Prudent fiduciaries periodically review their plan document and procedures to ensure their plan is being administered as intended. Would you believe one of the most common mistakes Plan Sponsors make has to do with matching contributions? As service providers change over time (recordkeepers, payroll providers) it is important to ensure your plan is being administered appropriately. Understanding if current contributions being matched on a payroll by payroll or total year salary can result in material differences.

Every year there are certain circumstances that could lead to the company match contribution being lower than stated by the plan document. In these cases, a year-end true-up would be necessary for a participant to receive the full company match. Following are two scenarios where the company match may not be what it seems.

The ideal situation for those saving for retirement would be to save as much as possible to receive the full company match and to contribute to the IRS maximum. The contribution limit for employees who participate in 401(k), 403(b) and most 457 plans, as well as the federal government’s thrift savings plan has increased to $23,000 in 2024, up from $22,500.1 However, the reality is that many retirement plan participants do not max out their contributions. Many may change their deferral percentage mid-year for one reason or another. Below is an example of how changing deferral rates mid-year may affect the company match.

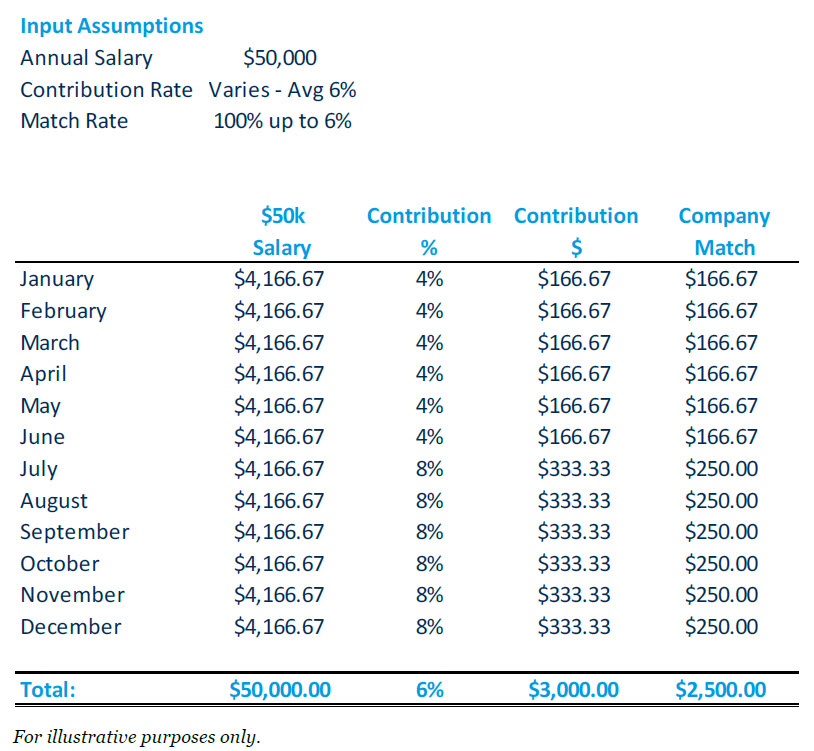

Scenario One: Participant Changes Deferral Rate During the Year

Let’s assume the plan document for XYZ Corporation states that the company will match dollar for dollar up to 6% of total pay for the year. For Participant A, making $50,000 a year and deferring 6%, the match would be $3,000 ($50,000 x 0.06). Now let’s assume that for the first six months of the year, Participant A deferred 4% ($25,000 x 0.04 = $1,000) and the second half of the year Participant A deferred 8% ($25,000 x 0.08 = $2,000). However, the match formula only allows the company to match dollar for dollar up to 6% ($25,000 x 0.06 = $1,500).

Through the course of the year, Participant A deferred a total of 6% of their total compensation, which entitles him/her to the full company match of $3,000 as stated above. However, if XYZ Corporation matched contributions on a payroll period basis, the participant would only receive $2,500 (or 5%) in company match. XYZ Corporation would need to make an additional matching contribution of $500 to the participant’s account. This true-up contribution may be made as late as the deadline (including extensions) for filing XYZ Corporation’s federal tax return.

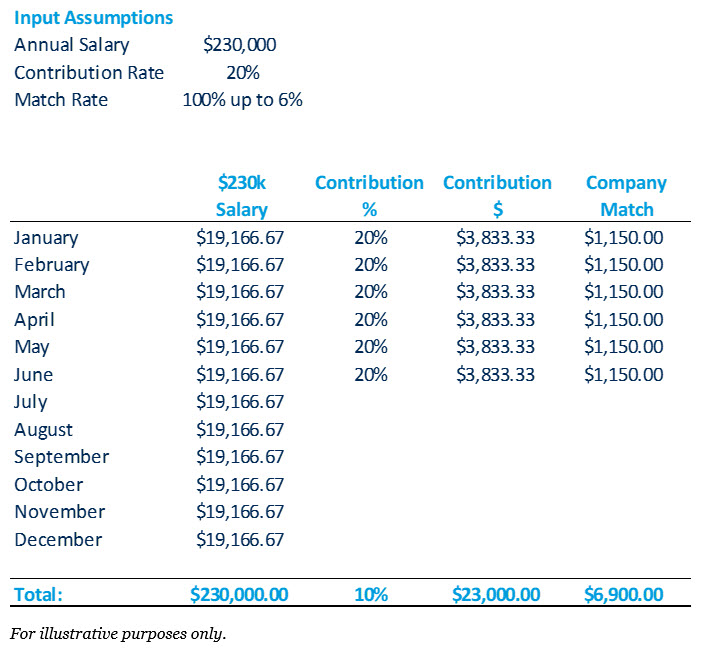

Scenario Two: Participant Front-Loads Contributions

For most participants, saving for retirement can be a struggle. There are others who can, and do, save up to the IRS maximum. The concept of compounding interest is not lost on these individuals and a common problem with this group is that they will max out their contributions early, which may decrease the match received.

Let’s assume the plan document for XYZ Corporation states that the company will match dollar for dollar up to 6% of total pay for the year. For Participant B (under the age of 50), making $230,000 a year and deferring 6%, the match would be $13,800 ($230,000 x 0.06). If Participant B deferred 20% of his/her salary at the beginning of the year, they would max out their contribution in June (contribution limits for elective deferrals for 2024 is $23,000). However, at this rate, the company would have only matched for the first six months or $6,900. Once again if the Plan Document stated that matching contributions were based off annual pay and not per pay period, a true-up payment of $6,900 would be required to stay in compliance.

A Common Provision

The two examples above both have one common provision; they both have plan documents that state the match will be calculated on annual salary. However, in both cases the Plan Sponsor matched contributions on a payroll basis. These examples are not applicable to Plan Sponsors that match per pay period. There are pros and cons to both matching scenarios. Sponsors should review and ensure their plan is being administered as written.

With the rollout of several mandatory and optional provisions allowed by SECURE 2.0, 2024 will serve as a good year to review plan documents to ensure the plan is being administered as intended. As a fiduciary, it is important to make sure you are following the Plan Document regardless if it is a custom document or a prototype or volume submitter.

Save the date for our Annual Investor Conference on September 26, 2024 at the Chicago Marriott Downtown Magnificent Mile. Please reach out to any of the professionals at Fiducient Advisors for additional details.

1IRS.gov: https://www.irs.gov/newsroom/401k-limit-increases-to-23000-for-2024-ira-limit-rises-to-7000#:~:text=Highlights%20of%20changes%20for%202024,to%20%247%2C000%2C%20up%20from%20%246%2C500. November 1, 2023

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.