Key Observations

• Equity markets across the globe advanced in April and, in a reversion to return patterns witnessed earlier in the pandemic, were led by large cap and growth names.

• Monetary and fiscal policy accommodations and the continued escalation of vaccination distribution efforts fueled gains on the economic data front, exemplified by first quarter U.S. GDP growth of 6.4 percent.

• An increasingly clarified path toward normality and a strong start to earnings season bolsters our guardedly optimistic posture toward risk assets, restrained by somewhat elevated valuations, pandemic hotspots, tax policy considerations and resurgent

geopolitical risks.

Market Recap

Major capital markets around the world delivered uniformly positive results in the month of April with investors emboldened by reaffirmed commitments to accommodative stimulus and the demonstrable gains made toward wider scale vaccination. Importantly, these factors stoked tangible gains across a host of economic data, suggesting the bid to return to normal is both viable and, perhaps, imminent. The 6.4 percent growth in first quarter U.S. GDP was particularly noteworthy as it provides a very direct link to the economic impact of consumers, who spent at a rapid clip in the period. Having booked three consecutive quarters of robust growth, the U.S. economy is now, remarkably, within earshot of its pre-pandemic peak level. Recent GDP growth elsewhere around the world is a bit more mixed with solid gains in China offset by weaker results in the Eurozone and Japan.

U.S. Equities (Russell 3000 Index) returned 5.2 in April, although a reversal from the prior few months took hold with larger capitalization and growth sectors reasserting their leadership. Investors anticipated robust earnings results from several large technology companies, which drove equity prices higher within the sector. Those expectations broadly came to fruition, with 94 percent of technology companies beating earnings estimates and the sector reporting 40 percent year-over-year earnings growth[1]. International developed and emerging market equities generated positive returns in April but modestly trailed the U.S. as many foreign countries continue to face challenges with virus containment and vaccine distribution. The MSCI EAFE rose 3 percent and emerging market stocks gained 2.5 percent. U.S. Treasury yields moved lower with the 10-year and 30-year both falling 11bps to 1.63 percent and 2.30 percent, respectively. The Bloomberg Barclays Aggregate Index, a proxy for returns on Treasury and investment grade corporate bonds, returned 0.8 percent in April. The Bloomberg Barclays U.S. Corporate High Yield Index benefitted from modest credit spread tightening and generated a 1.1 percent return over the month. Most real assets generated healthy returns amid higher inflation expectations and increasing demand. The S&P Broad Real Asset Index, which is comprised of equities, fixed income, and futures representative of liquid real assets, returned 4.5 percent through April.

Sustained Economic Momentum

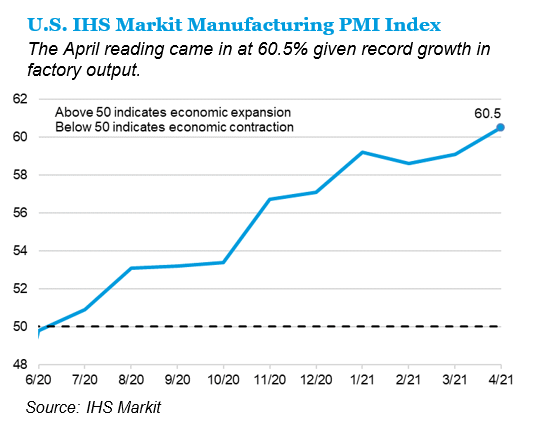

Purchasing manager survey activity around much of the world continues to trend positively while remaining at levels indicative of expansion. On the heels of a very strong reading in March (59.1), the IHS Markit Flash Manufacturing PMI reading in April for the U.S. moved up to 60.5. Recent PMI results in the Eurozone and Japan have been expansionary as well although the related data in China has softened a bit. Specific to the U.S., while both demand and factory output remains elevated, those surveyed indicate that supply chain disruptions are hindering production and pressuring input costs. We expect these bottlenecks will begin to alleviate as suppliers recalibrate their processes in response to the evolving economic backdrop. Inflation measures may, indeed, rise a bit near-term but we share the Fed’s sentiment that escalating prices will be transitory and not otherwise inhibit the economic recovery.

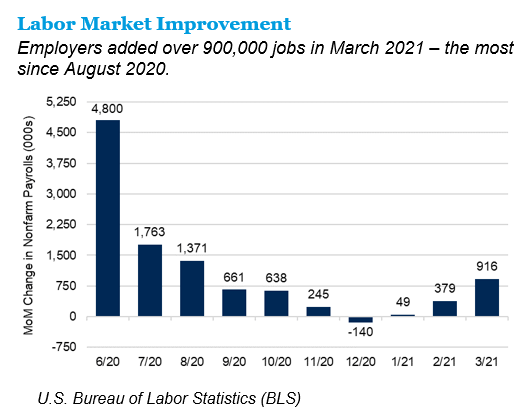

Labor market improvements lend additional evidence to the notion that employers are preparing for a sustained ramp up in economic activity as reopening efforts accelerate. The U.S. economy added over 900,000 jobs in March, the unemployment rate ticked down to 6 percent, and particularly noteworthy gains were sourced in the segments of the economy (e.g., leisure & hospitality) hit hardest at the pandemic’s onset.

Market Outlook

Near-term capital market prospects, in our view, remain tethered to the host of factors that contributed to the market advances experienced over the last several quarters; namely, the decidedly accommodative (and ample) supply of stimulus and the meaningful gains achieved on the vaccination front. These conditions should hasten the pace of reopening and forge a more distinct path to a sustained economic recovery. Moreover, the improving economic data we highlight elsewhere in this update and a strong earnings reporting season heighten our conviction that the near-term prospects appear to be, on balance, favorable for risk assets. However, we readily acknowledge that there remain a handful of considerations that may temper investors’ enthusiasm. Somewhat elevated risk asset valuations, resurgent pockets of infection, widely divergent vaccination efforts globally (distribution progress across much of the emerging markets substantially lags efforts across most of the developed markets), the potential for onerous tax policy and increasing geopolitical risk require investors’ attention.

For more information, please contact the professionals at Fiducient Advisors.

1 Factset, as of March 31, 2021

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.