Key Observations

• March was another strong month for risk assets, particularly in the U.S. as vaccine manufacturing and distribution ramped up

• Loosening COVID restrictions coupled with the new $1.9 trillion stimulus bill supported increased business activity and rising inflation expectations

• We remain constructive on risk markets but acknowledge that equity valuations are elevated, interest rates are low and credit spreads are tight

Market Recap

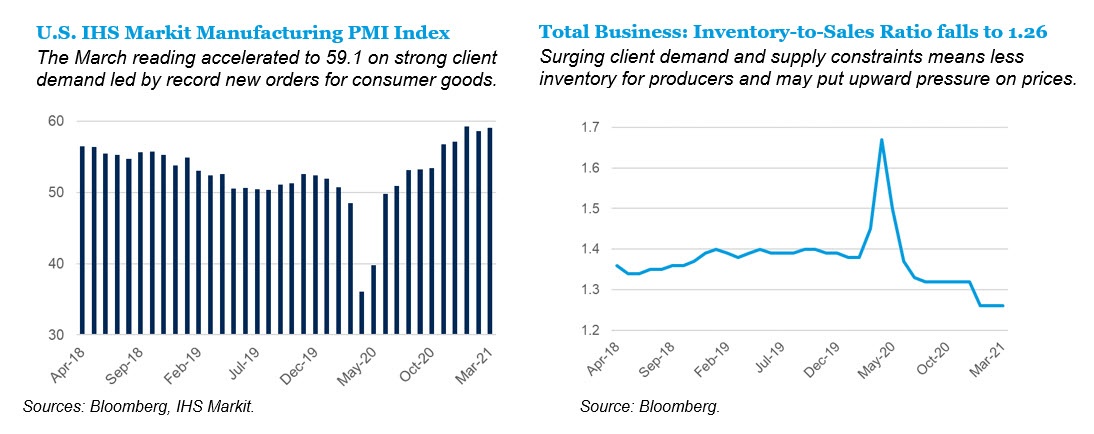

Global Equities ended the first quarter with strong returns in March, led by sectors more sensitive to economic growth (i.e., industrials, materials, consumer discretionary). Private sector business activity was strong, led by service providers, however, manufacturing PMI for March recorded its second highest reading on record despite production reportedly held back by supply shortages. Accommodative monetary policy took a backseat on March 11 when President Biden signed the American Rescue Plan Act (ARPA), a $1.9 trillion stimulus program aimed at supporting households and businesses during the transition toward more normal economic activity. While an uneven global economic recovery caused some supply chain disruptions, continued government stimulus reinforced further improvement and a generally optimistic tone. The Federal Reserve lifted its core PCE inflation estimate 0.4 percent to 2.2 percent during the first quarter. In our view, a backdrop of steadily rising official inflation data alongside economic growth should be supportive of risk assets.

U.S. Equities (Russell 3000 Index) returned 3.6 percent in March and 6.3 percent for the first quarter led by value-oriented stocks though growth stocks also produced positive returns. The MSCI EAFE rose 2.3 percent in March and 3.5 percent for the quarter, and emerging market stocks fell 1.5 percent in March but still closed the first quarter up 2.3 percent. Real assets benefitted from higher inflation expectations and returned 1.5 percent in March and 3.3 percent for the quarter. The U.S. Treasury yield curve steepened as inflation expectations pulled nominal yields higher. The Bloomberg Barclays Aggregate Index, a proxy for returns on Treasury and investment grade corporate bonds, fell 1.2 percent in March. The Barclays U.S. High Yield Index benefitted from a lower sensitivity to rising rates and tightening credit spreads. The index ended March in positive territory and rose 0.8 percent in the first quarter.

Market Recap Economic Growth Accelerated in March

U.S. business activity registered a substantial increase at the end of the first quarter. The IHS Markit Flash Services PMI for March ticked up 0.5 to 59.1 compared to February signaling the strongest output expansion since June 2014. A rise in new orders contributed to the acceleration amid stronger demand and looser COVID-19 restrictions in some states. Manufacturing output remained strong but was limited by raw material shortages caused by the supply chain disruptions. However, the U.S. manufacturing sector registered the sharpest upturn in new business in almost seven years. The confluence of inventory restocking on a global scale amid an ongoing recovery in global supply chains spurred the sharpest increase of input costs in nearly a decade. As mobility increases and personal consumption normalizes, economic growth and modest inflationary pressures should benefit global equities, broad real assets and fixed income spread sectors.

Market Outlook

Positive vaccine developments and faster distribution were a tailwind for risk markets through the first quarter, particularly in the U.S. Those efforts remain a key focus as investors evaluate how further reopening measures will impact certain regions, industries and support more global growth. Despite the optimism and encouraging economic reports, we expect fiscal and monetary policy to remain accommodative in the near-term. The rebound from the March 2020 lows was nothing short of remarkable, but as the Fed reiterated at the last FOMC meeting, the road to full recovery is a long one. Healthier labor market conditions and higher business activity should benefit risk assets as we head into the spring. We are generally constructive on the economic picture, but elevated equity valuations, historically low interest rates and tight spreads warrant some caution.

For more information, please contact the professionals at Fiducient Advisors.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.