As the effects of the pandemic continue to ripple across markets and the economy, private market investors are getting a first look at actual data points from the second quarter. Everybody knew activity slowed, but by just how much was still relatively unknown as LPs and GPs both adapted to conducting diligence and day-to-day tasks in a virtual world. The sudden and dramatic slowdown in what was ultimately a pre-packaged recession had implications on capital deployment, fundraising and just about every other aspect imaginable. However, as we turn the pages into the third quarter, activity seems to be picking up again.

Private Equity

Global fundraising activity slowed in the first-half of 2020, albeit not to the degree that was seen within the Mergers & Acquisitions (M&A) and transaction market.

Private Equity (PE) saw a total of $259 billion capital raised in the first half of 2020, a 4.1 percent decline relative to $270 billion raised during the same period last year, according to Preqin’s Private Equity Quarterly Update for Q2 2020. This was, however, still above the $236 billion recorded in the first half of 2018. Per the same report, 552 funds closed during Q1 and Q2 of 2020 marking the lowest number seen in the first two quarters of the last five years as well as a decline of 30.9 percent year-over-year (YoY). A spike in the number of “dislocation” or “opportunistic” funds attempting to take advantage of the sharp downturn in public markets aided the total fundraising numbers.

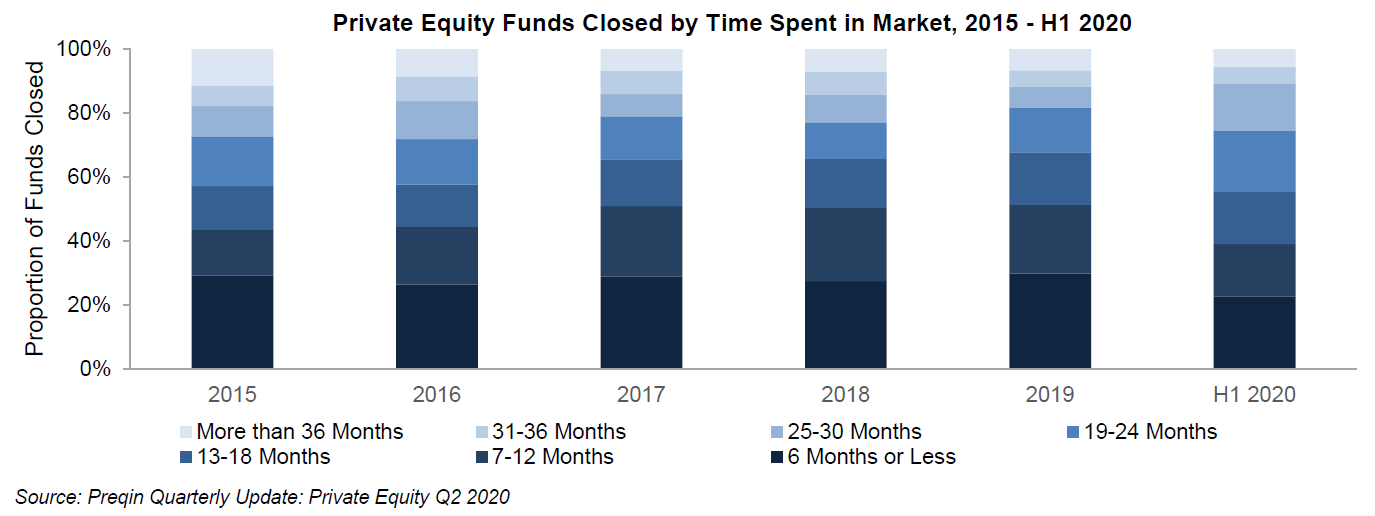

Despite a relatively benign drop in dollars raised, managers faced a more challenging fundraising market during the period as seen in Preqin data reporting that 23 percent of the funds closed spent six months or less in the market, while 39.0 percent of those closed within 12 months. This is in comparison to 30 percent and 51 percent, respectively, for the whole of 2019.

Much of the lengthened duration is directly attributable to LPs determining their new budgets, according to Preqin’s Private Equity Quarterly Update. Thanks to the wild swings in public markets, most portfolios felt the denominator effect which resulted in a larger than budgeted private equity allocation given the drop in overall portfolio value. This quickly reversed over the summer months, but serves as a good reminder to all LPs to ensure they have proper liquidity and risk positioning. Further, an inability to travel slowed some groups, as many LPs decided to focus on existing and established relationships rather than forging new ones during the uncertain time.

Transaction activity slowed drastically during the first half of 2020. Per Pitchbook, a total of 1,678 Private Equity deals raised $246.2 billion in the U.S. The greatest number of deals came from the Mid-Atlantic region at 302, followed by the Great Lakes and West Coast with 281 and 279 deals, respectively. The Southeast region raised more capital than others with $51.5 billion, followed by the West Coast with $44.9 billion. Furthermore, of the $246.2 billion raised by buyout deals in the U.S., 386 deals falling in the $100 million – $500 million range saw the largest inflow with $106.4 billion, while 825 deals falling under $25 million range saw the most number of deals raising just $8.4 billion.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.