Bull markets can make experts out of us all, but bear markets require us to be disciplined, to remove emotions from the decision making process, to be patient and to have an understanding of the consequences our actions or lack thereof.

Investment committee meetings, during a time of extraordinary market (and in this case, worldwide) volatility, can be chaotic, stressful and in some cases counterproductive.

Questions commonly asked include:

• What are the correct actions our committee should take?

• When should we rebalance the portfolio?

• Do we have the right investment managers for this market?

• Should we change our risk profile?

These fair questions combined with fear or panic driving committees to make poor decisions are real. It is important to remember that as a steward of an investment portfolio, the role of the committee is indeed to oversee the investments but, more importantly, to lead the organization itself through the turmoil and ensure its long-term viability.

During times of uncertainty, overseeing your investments may be difficult. Committees often have members who care deeply about the mission of the organization, but are not investment experts. Staff members may be juggling several responsibilities including filling out investment manager contracts or processing trades which takes valuable time away from their main role. However, by engaging an outside firm to serve in a discretionary investment management or OCIO (Outsourced Chief Investment Officer) capacity, you can remove the day-to-day investment oversight and administrative responsibilities, freeing your committee and staff to focus on the work of the organization itself.

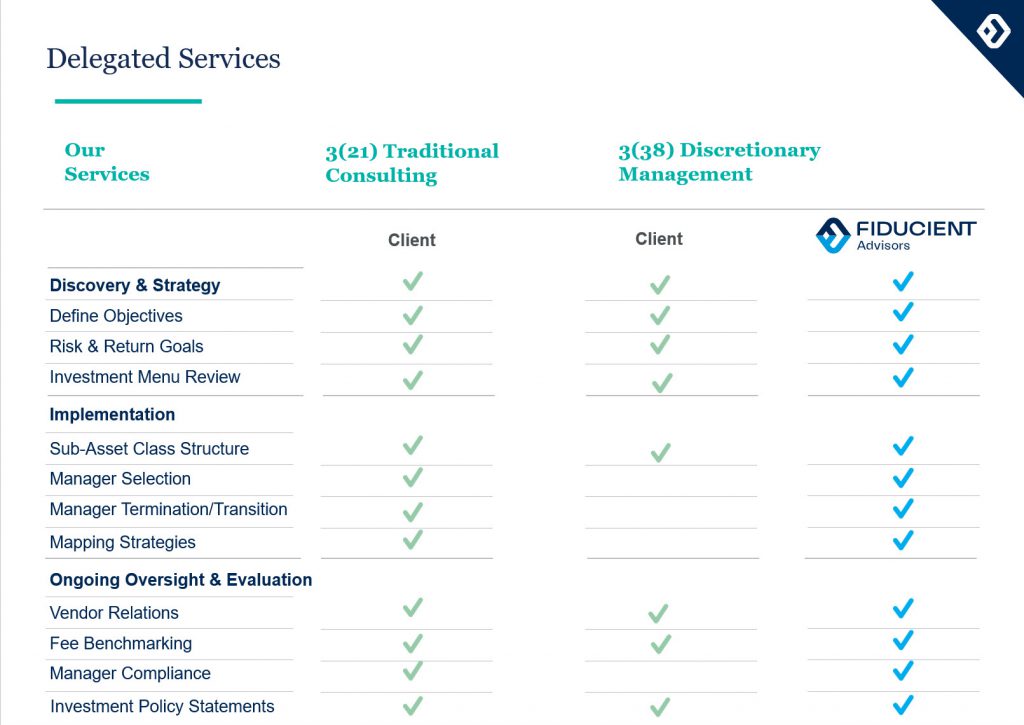

We understand turning over critical responsibilities can be a daunting proposition. Transparency and communication are vital for a successful discretionary investment management or OCIO relationship. We are committed to working with our discretionary clients in defining the objectives, risk and return goals and overall strategy for the portfolio. This is critical for long-term success as only you can truly know the long-term goals of your organization. The graphic below details key decision making steps that will always remain a collaborative effort as well as services we will perform on your behalf.

With key structural decisions and objectives defined together, our Portfolio Management Team (PMT) becomes your investment office. The PMT leverages the myriad strengths of our firm’s 25 years of experience to manage the investment decision making process and operational duties. The resources available to the PMT include our Investment Committee, Discretionary Committee, Compliance Team, Investment Operations and the entire research division of our firm. With 180 professionals and over $200 billion* of assets under advisement, we believe our organization is uniquely positioned to put our best thinking to work for you.

There are four primary areas for consideration of partnership with a discretionary investment management firm: investments, administration and operations, cost and accountability.

Investments

We believe every client is unique and treat each portfolio as such. The inclusion of illiquid assets such as hedge funds and private equity might make sense for larger portfolios with plenty of liquidity and a long time horizon, but they might not for smaller portfolios more reliant on liquidity to meet short and intermediate cash needs. Our portfolios are broadly diversified across fixed income, U.S. and international equities, real assets and alternatives. We work hard to control investment expenses while implementing our best ideas into the portfolio.

Performance is where the “rubber hits the road” and we strive for transparency when presenting outcomes. Monthly and quarterly results can be presented in many ways. From simplified, board-level reports to detailed, data intensive reviews of every aspect of the total portfolio and its underlying managers, we are there to explain what happened, what it means and what we are planning to do about it.

Administration and Operations

Along with the lead and co-portfolio managers, our investment operations team will be an integral part of the discretionary relationship. We will handle all responsibilities listed in the graphic above as well as nearly any other investment related issue that presents itself during the typical course of business. Additional responsibilities may include working with the advancement office on preparing communications for an upcoming fundraising campaign, speaking with key constituents in the organization about portfolio results and working with new committee members to help with an on-boarding process. We serve as an extension of your staff in many respects and rely on frequent, open and candid communications when working with our clients.

Cost

We will break down the total cost of the outsourced relationship, including: investment manager, custodial and trading fees as well as the cost of our service. We derive our cost from the services we provide as either an asset-based fee or a flat cost and present them openly. We do not manage investment products or derive revenues through soft-dollars. Our goal is to cost effectively find the best investments to fit your needs.

Accountability

A successful discretionary relationship needs to be rooted in accountability. We take great pride in executing our duties, communicating with our clients and delivering results. Our team will deliver an annual “assessment of work” document to ensure we are helping you prosper in every way we can.

Managing all aspects of a complex investment program is difficult even with friendly markets but it can be overwhelming in volatile ones. A well run discretionary program can help your organization reduce its operational burdens, improve efficiencies and potentially enhance the investing experience.

For more information about our discretionary services, please contact Matt Porter, mporter@fiducient.com or (312) 853-1000.

* Information intended as representative illustrations of combined capabilities of Fiducient Advisors and Fiduciary Investment Advisors, LLC (FIA). As of April 1, 2020, FIA became a subsidiary of Fiducient Advisors and anticipates fully merging by the end of 2020.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.