Many sponsors of defined benefit plans focus their investment strategies mainly on mitigating the impact of the company’s pension program on its balance sheet; however, a concern for many companies goes beyond the balance sheet. The annual cost of the pension plan (i.e., the pension expense) hits the company’s profit and loss statement (P&L), and its change from one year to the next can cause concerns for Plan Sponsors. This article seeks to provide insight into areas plan sponsors should consider to help reduce the volatility of their annual pension expense.

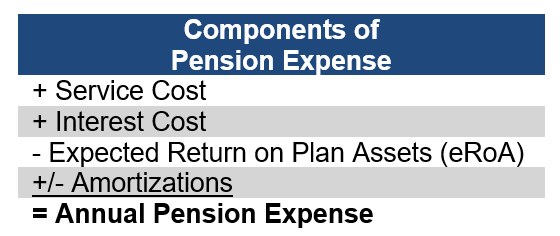

Pension expense is a complex combination of items including service cost, interest cost and expected return on plan assets along with amortization costs associated with plan changes, changes in actuarial assumptions and differences between actual and expected investment returns.  This important interaction of both plan assets and liabilities highlights the need to partner with a consulting firm that understands the many levers, both on the liability side and the asset side, that can help a Plan Sponsor achieve their long-term goals for the pension program.

This important interaction of both plan assets and liabilities highlights the need to partner with a consulting firm that understands the many levers, both on the liability side and the asset side, that can help a Plan Sponsor achieve their long-term goals for the pension program.

Mitigating the volatility in pension expense due to investment gains and losses seems straightforward – simply align the expected return on plan assets with the portfolio’s anticipated return on plan assets. But, as is the case with all aspects of pension plan management, there is much more behind this proverbial curtain.

Service and interest costs together typically comprise the largest component of a company’s annual pension expense. While there is little volatility from year to year in these costs, lowering them can be an effective approach to lowering overall pension expense. However, the only way to lower these costs is to shrink the total liability on which they are based – essentially share a piece of the liability “cake” with an annuity provider.

Service cost captures the additional benefits active participants will earn during the next year. Closing the plan to new entrants while allowing current participants to accrue benefits will limit the growth of the service cost component. However, freezing future accruals will meaningfully and immediately lower the amount of this cost.

Conversely, interest cost is largely based on promises already made, so reducing this cost requires both prudence and care. Interest cost represents the annual growth in the plan’s liability (i.e., the liability “cake”) due to the reduction of the discounting period, all else equal. It is calculated by multiplying the yield of high-quality corporate bonds by the plan’s liability. Decreasing this cost requires reducing the size of the liability “cake.” Risk transfer activities such as lump sum windows or annuity purchase agreements can be an effective way to eat this portion of “cake” and thus reduce the annual ongoing interest cost for the remaining life of the plan.

The expected return on plan assets (eRoA) is an offset to the pension expense calculation. Growth in plan assets serves to offset the economic cost of the plan. Increasing the amount you expect the plan assets to grow by is a quick (albeit potentially foolish) way to decrease your pension expense. However, there are two huge issues with this “cost-reduction” approach.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.