfare & Pension Benefit Plans Report to the Hon. Martin Walsh, U.S. Secretary of Labor; Brokerage Windows in Self-directed Retirement Plans, December 2021.

3Tina Brown and Brian Lamb, Legal Landscape Update, Thompson Hine, March 2022.

4Robert Toth, Master Custodial Accounts and the 403(b) Self-Directed Brokerage Account, Toth Law & Consulting, June 2021.

5 Advisory Council on Employee Welfare & Pension Benefit Plans Report to the Hon. Martin Walsh, U.S. Secretary of Labor; Brokerage Windows in Self-directed Retirement Plans, December 2021.

6Stephen Saxon and George Sepsakos, Common Questions: What Every Fiduciary Should Know About a Self-Directed Brokerage Account (SDBA), The Groom Law Group and Charles Schwab. https://www.schwab.com/system/file/P-12505341#:~:text=Charles%20Schwab%20%26%20Co.%20sponsors%20the%20Personal%20Choice,that%20is%20offered%20within%20an%20employer-sponsored%20retirement%20plan.

7Advisory Council on Employee Welfare & Pension Benefit Plans Report to the Hon. Martin Walsh, U.S. Secretary of Labor; Brokerage Windows in Self-directed Retirement Plans, December 2021

8Mark Schoeff, Jr., Industry Groups Want DOL to withdraw guidance on use of cryptocurrency, InvestmentNews, April 2022.

9Randy Tracht; A Discussion on Compliance Assistance Release No. 2022, Morgan Lewis, May 2022.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.